Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

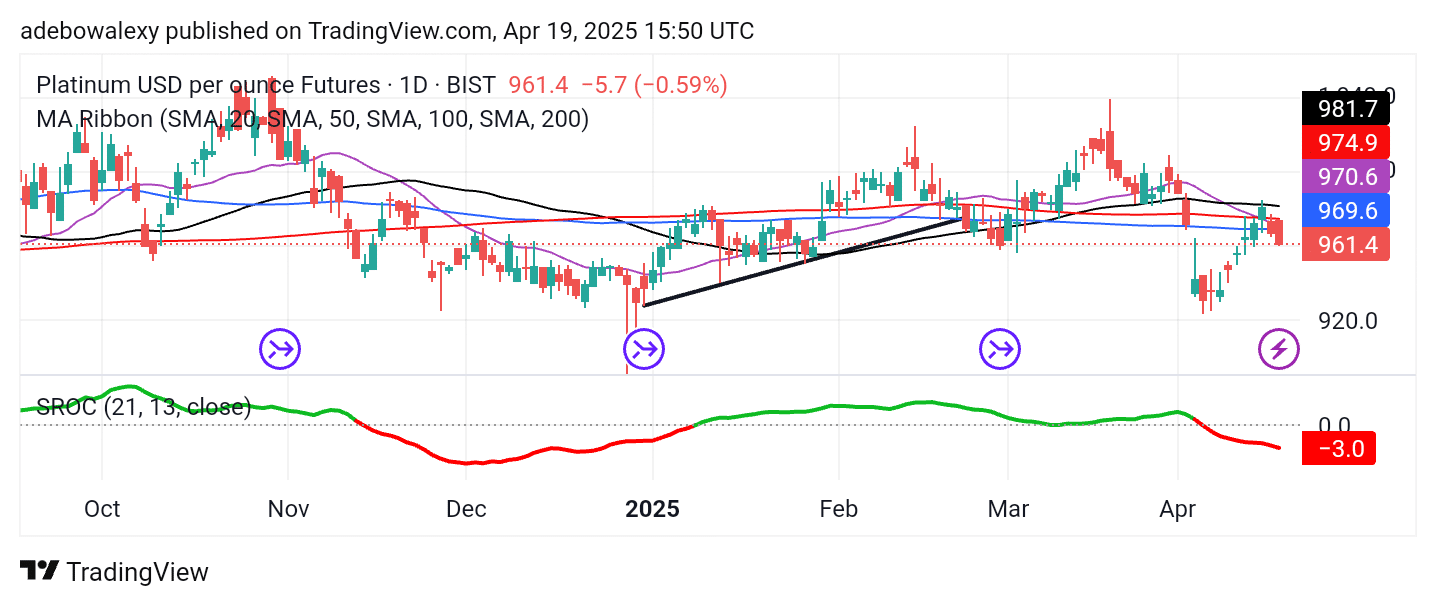

The platinum market has seen a notable recovery over the past week, with prices climbing upward. However, considering the CFTC Commitments data, it appears that the upward retracement has been challenged by a growing number of investors taking short positions. This, among other factors, has strengthened resistance levels above the current price action, causing the market to reverse direction.

Key Price Levels

Resistance Levels: $975, $1,000, $1,020

Support Levels: $920, $900, $875

Platinum Dips Sharply

Over the past two sessions, the XPT market has experienced a strong downward rebound. This occurred after price action attempted to breach the resistance formed by the 50-day Moving Average (MA) line. Previously, the price had tried to climb above all the MA lines on the chart.

However, this effort failed, and the market retreated after encountering resistance at the 50-day MA. Friday’s session closed below all the MA lines, effectively placing the market back under stronger bearish pressure. Meanwhile, the Stochastic Rate of Change (SROC) continues to decline below the equilibrium level, supporting the view that downward forces may continue to weigh on the market.

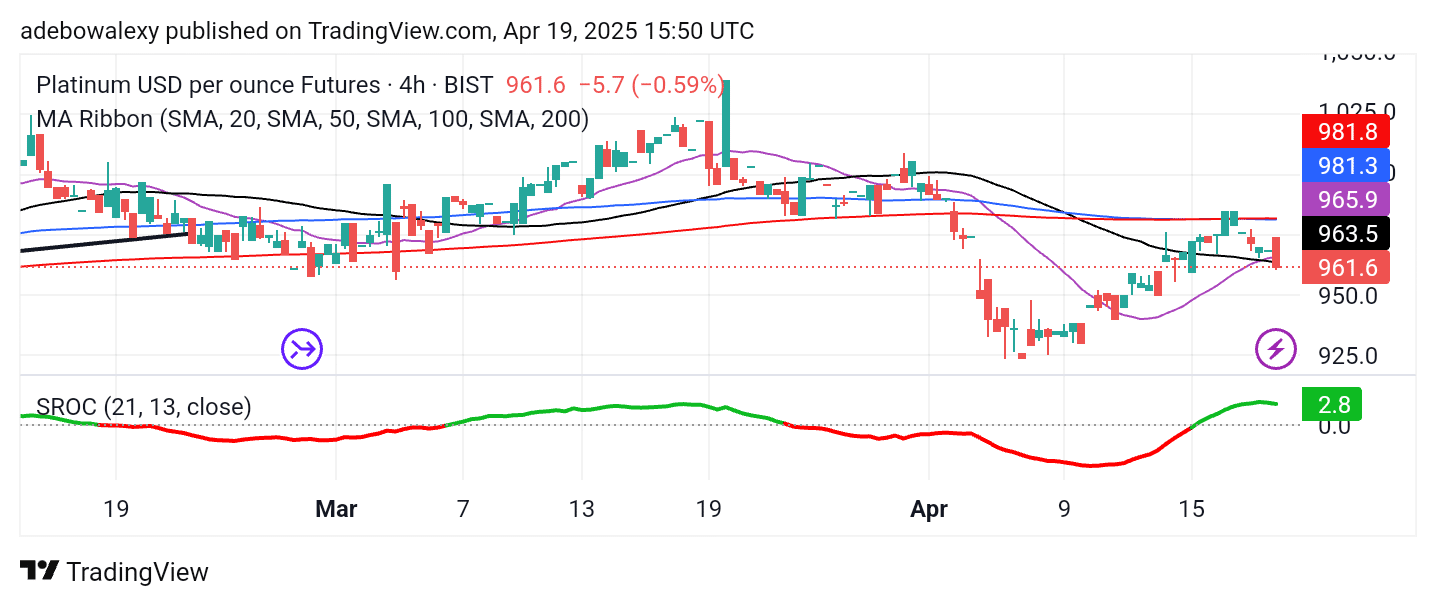

XPT Has a Short-Term Bearish Outlook

Even on shorter timeframes, the platinum market maintains a bearish outlook. The latest price candle on the chart is large and red, similar to the last candle on the daily chart, and has driven the market below all the MA lines. This movement aligns with the bearish trend observed in the daily timeframe.

However, the SROC indicator line remains above the 0.00 mark. Its terminal point still appears green and continues to move sideways just above the equilibrium level. That said, bearish traders may want to remain cautious and watch for potential support around the $950 or $940 levels.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.