Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

A common trend among Asian stocks is that they trimmed some of their previous gains. This is also true for the Japan 225 market, which closed the week’s trading with minimal losses. Investors continue to try and understand U.S. trade tariff policies, keeping everyone on edge.

Key Price Levels

Resistance Levels: 35,000, 36,000, 37,000

Support Levels: 34,000, 32,000, 30,000

Nikkei 225 Continues an Upward Path

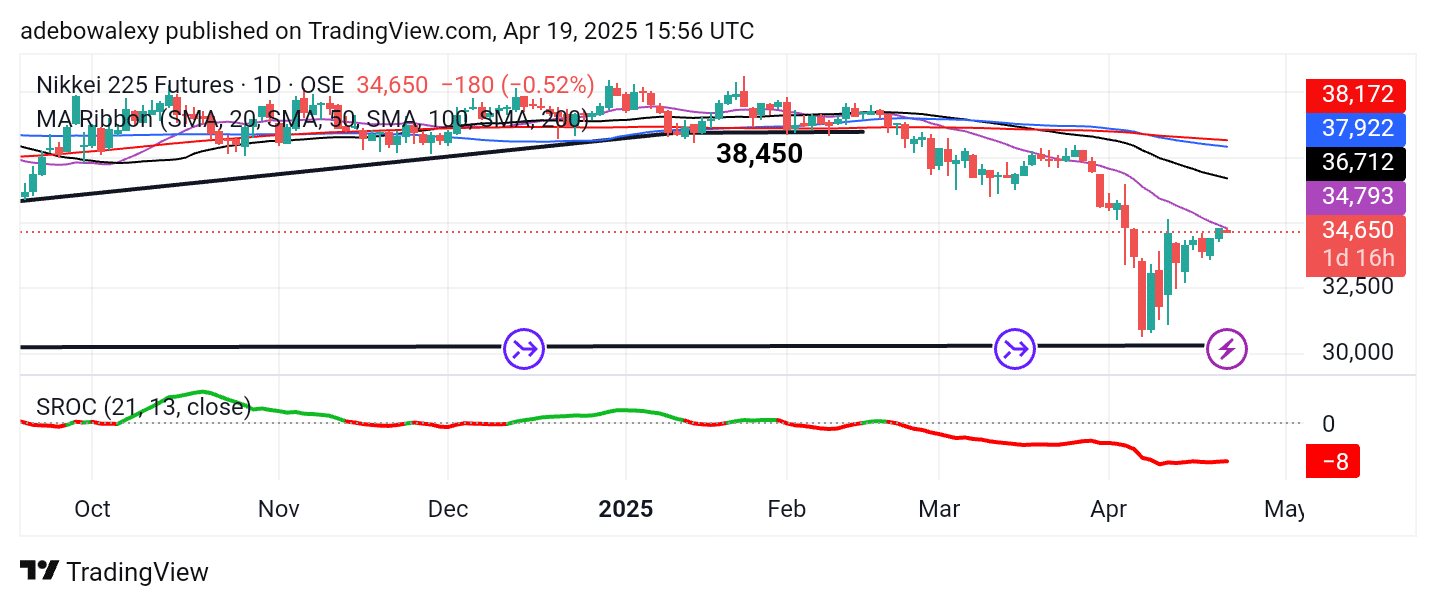

While the Japan 225 market ended the previous week in the red, price action still shows signs of maintaining an upward trend. The last price candle is red and appeared after price action tested the resistance formed by the 20-day Moving Average (MA) line.

As a result, the market has retreated below all the MA lines on the chart. Similarly, the Stochastic Rate of Change (SROC) indicator is trending sideways below the equilibrium level, which undermines bullish expectations in this market.

Japan 225 Consolidates on Short Timeframe Charts

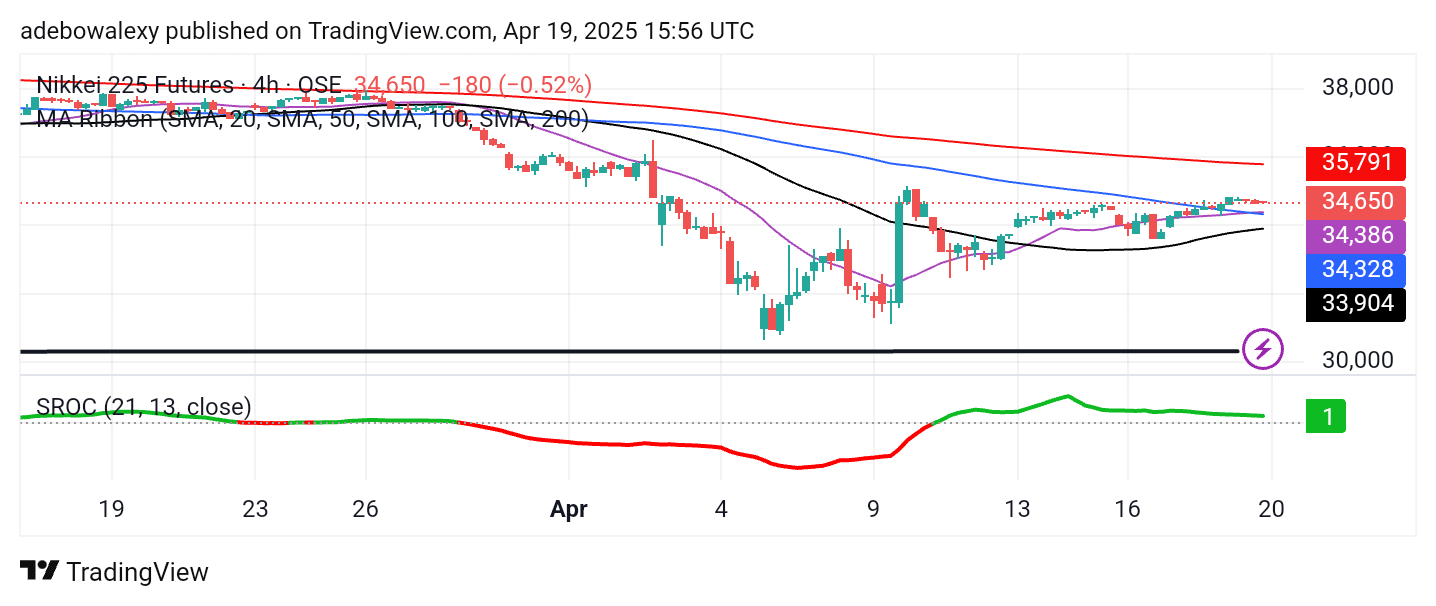

Looking at the Nikkei 225 on the 4-hour chart, the most recent price candle shows minimal price movement. It is a red, dash-shaped candle that has appeared just above a crossover between the 20- and 100-day MA lines.

Notably, the 50-day MA line is positioned below both the 20- and 100-day MA lines. The SROC indicator is moving sideways above the equilibrium level. Consequently, while staying alert to emerging fundamentals, traders may anticipate a trend continuation toward the 35,500 price level.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.