The Canadian dollar remained firm against its U.S. counterpart, buoyed by robust job growth data from both nations for September. Despite this resilience, the loonie was poised to conclude the week with a modest decline due to concerns over rising global bond yields.

The Canadian dollar, trading at 1.3767 against the U.S. dollar, displayed resilience after briefly touching a six-month low of 1.3785 on Thursday. However, it was set to record a weekly loss of 0.8%, largely attributed to unease regarding escalating interest rates and their potential impacts on economic growth and asset values.

Regardless, Canada impressed with a significant job gain of 63,800 in September, surpassing market expectations by threefold. Additionally, wages continued to rise, as reported by Statistics Canada.

This impressive data has heightened the likelihood of another rate hike by the Bank of Canada (BoC) during its upcoming policy meeting on October 25. Money markets are now predicting a 40% probability of tightening, up from 28% before the data release.

The U.S. economy also outperformed expectations by adding more jobs than anticipated in September, strengthening the U.S. dollar against major currencies. The U.S. dollar index increased by 0.2% on Friday, reinforcing expectations of an expedited normalization of monetary policy by the Federal Reserve.

Optimism for the Canadian Dollar

Analysts maintain a bullish outlook for the Canadian dollar in the coming year, emphasizing its undervaluation and strong economic ties with the United States. According to a Reuters poll, the loonie is expected to appreciate to 1.30 per U.S. dollar within the next year, according to the median forecast.

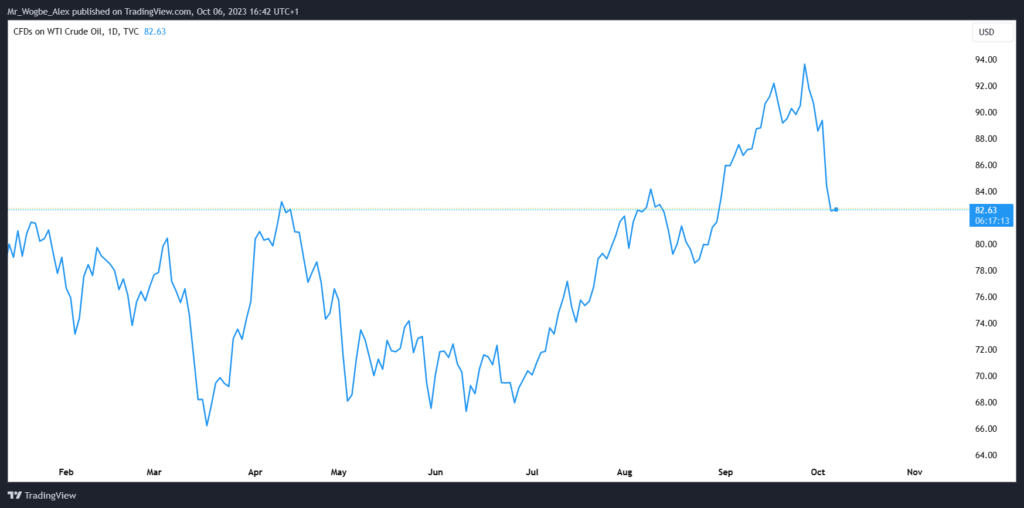

As one of Canada’s primary exports, the price of oil weighed on the Canadian dollar this week. Concerns over demand and Russia’s partial lifting of its fuel export ban pressured the market, with U.S. crude oil futures dropping to $81.56 a barrel on Friday, marking a 1.1% decrease.

Following the positive jobs data, Canadian government bond yields rose across the curve on Friday. The 10-year yield climbed to 4.273%, although it remained slightly below the 16-year high of 4.292% reached earlier in the week.

Interested In Becoming A Learn2Trade Affiliate? Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.