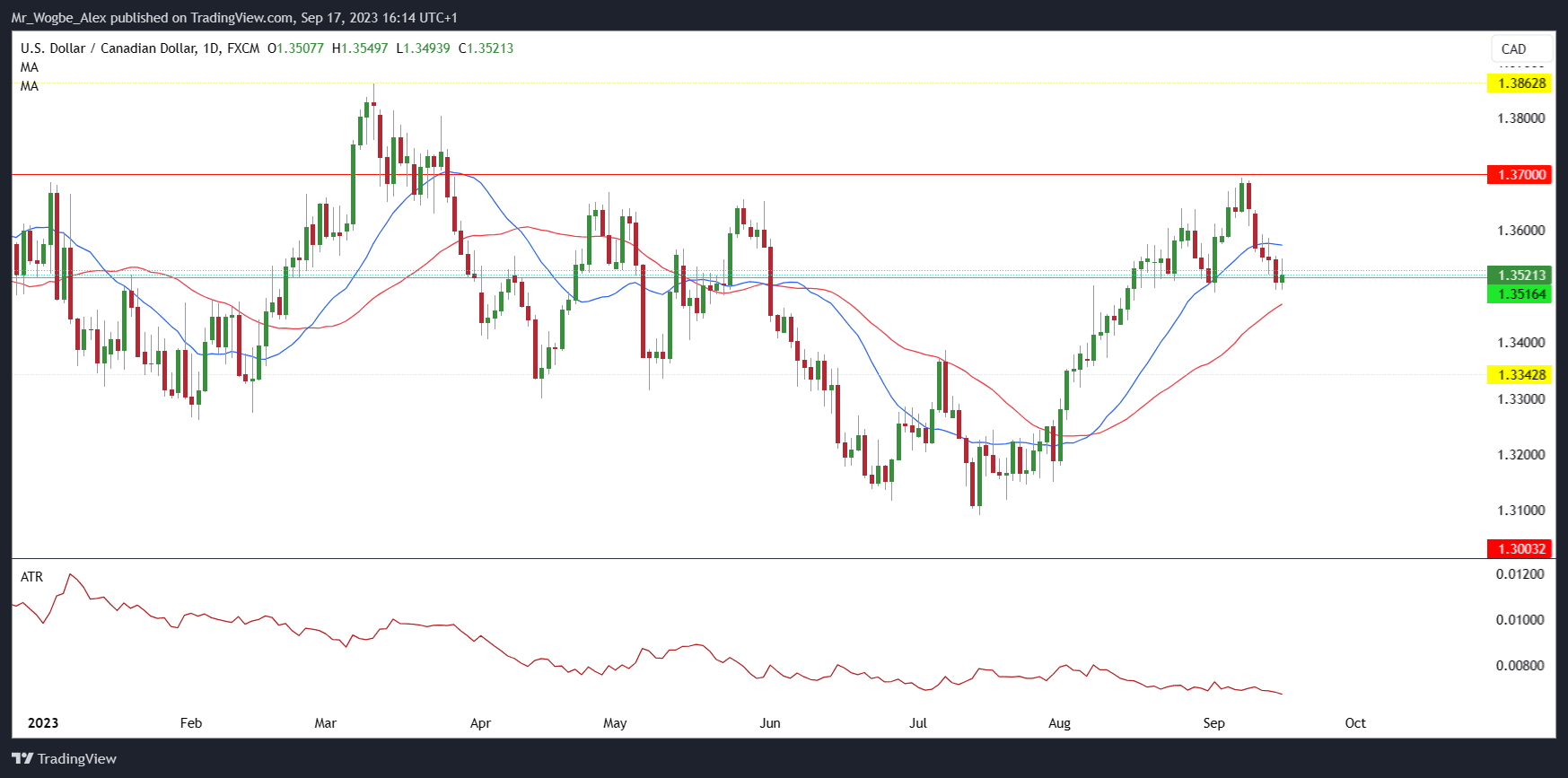

The Canadian dollar (CAD) edged lower against the U.S. dollar (USD) on Friday but still posted its biggest weekly gain since June. The loonie traded at 1.3521 to the greenback, down 0.1% from Thursday.

The surge in oil prices played a pivotal role in bolstering the Canadian dollar’s performance. Crude oil soared to a 10-month high, reaching an impressive $91.19 per barrel on Friday.

Given that oil ranks as a cornerstone of Canada’s exports, it’s no surprise that such robust prices lent strong support to the CAD last week. This bullish trend in oil can be attributed to Saudi Arabian production cuts and renewed optimism surrounding Chinese demand.

Adding to the CAD’s strength was the Euro’s (EUR) notable weakness. The EUR stumbled after signals from the European Central Bank (ECB) suggested a pause in its interest rate hike cycle. This development triggered considerable selling pressure on the EUR-CAD pair, as explained by Amo Sahota, Director at Klarity FX in San Francisco, in a note to Reuters.

Looking Ahead for the Canadian Dollar

Looking ahead, the Canadian dollar faces a mixed bag of challenges and opportunities in the coming week. Investors are closely eyeing two pivotal events: Canada’s inflation report and the U.S. Federal Reserve’s policy decision.

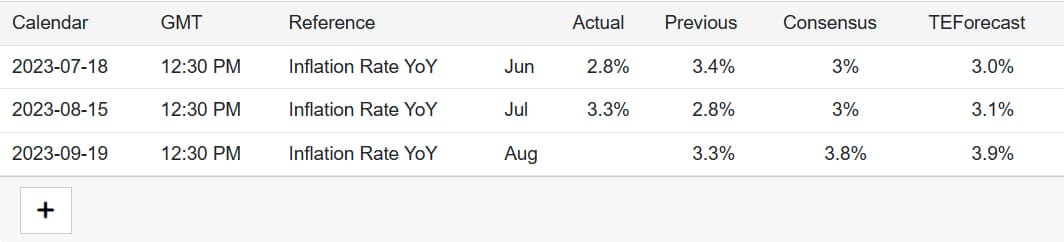

Economists anticipate Canada’s consumer price index to reveal a year-on-year inflation increase to 3.8% in August, up from July’s 3.3%. Meanwhile, the Fed is widely expected to maintain its benchmark interest rate at 5.25%–5.50%, but speculation is rife about hints regarding future plans.

It’s worth noting that the interest rate differential between Canada and the U.S. has recently tilted in favor of the USD. Canada’s 2-year yield has dipped below its U.S. counterpart by approximately 30 basis points, potentially posing headwinds for the CAD. Historically, higher yields tend to attract more capital flows, influencing exchange rates.

Interested in Getting the “Learn2Trade Experience?”Join us here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.