Market Analysis – May 29

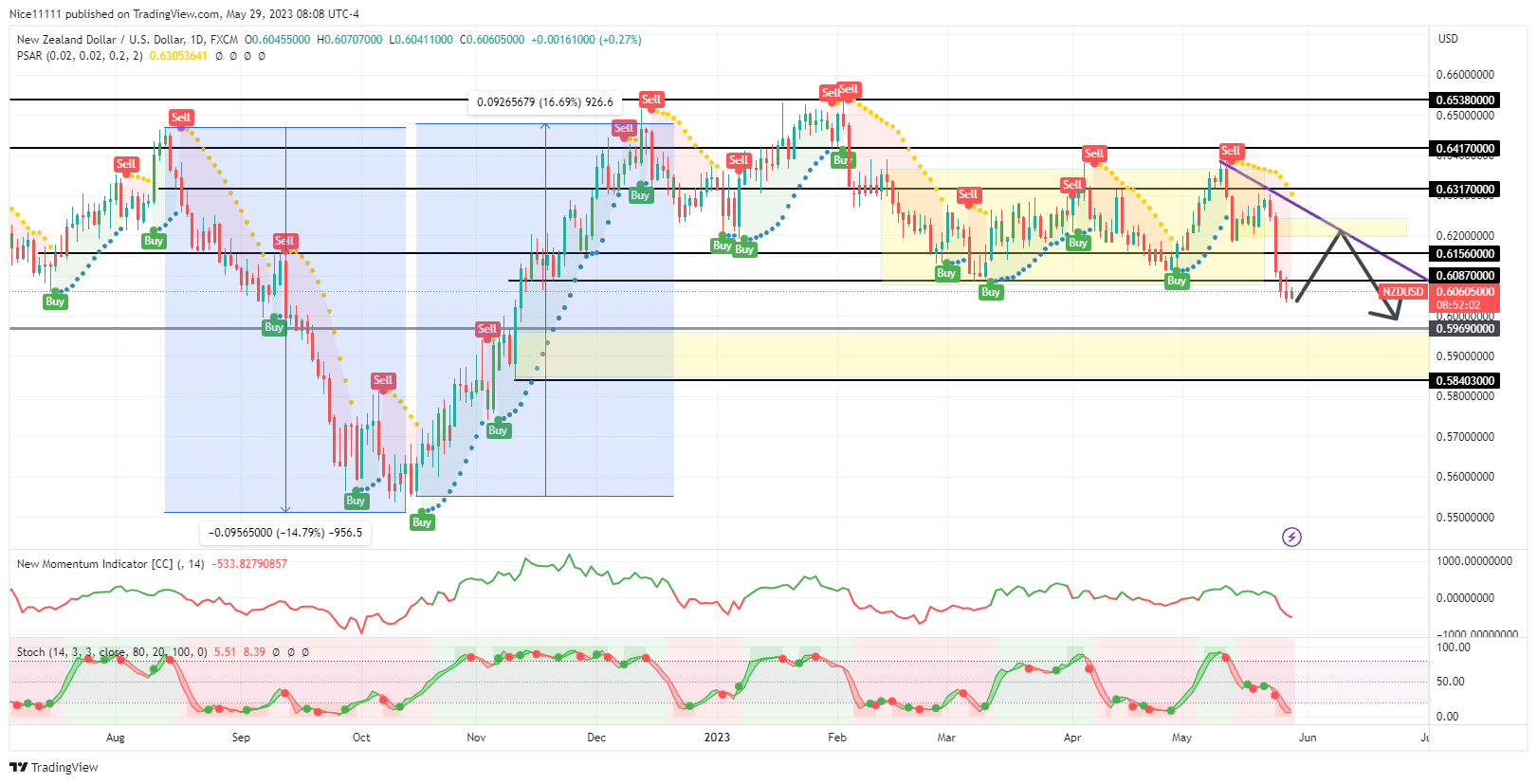

The NZDUSD price has dived below the 0.6080 support level. The support level has defined the ranging market since the 24th of February. The resistance level of 0.6320 has served as the upper border of the long-term consolidation. The forceful break of the support level is expected to create a strongly trending market after a long period of stiffness.

NZDUSD Key Levels

Supply Levels: 0.6320, 0.6420, 0.6540

Demand Levels: 0.6150, 0.6080, 0.5840

NZDUSD Long-term Trend: Bearish

The NZDUSD price has just escaped from a consolidation phase that appeared to be the result of massive price swings in the past. NZDUSD formed steep slopes of about a thousand pips during the price crash and pump in the second half of the previous year.

The New Momentum Indicator revealed the impressive momentum of the Kiwi market. After the exhaustion of the buyers at the beginning of the year, the price declined steadily into consolidation. The Parabolic Stop and Reverse (SAR) indicator showed buy and sell opportunities at the test of the support and resistance levels of 0.6150 and 0.6310.

NZDUSD Short-term Trend – Bearish

The breakout of the range is expected to drain the price to the next significant support level of 0.5970. A pullback is therefore anticipated towards the bearish order block above 0.6150 for shorting opportunities as the Stochastic is oversold.

Do you want to take your trading to the next level? Join the best platform for that here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.