Market Analysis- May 22

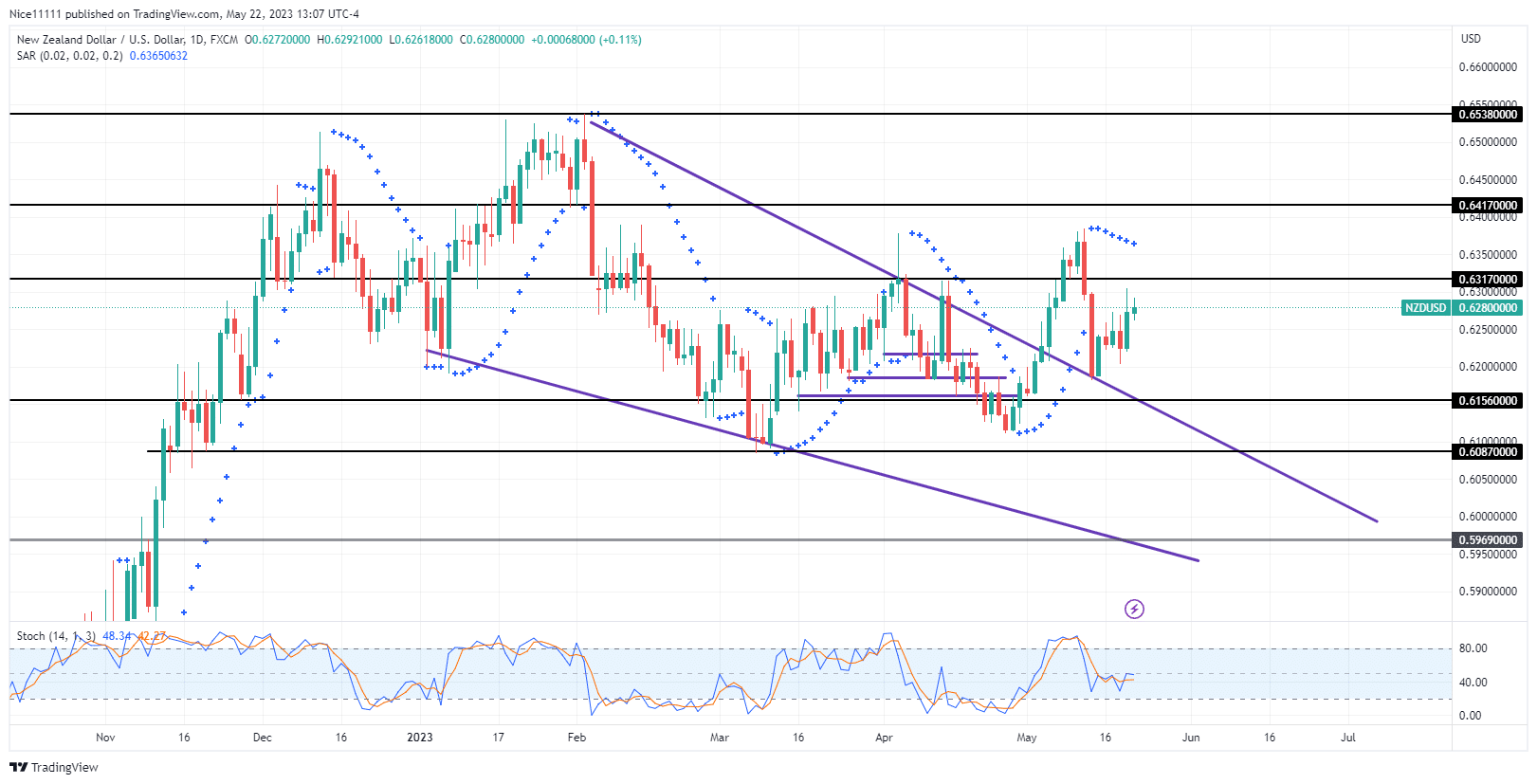

NZDUSD has launched towards the 0.63170 supply level. A bullish displacement that closed the month of April successfully rose above the bearish trendline. The retest that followed the breakout has served as support for an ascent.

NZDUSD Key Levels

Demand Levels: 0.6150, 0.6080, 0.5960

Supply Levels: 0.6310, 0.6410, 0.6530

NZDUSD Long-term Trend: Bullish

The formation of a double top at the supply level of 0.6530 initiated the decline in price in February. The Parabolic SAR (Stop and Reverse) indicator signaled a downward trend at the test of the supply zone.

On the daily chart, the months of March and April had no distinct direction.

The price paddled back and forth between 0.6310 and 0.6156. The current playout of the bullish breakout has helped define the market’s direction as bullish.

NZDUSD Short-term Trend: Bullish

On the 4-hour chart, the market structure has turned in an upward direction. A break in structure on the lower timeframe has been observed as the price draws closer to the supply level of 0.6310. The stochastic is oversold on the 4-hour timeframe; hence, a return to the bullish order block before the break of structure is anticipated.

Do you want to take your trading to the next level? Join the best platform for that here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.