NZD/USD Market Analysis – February 15

The NZD/USD pair has recently been a masterclass in market volatility and shifting sentiment. After a period of aggressive bullish momentum that saw the Kiwi dollar charging higher, the market has entered a phase of calculated cooling. Traders are now watching a slow, deliberate drift back toward the 0.6000 psychological handle—a level that often acts as a “line in the sand” for the pair.

But what transformed a “risk-on” rally into this cautious retracement? The answer lies in a complex interplay of domestic labor data and the looming shadow of central bank policy.

While the Reserve Bank of New Zealand (RBNZ) recently maintained a stimulatory stance with the OCR at 2.25%, the narrative is beginning to shift. A surprise uptick in the unemployment rate to 5.4% has introduced a layer of economic “slack” that complicates the RBNZ’s next moves. Combined with a resilient US Dollar and fluctuating global commodity prices, the NZDUSD is currently caught between two worlds: a domestic recovery that is gaining momentum and a technical gravitational pull toward 0.6000.

NZD/USD Key Levels

Supply Levels: 0.61000 , 0.61500, 0.62000

Demand Levels: 0.60000, 0.5900, 0.58000

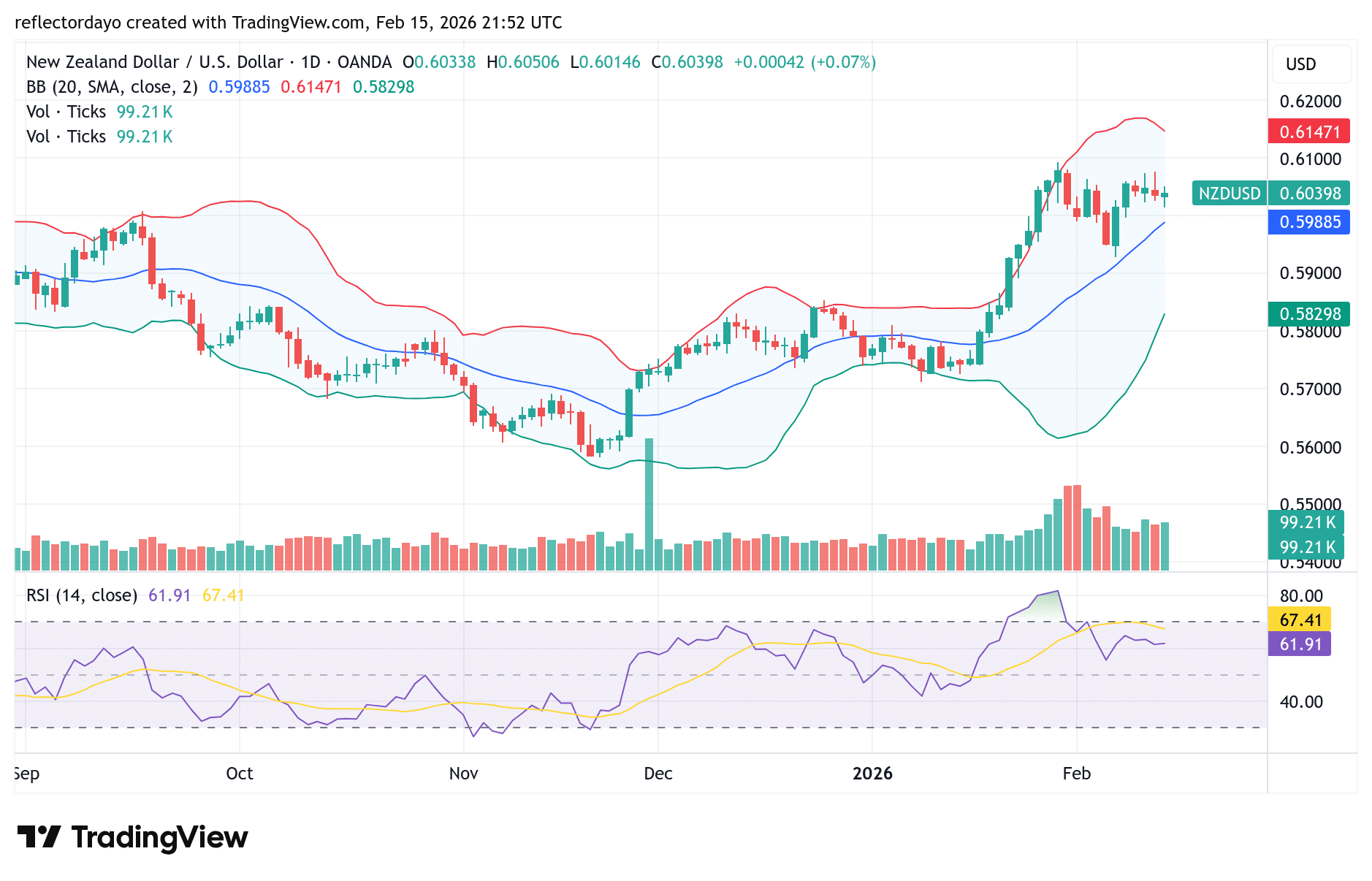

NZD/USD Daily Outlook

The NZD/USD pair recently gained strong upward traction amid heightened market volatility, reflecting renewed buying interest from investors. Price rallied from the 0.5750 handle, breaking decisively above the 0.6000 level and extending gains to peak around 0.6100.

However, within the 0.6000–0.6100 zone, caution began to emerge, prompting a period of consolidation. More recently, price action has started to drift gradually back toward the key support at the 0.6000 level.

The reaction around this support zone will likely determine whether the broader bullish structure remains intact or if a deeper retracement is on the horizon.

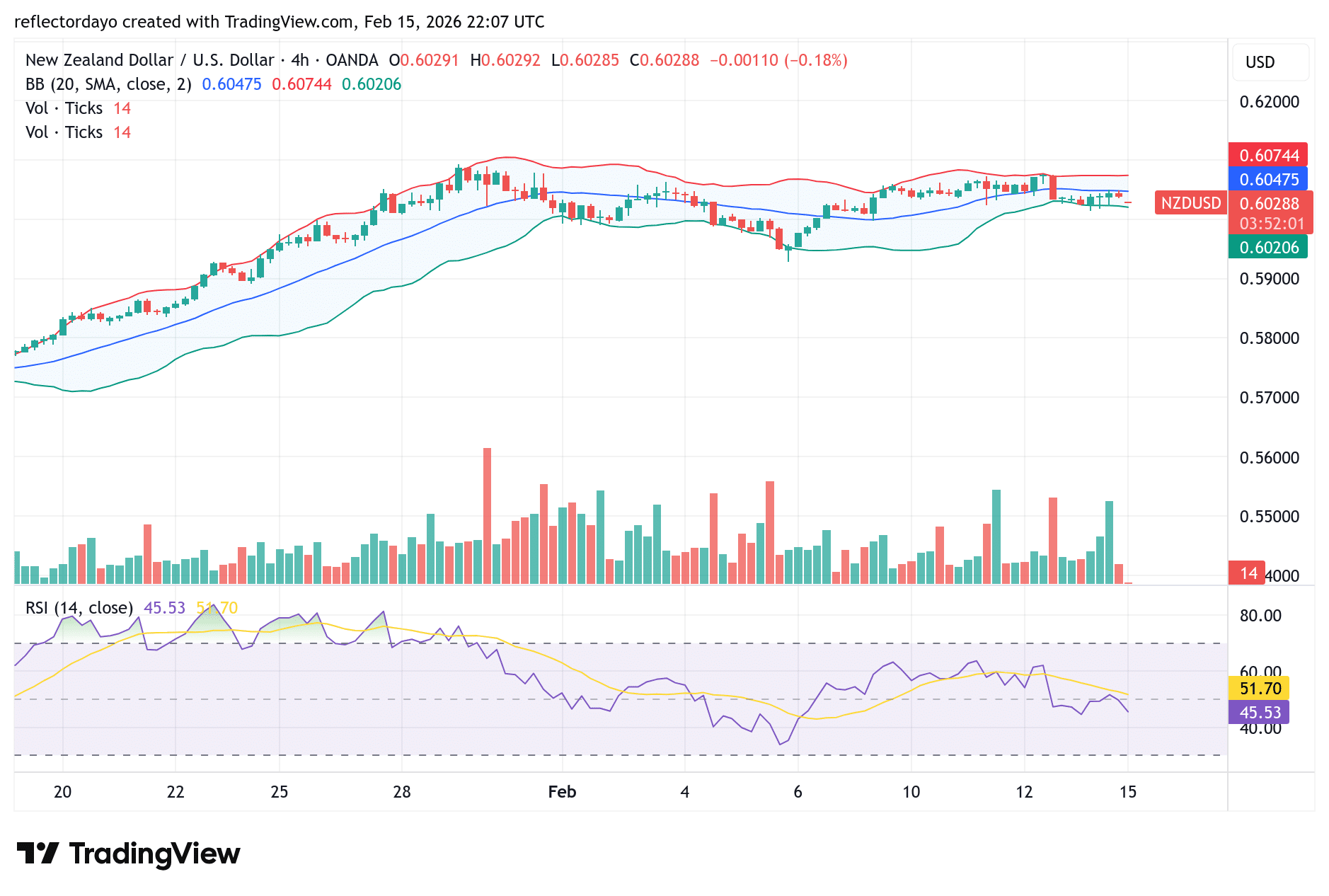

Short-Term Trend

From the 4-hour chart perspective, the market appears to be in a consolidation phase. The Relative Strength Index (RSI) is hovering around the midpoint, reinforcing the view of equilibrium between demand and supply.

Despite this balance, price action has gradually drifted lower, with the pair now trading around the 0.6030 level. The bearish pressure remains subtle rather than aggressive, suggesting a controlled retracement rather than a full momentum shift.

Given that 0.6030 represents a significant price zone, a bounce from this level is possible. Should buyers step in decisively, the market may attempt a retest of the 0.6100 resistance level.

Make money without lifting your fingers: Start using a world-class auto trading solution.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.