Market Analysis – February 8

The NZD/USD (Kiwi) pair is trading on a firmer footing as the US Dollar weakens in response to cooling US labor market data, which has revived expectations of a more dovish Federal Reserve stance. Recent employment figures suggest easing pressure in the US job market, prompting investors to reassess the Fed’s policy outlook and reduce Dollar exposure.

Market pricing now reflects expectations for two Federal Reserve rate cuts this year, with the first likely to begin in June and a possible follow-up cut in September. This shift in rate expectations has weighed on US Treasury yields and provided near-term support for risk-sensitive currencies such as the New Zealand Dollar.

However, upside momentum in NZD/USD (Kiwi) remains somewhat constrained by mixed labor market data from New Zealand. A rise in the unemployment rate has dampened domestic sentiment and pushed back expectations for any near-term tightening by the Reserve Bank of New Zealand, limiting the Kiwi’s ability to fully capitalize on the US Dollar’s weakness.

NZD/USD Key Levels

Supply Levels: 0.60500 , 0.61000, 0.62000

Demand Levels: 0.58000, 0.5700, 0.56500

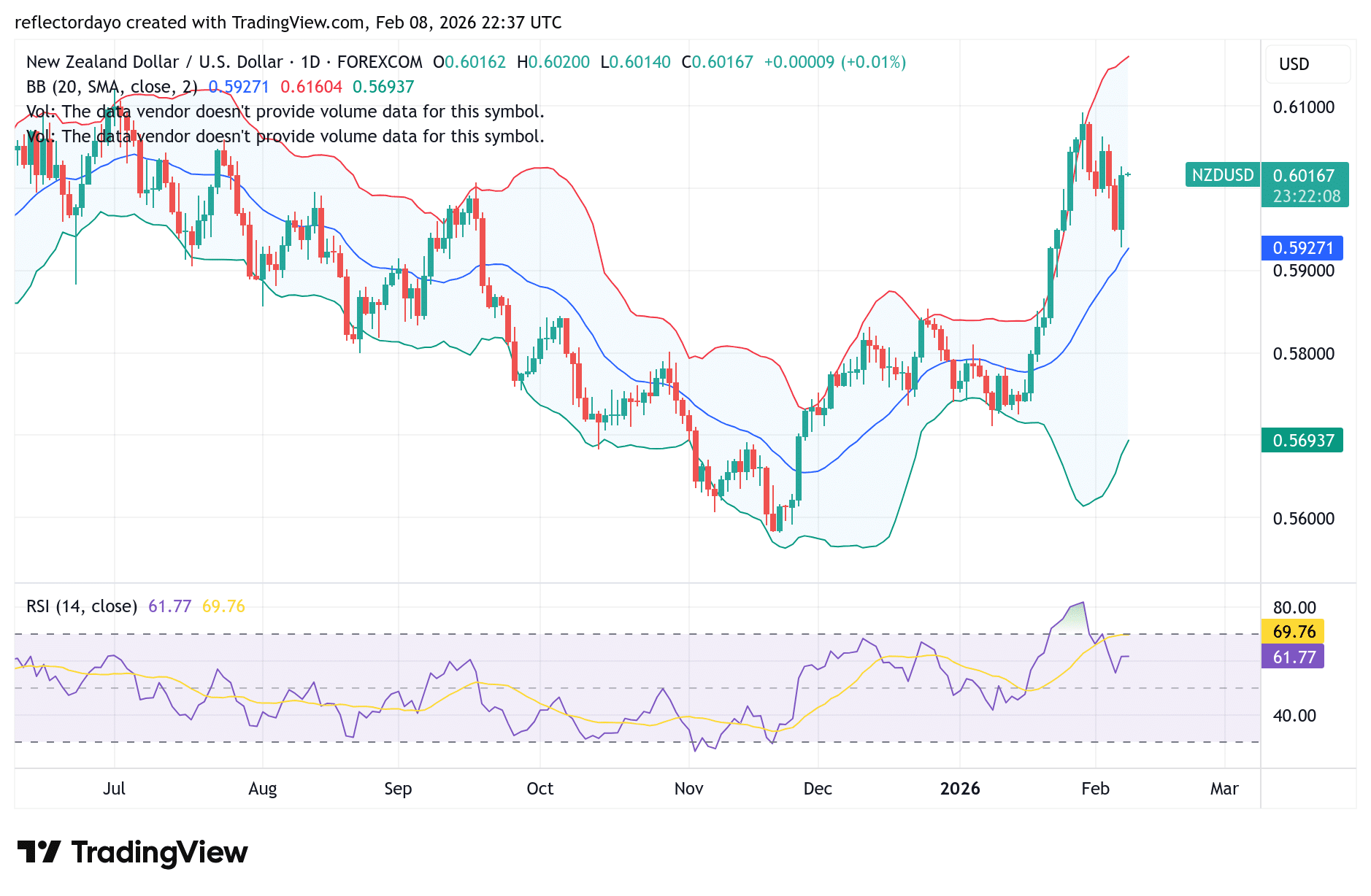

Kiwi: Daily Outlook

The NZD/USD pair has exhibited notable volatility in recent sessions. Last week, the market peaked near the 0.6100 price level, with expectations that 0.6000 would act as a key support, keeping price action contained within the 0.6000–0.6100 range. However, as the new week unfolded, the pair failed to sustain its position above the 0.6000 threshold and declined sharply, dipping close to the 0.5900 level before staging a rebound.

Importantly, the recovery was strong enough for the market to reclaim the 0.6000 level and close the week above it. If support at 0.6000 continues to hold, bullish momentum may persist, potentially driving the pair back toward the 0.6100 resistance zone.

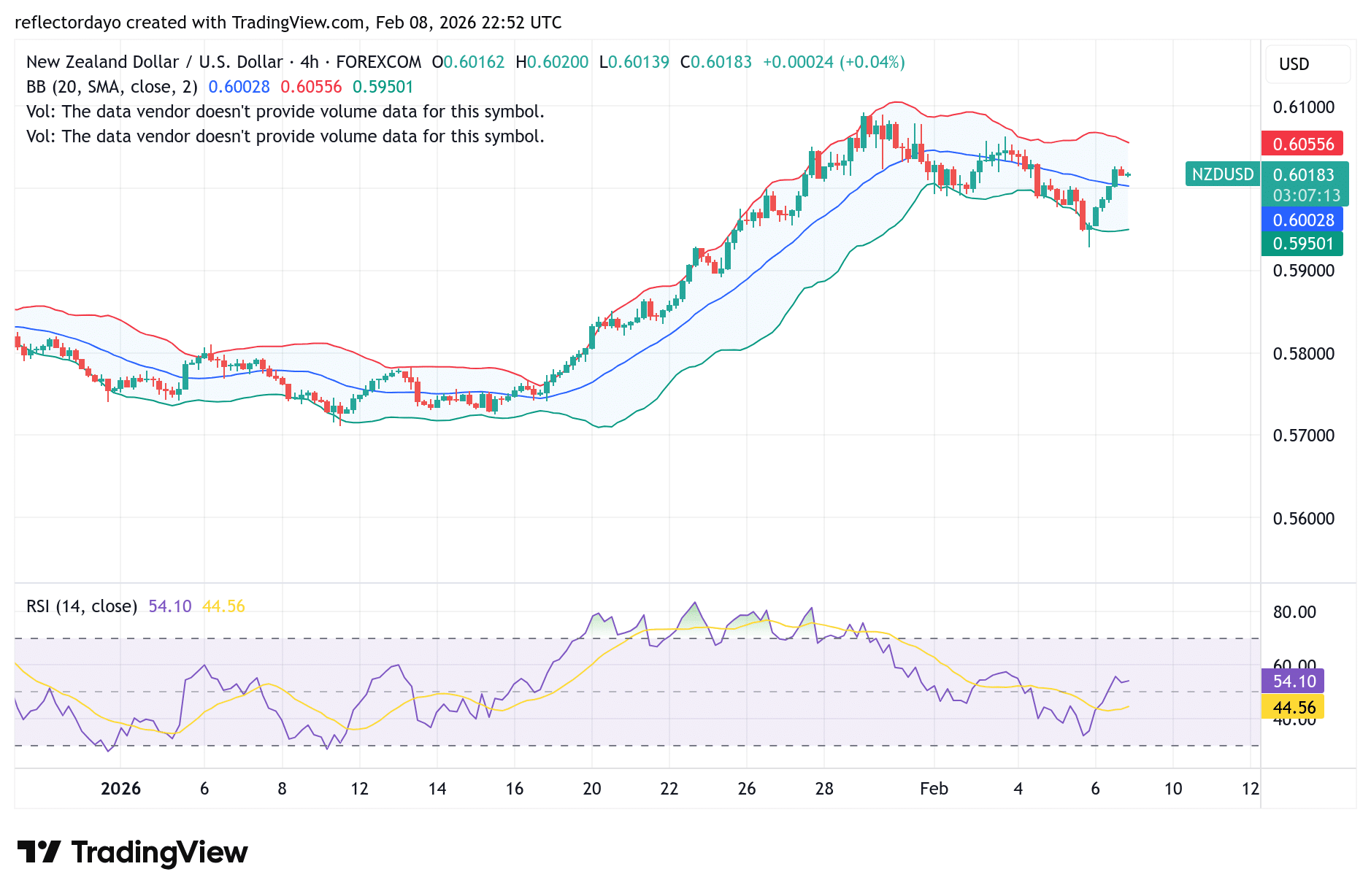

NZD/USD Short-Term Trend

A weekly close above the critical 0.6000 price level could give bullish sentiment an early advantage as the market opens for the new trading week. Trading activity may initially consolidate around this zone as participants assess directional momentum. Notably, the nearest resistance lies at the 0.6050 level. If bullish bias in the coming week is strong enough to break and hold above this threshold, the market could extend its advance toward the 0.6100 price target.

Make money without lifting your fingers: Start using a world-class auto trading solution.

Related Resources

- Forex Signals — live EUR/USD, GBP/USD and more

- What Are Trading Signals? — beginner’s guide to signal services

- VIP Trading Signals — join 40,000+ traders getting early signals

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.