Wall Street traded on a very upbeat momentum as investors flooded energy stocks and priced in another round of aid spending from Washington.

The Nasdaq 100 (NDX) rose by 0.67% yesterday to record a new all-time high around 13696. The Dow Jones (DJIA) and the S&P 500 (SPX) also recorded new ATHs with +0.76% and 0.74%, respectively.

Wall Street began the week with strong gains led by the energy sector, better-than-expected earnings report, and expectation of another round of fiscal aid.

Democrats in the US Congress recently initiated a process that would allow the Senate to bypass the Republicans and vote on Biden’s relief plan, in a process known as budget reconciliation.

While it’s becoming unlikely that the entire $1.9 trillion will get passed, analysts expect it to still be a large sum. Last week’s worse-than-expected job reports will likely boost the prospects for larger spending.

Meanwhile, Treasury Secretary Janet Yellen said on Sunday that Biden’s plan could help facilitate strong economic growth to take the US back to full employment by next year.

Reuters reported that financial aid from Democrats is expected to include about $50 billion in extra funding for US airlines, transit systems, airports, and passenger railroad Amtrak, and a new $3 billion program to assist aviation manufacturers with payroll expenses.

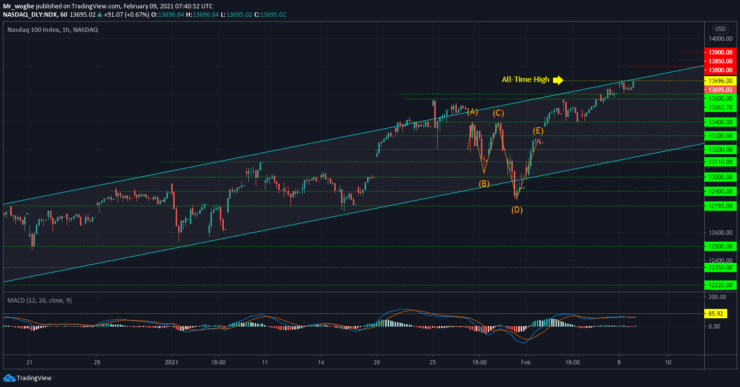

Nasdaq 100 (NDX) Value Forecast — February 9

NDX Major Bias: Bullish

Supply Levels: 13696, 13750, and 13800.

Demand Levels: 13600, 13563, and 13450.

The NDX had a very bullish run yesterday, recording a new ATH at 13696. Not surprisingly, the index struggled with climbing further from the ATH level considering that it ran into the top-end of our ascending channel. That said, the index has to resume market today with strong momentum to help it break above the channel or risk a slowdown and even a retrace to the 13600-563 area over the coming hours and days.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.