S&P 500 Price Analysis – February 9

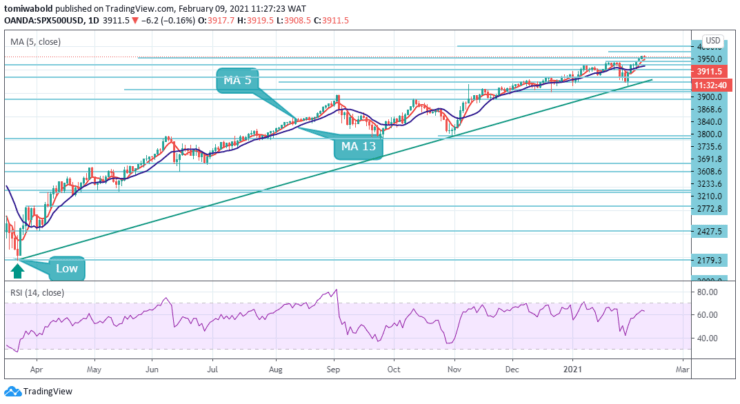

The S&P 500 stays past the 3900 levels, currently near 3919 highs, during early Tuesday as it eases amid the lack of a new catalyst. The market bias stays positive following fresh interest in US bonds combined with US stimulus hopes.

Key Levels

Resistance Levels: 4100, 4000, 3950

Support Levels: 3900, 3800, 3691

As seen on the daily, S&P 500 rally has finally extended to 3919 with further layers of resistance seen stretching up to 4000 high. The anticipated scenario remains for a cap in the 3900/4000 region and a potentially lengthier correction phase to then unfold.

The MA 5 seems to propel price in the 3850 to beyond 3900 regions. On the downside, 3840 (psychological level) aligns with the MA 200 as key support. A daily close below that level could force the index to attempt a slide toward the 3800 levels in the following sessions.

The S&P 500 index is in a bullish trend on the 4 hour time frame and this means that intra-day trades may be derived in line with the bigger time frame’s trend. Looking at the 4-hour time frame, the price has formed a bullish pattern and they usually break in the direction of the current trend.

As for the RSI, it is trading at the overbought region, however, if it breaks below, this could be the first confirmation that the bears are about to start their party-meaning more weakness ahead. The preferred bias is a short position beneath 3900 levels with targets at 3868 level & 3840 in extension. Alternatively, we look for further upside with 3950 & 4000 as targets.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.