Futures tracking the Nasdaq 100 (NDX) and the S&P 500 (SPX) saw record-high figures on Friday, as risk asset investors expect goodish jobs report to confirm that the worst of the labor market crisis is over, alongside additional economic stimulus.

The Labor Department is likely to report that the US economy grew by 50k jobs in January, following a 140k loss in December. The goodish pick up in job numbers in January was likely triggered by the easing of lockdown restrictions across the US.

However, a goodish jobs report still does not eliminate the need for additional government fiscal aid, as long-term unemployment prospects still seem gloomy.

President Joe Biden’s proposed $1.9 trillion stimulus bill got fast-tracked earlier today, as the US Senate approved a budget plan that included the passage of the bill in the coming weeks.

The tech-heavy index is set to record its best week yet since the US elections in November, as upbeat earnings and economic data increased optimism over a speedy economic recovery. Meanwhile, last week’s retail trading frenzy appears to be fading, triggering an 80% drop in GameStop (GME) stock.

Better-than-expected corporate earnings reports so far in the fourth quarter have bolstered speculators’ expectations for the market risk mood in the coming days and weeks.

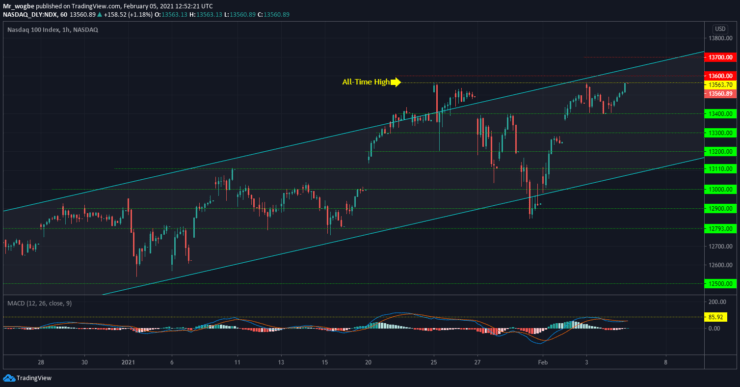

Nasdaq 100 (NDX) Value Forecast — February 5

NDX Major Bias: Bullish

Supply Levels: 13650, 13700, and 13750.

Demand Levels: 13500, 13450, and 13400.

The Nasdaq 100 is on an aggressive bullish rally, with the index having broken the crucial 13600 resistance over the past few hours (pre-market data). That said, we expect this current rally to take the NDX to the 13650 price point (top-end of our ascending channel) in the coming hours.

Also, we could see a break above the prevailing channel given the current momentum in the market. Nonetheless, any fall from the current level should be heavily repelled by the 13450 support in the meantime.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.