The Nasdaq 100 (NDX) recorded a whopping 2.65% climb yesterday, paring back most of the losses it suffered last week. Although price action can still be seen in the new retail traders’ favorites like GameStop and AMC, a significant decline in short interest surrounding these stocks has put the markets in a different landscape compared to last week.

Goldman Sachs reported that hedge funds bought and sold the most amount of stocks ever seen in the past ten years last week, which resulted in the most “de-grossing” since February 2009. While the recent deleveraging of markets could make trading popular “Reddit stocks” complicated for retail traders, the excess cash on the sidelines could benefit the broader indices.

In other news, Democrats in both the House and the Senate filed a joint budget resolution in their respective chambers yesterday, which will clear the road for President Joe Biden to pass his proposed $1.9 trillion stimulus bill.

Before now, President Biden was hopeful about passing a bipartisan bill and met with a group of ten Republican Senators to debate their $600 billion counter-proposals. However, with several Democrats rejecting a smaller stimulus bill, the Biden Administration will likely forge ahead without the approval of the Republicans on his $1.9 trillion packages.

That said, additional stimulus measures will bolster the NDX and other indices in the coming weeks.

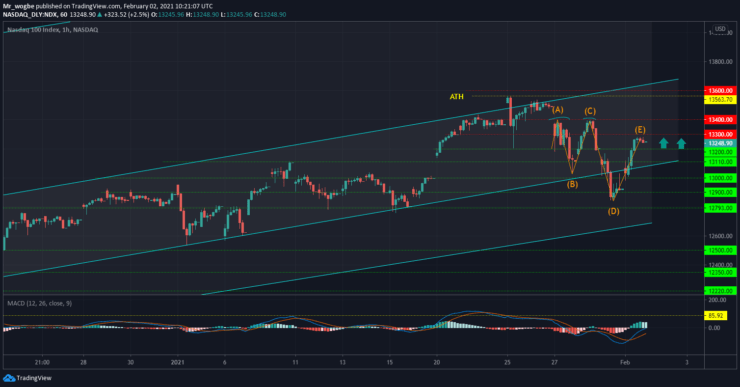

Nasdaq 100 (NDX) Value Forecast — February 2

NDX Major Bias: Bullish

Supply Levels: 13400, 13500, and 13563.

Demand Levels: 13200, 13110, and 13000.

Following the emergence of a double-top pattern and the Reddit traders’-induced market volatility, the NDX fell dramatically by more than 4% last week. However, the index has recovered most of the losses, +3%, from the recent crash.

That said, we expect full recovery to the 13400 resistance before the close of the market today, followed by an attempt at the 13563 over the week.

On the flip side, any fall from the NDX’s current price level will get strongly repelled by the 13110 support, where the base of our ascending channel lies.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.