Lululemon Athletica (LULU) has taken North America by storm with its sports and casual wear.

The Canadian-based athletic apparel retailer has been a pandemic winner, as stay at home workers swap suits and dresses for sweatpants and leggings.

But its shares have been on the slide since the start of this year, after revised guidance for Q4 FY2020 (the period ended 31 January).

In an 11 January press release chief executive Calvin McDonald said: “We’re pleased with the momentum over the holiday period as our investments in Lululemon and Mirror allowed us to connect with guests both physically and digitally. We remain confident about our opportunities in 2021 and committed to our Power of Three growth plan.”

Investors shouldn’t be blinded by analyst disappointment on guidance

But that optimism was followed in the small print that reported “growth rate in net revenue to be at the high end of its mid-to-high teens expectation” and adjusted diluted EPS to come in at the high end of its mid-single digits expectations.

You would have thought that would please the market, but it wasn’t the usual beat that analysts have become accustomed to and the shares fell on the news.

Some analysts had been expecting LULU to bring forward new sales forecasts north of 20%.

LULU doesn’t release Q4 results until 31 March but if the third quarter results are a clue, then sales can be expected to be growing at a steady clip.

In 3Q LULU showed how it was able to keep growing despite the impact of lockdowns on store closures as it continued to expand its e-commerce footprint and maintained its store-opening schedule.

Third-quarter sales were an impressive $1.1 billion, which was up 22% on a year previously ,and an acceleration from the stuttering start to the year that saw a pull back in the shares in June after results laid bare the impact of the Covid pandemic in the first half.

While most bricks and mortar retailers’ performance has languished in the doldrums, if not seen them flirt with near-death experiences, LULU has gone from strength to strength. That’s in no small part due to the way it has positioned its business to capture the e-commerce opportunity.

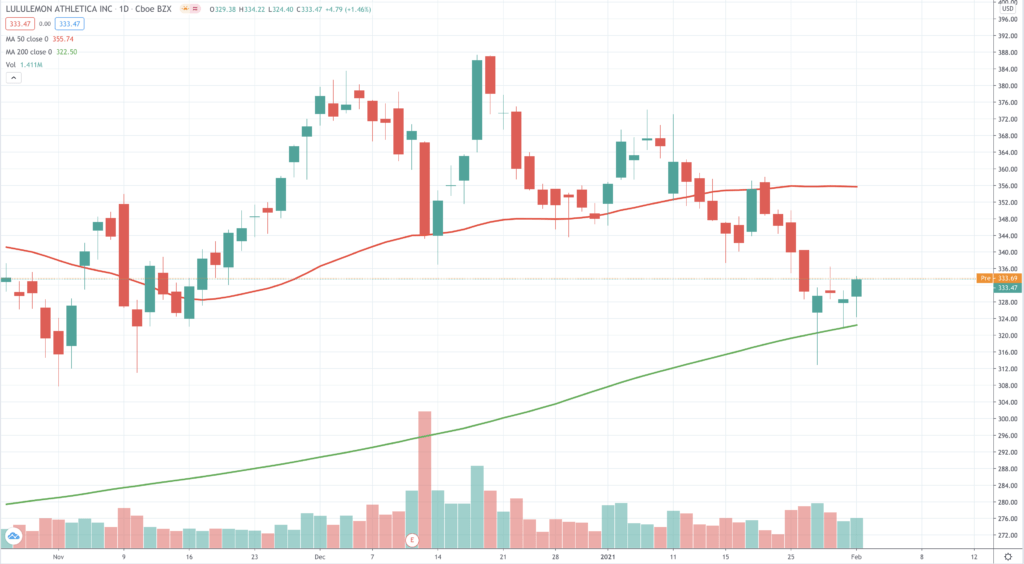

With the share price a long way off its all-time high at $398 printed on 2 September and the nearer-term high of $367 recorded on 7 January, the current bearish channel may be weakening.

LULU was up 1.46% yesterday (Monday 1 February), closing at $333.

Expansion plans will drive revenue growth

Part of LULU’s growth plan, referenced by the McDonald includes stepped-up expansion in East Asia and Europe.

Clearly, with the pandemic forcing many countries into varying degrees of lockdown, it’s not a great environment to rollout store opening. But its stores – a bit like Apple’s – are not just another retail channel in and of themselves, but shop windows, if you will, on a wider brand offering that is a lifestyle play, hence the description of customers/shoppers as guests.

In 2020 it opened 30 to 35 stores and has plans to open a similar number this year. As well as building on its East Asia presence in Japan, China, South Korea and Australia, the company is focused on the UK and Germany as big growth opportunities. Lulu currently has 16 stores across the UK.

Only 14% of revenues in the third quarter came from outside North America, and chief executive McDonald wants to boost that to 50%.

Helping it in that journey was the acquisition of fitness equipment start-up Mirror last year.

The company is also looking to expand sales to men.

The European expansion plans will also be assisted greatly by the hiring of André Maestrini from Adidas – he joined Lululemon at the beginning of this year.

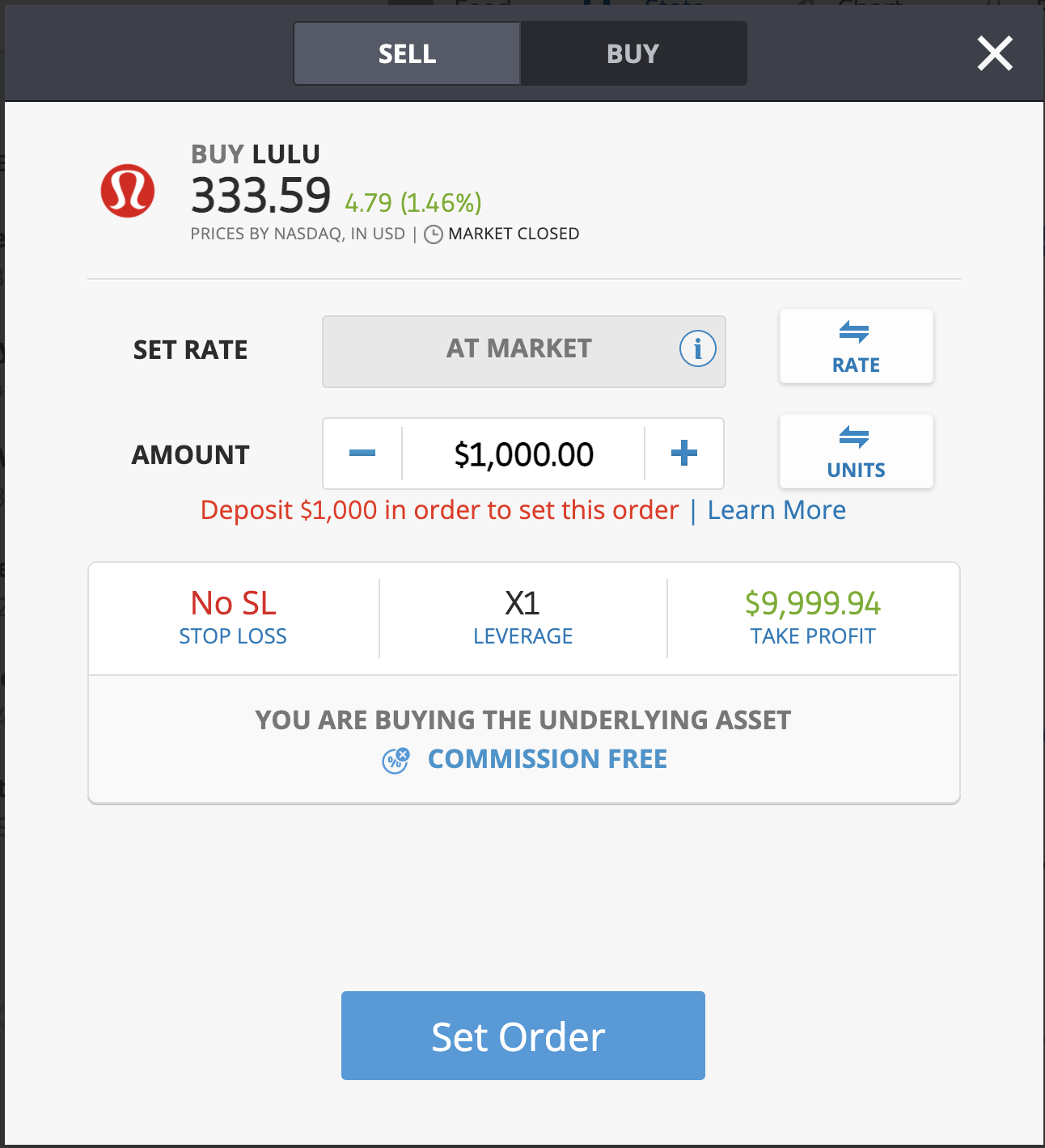

8cap - Buy and Invest in Assets

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Buy over 2,400 stocks at 0% commission

- Trade thousands of CFDs

- Deposit funds with a debit/credit card, Paypal, or bank transfer

- Perfect for newbie traders and heavily regulated

What are the risks in buying Lululemon stock?

Lululemon risks, include the ease with which competitors could replicate its success (although none has done so yet) and the upmarket positioning of the brand, which means many consumers will baulk at its prices. Sweatpants sell for $120, which is probably more than 10x their cost at Primark.

However, with the K-shaped recession seeing a stark divide open up between winners and losers in the pandemic, there is undoubtedly a swelling well-heeled demographic that has been saving money and shifting spending patterns to precisely the goods that Lululemon is selling.

Optimum entry point for new investors in Lululemon

With the results upcoming at the end of March and vaccine rollouts expected to accelerate in its target markets, the current price presents an optimum entry point for new investors who wish to ride the new stay-at-home work-from-home wave that is set to become a permanent wave.

In his comments on 14 January McDonald emphasised that the company’s ‘guests’ were generating demand that Lululemon “wasn’t able to fully satisfy”, pointing to strengthening sales ahead, even as return to the office and more outdoor activity returns.

“Although online has done incredibly well, we know there are still a large number of guests that are physical store shoppers only. I have seen a shift in what guests want. I believe it is sustainable and we did not by any means satisfy the demand in 2020 that those shifts will create this opportunity,” said McDonald.

He continued: “And as people shift back to more outdoor, going back to the office – which will happen in 2021 – there is no doubt in my mind that the opportunity and demand for our product and for versatile apparel has a long opportunity of growth ahead of us, and that is what we are continuing to lead in. I do not believe that there is a pull forward. I think there is a demand that even Lululemon wasn’t able to fully satisfy.”

You can watch the video of McDonald’s comments here:

Our near-term price target is $367.

8cap - Buy and Invest in Assets

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Buy over 2,400 stocks at 0% commission

- Trade thousands of CFDs

- Deposit funds with a debit/credit card, Paypal, or bank transfer

- Perfect for newbie traders and heavily regulated

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.