Key Highlights

Litecoin drops to $134 low after failing to break above the resistance line

The crypto may lose $120 support if buyers fail to break the resistance line

Litecoin (LTC) Current Statistics

The current price: $138.52

Market Capitalization: $11,635,672,150

Trading Volume: $6,174,947,435

Major supply zones: $200, $220, $240

Major demand zones: $100, $80, $60

Litecoin (LTC) Price Analysis February 2, 2021

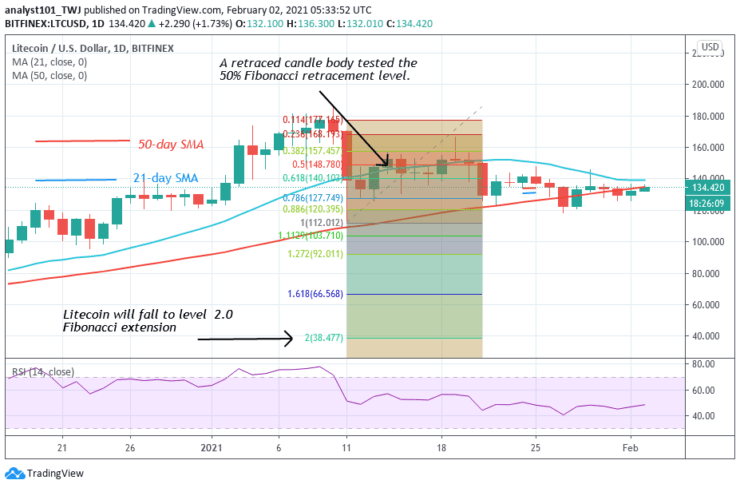

Litecoin has continued to make a downward move as the crypto reaches the low of $134. In the previous price action, Litecoin has been making a series of lower highs and lower lows. The downtrend would have been interrupted if the bulls have broken the resistance line. On the downside, if the coin falls and breaks below the $120 support, LTC will be faced with deeper correction as the coin will decline to $55 low. On the upside, the bulls have to break the resistance line to overcome the current downtrend.

Litecoin (LTC) Technical Indicators Reading

The bears have broken below the SMAs as bulls attempt to push LTC upward. The coin will resume upward if the crypto’s price rises above the SMAs. In the bullish trend zone, the coin has the chance of rising. Litecoin is at level 49 of the Relative Strength Index period 14. It indicates that there is a balance between supply and demand.

Conclusion

Litecoin has been falling consistently as bears approach the low of $120. The Fibonacci tool analysis will hold if the bears break the $120 support. On January 11 downtrend; a retraced candle body tested the 50% Fibonacci retracement level. The retracement indicates that the crypto will reach level 2.0 Fibonacci extensions or the low of $38.47.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.