Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Market Analysis – September 4

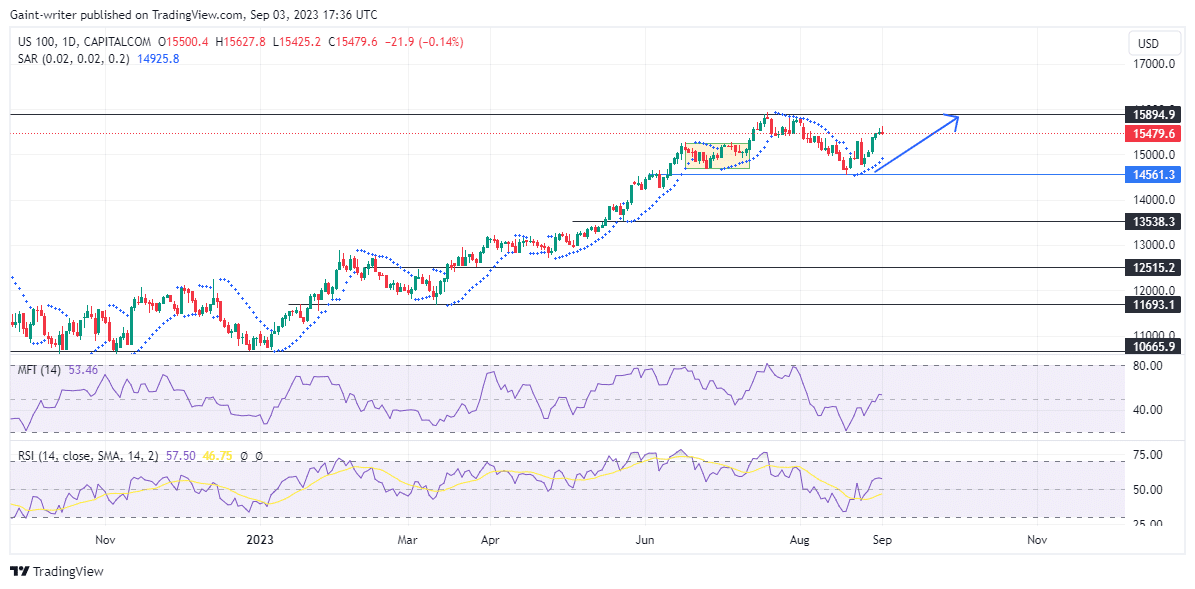

Nasdaq 100 (NAS100) sticks to a modest gain as the buyers are closing up to the 15894.90 key zone. The buyers are currently creating more awareness to push the price forward. However, it still appears that buyers need more confidence to pull the price up this week. If they fail to do so, the sellers may regain power and drag the price lower.

Nasdaq 100 (NAS100) Key Levels

Resistance Levels: 15894.90, 14561.30

Support Levels: 12515.20, 11693.10

Nasdaq 100 (NAS100) Long-Term Trend

The

bulls had a modest gain last week after reversing from the sell influence at the 14561.30 key level. The sell signal came as a result of a pullback in price down to the 14561.30 key level. This implies that the bulls have kept their stance for a long time. As this year began, the market was strong on bullish terms.

l

The 15894.90 is now the target to be breached as we speak. This level is the all-time high that the index failed to reach before retreating slightly. If the buyers can break above this level, they may trigger a breakout that could cause a further bullish surge. The next potential resistance levels are 16000 and 16200.

l

The RSI (Relative Strength Index) is still positioned in

bullish territory, hovering above the 50 level. This indicates that the buyers are gaining strength and have more momentum than the sellers. The RSI also shows no sign of divergence or overbought conditions, suggesting that the uptrend is intact.

Nasdaq 100 (NAS100) Short-Term Trend: Bullish

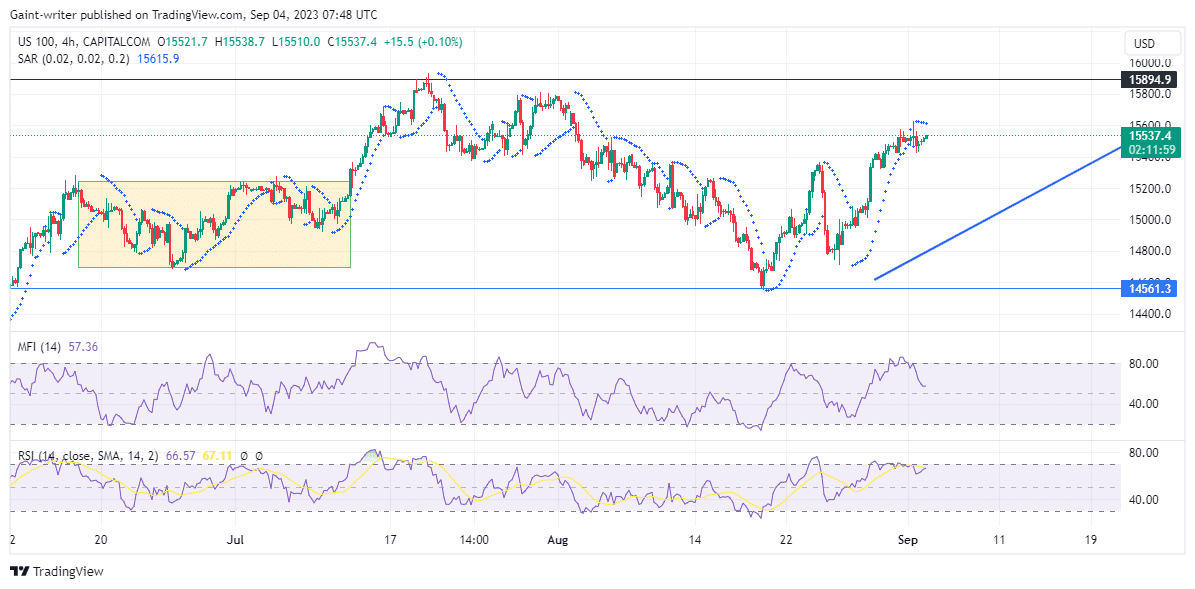

The

technical indicators are in favor of the buyers, who need more confidence to break above this level and extend the rally. The sellers may try to stop them and reverse the price lower, but they need to overcome the strong support at the 14,561.30 level first.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- The Lowest Trading Costs

- 50% Welcome Bonus

- Award-winning 24 Hour Support

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus