Market Analysis – September 4

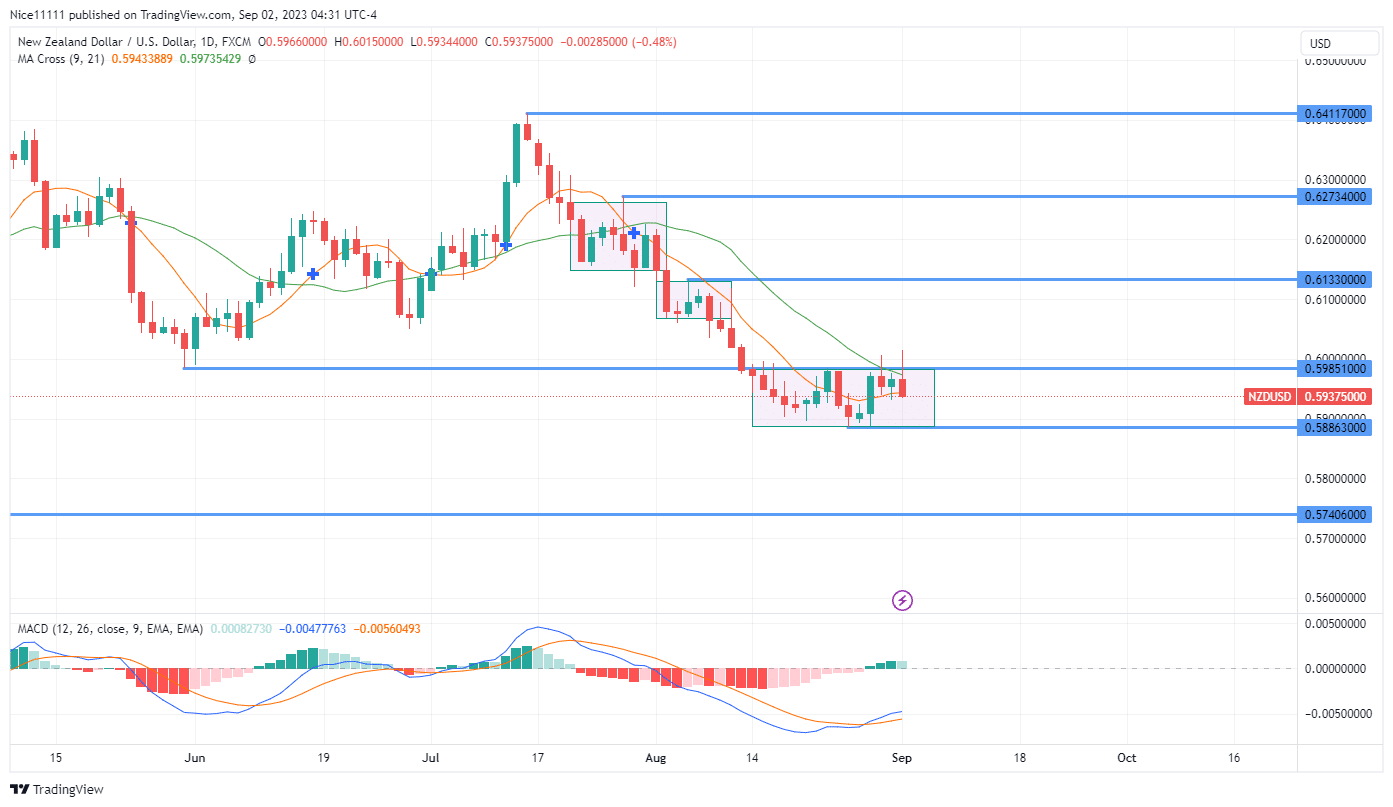

NZDUSD market direction turned bearish after the MACD (Moving Averages Convergence and Divergence) indicator signaled an oversold market in late July. The bullish order block failed to hold to establish the shift in the market structure.

NZDUSD Key Levels

Demand Levels: 0.5990, 0.5890, 0.5740

Supply Levels: 0.6130, 0.6270, 0.6410

NZDUSD Long-term Trend: Bearish

Shortly after the MACD histogram bars were projected in August, the Daily Moving Averages cross-confirmed a new downward trend. The Moving Averages hovered above the daily candles to reveal the selloff.

Shortly after the low of 0.5990 was swept, the steep NZDUSD trend transformed into a consolidation. The MACD currently points to a reversal with the cross of the lines in the oversold region. The daily candles are rising above the moving Averages which is a sign of a bullish reversal.

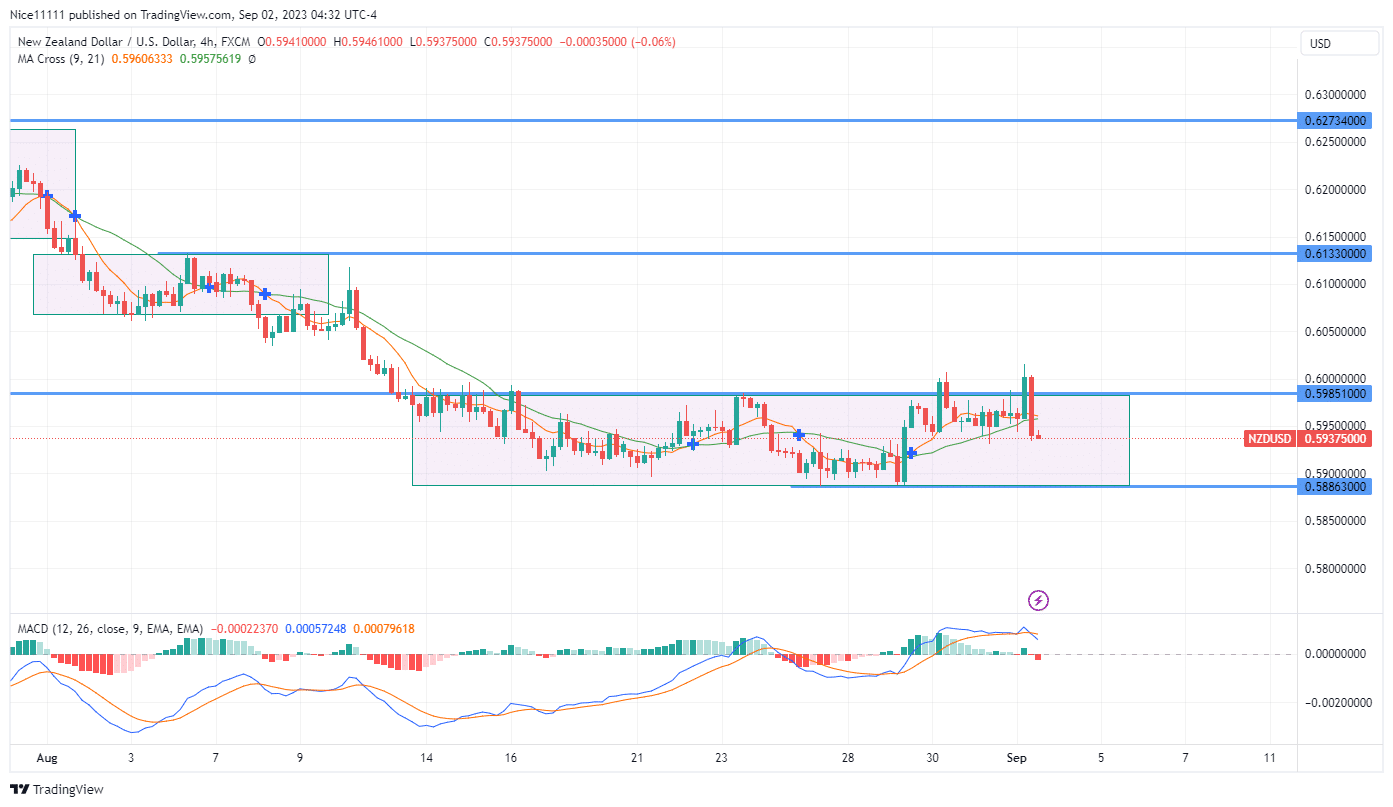

NZDUSD Short-term Trend: Bearish

The market consolidation is obvious on the 4-hour chart. The market price has failed to successfully break out from the range guided by the 0.5990 resistance line and the 0.5890 demand line. The Moving Averages have also been moving sideways on the 4-hour chart to reveal the consolidation. The breakout below the range might continue the sell trend. If the Bulls are successful, a new bullish trend might be established.

Do you want to take your trading to the next level? Join the best platform for that here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

9.8

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

9

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

9

Learn to Trade

Never Miss A Trade Again

step 1

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

step 2

Get Alerts

Immediate alerts to your email and mobile phone.

step 3

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.