NAS100 Analysis – January 25

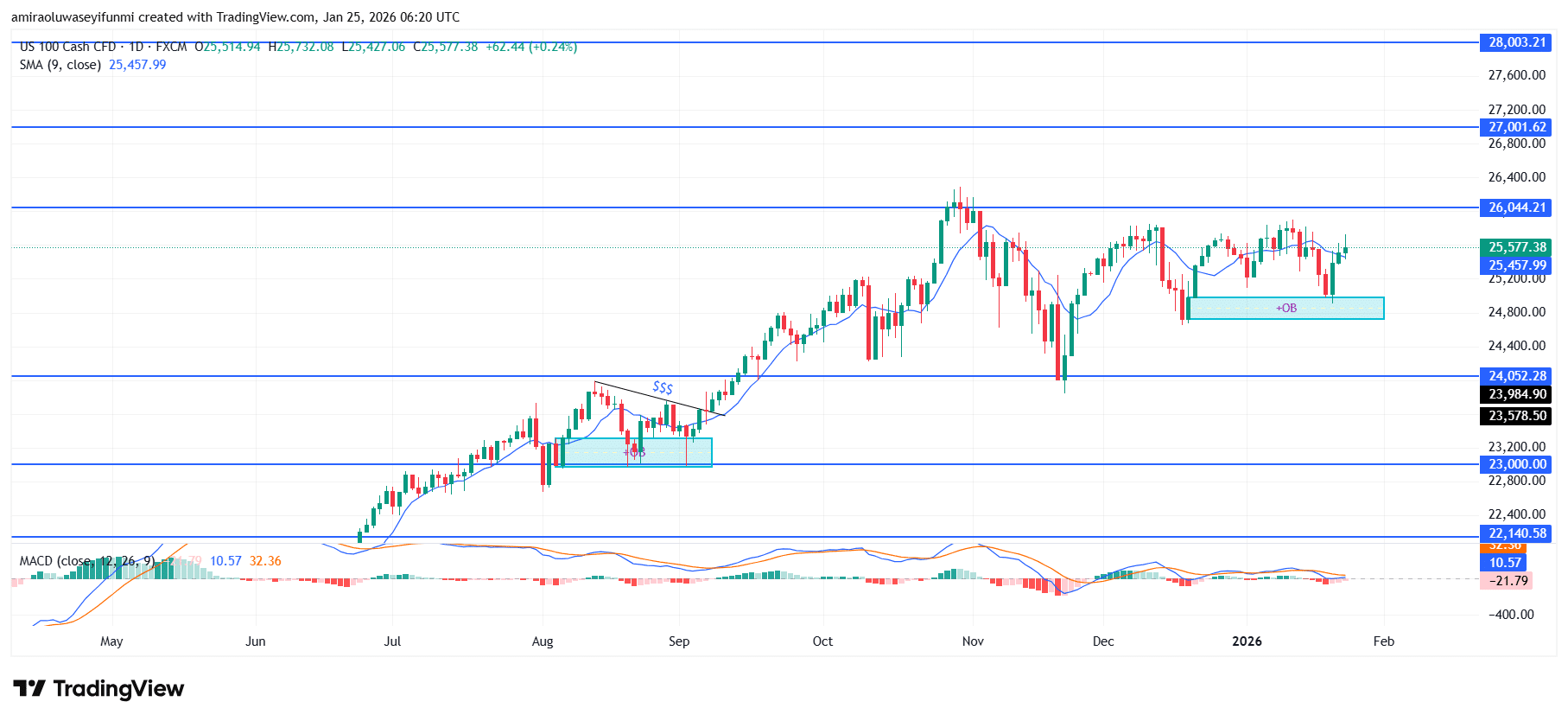

NAS100 is reflecting renewed upside traction as buyers regain directional control. The index is showing a clear transition toward positive trend behavior, with price action now favoring the upside across both trend-following and momentum-based indicators. Price is holding above the short-term moving average near $25,460, confirming that near-term control has shifted back to buyers. Meanwhile, momentum is rebuilding, with the MACD stabilizing around equilibrium and beginning to slope higher, signaling fading bearish pressure and the early phase of demand-driven positioning. Taken together, these factors suggest trend continuation rather than a short-lived relief bounce.

NAS100 Key Levels

Resistance Levels: $26040, $27000, $28000

Support Levels: $24050, $23000, $22140

NAS100 Long-Term Trend: Bullish

Price is consolidating gains following a prior expansion phase while continuing to respect a well-defined support zone between approximately $24,900 and $25,100. Repeated reactions from this area have produced a series of higher lows, underscoring sustained buyer defense. On the upside, price continues to test supply near $26,040, indicating mounting pressure against resistance rather than renewed seller control. This tightening range suggests that downside liquidity below the $25,000 handle has largely been absorbed.

Looking ahead, a sustained hold above $26,050 would likely serve as a catalyst for further upside, initially targeting the $27,000 region before exposing the broader $27,900–$28,000 supply zone. These areas align with prior structural inflection points and represent natural zones for price expansion. Any pullback toward $25,200 or $25,000 would remain technically healthy within a bullish framework, provided demand continues to hold those levels. From this perspective, traders aligning directional bias with forex signals may continue to favor upside continuation for NAS100.

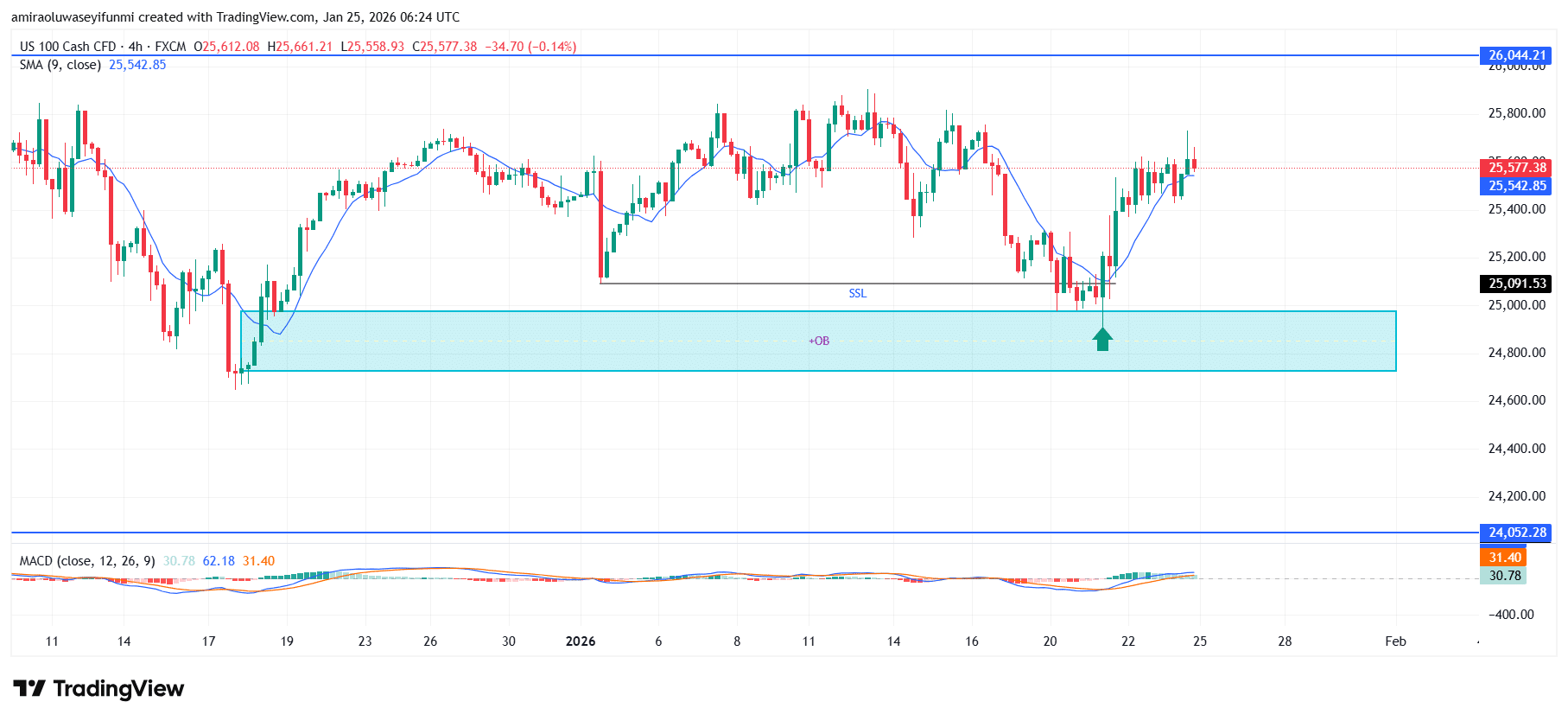

NAS100 Short-Term Trend: Bullish

On the four-hour timeframe, NAS100 maintains a bullish structure, with price holding above the rising 9-period moving average around $25,540 while momentum gradually improves. The recent rebound from the $24,800–$25,000 demand zone confirms strong buyer participation and effective absorption of prior sell-side pressure.

Price action is forming higher lows while pressing into the $25,600 resistance area, reflecting constructive consolidation rather than distribution. A sustained break above $25,600 would likely open the path for continuation toward $26,000 and potentially the $26,400 level.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.