Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

With a rebound in tech stocks and the Fed meeting just ahead, the Japan 225 market has started regaining traction. At this point, price action is making its way toward higher levels. Let’s take a closer look at how this may unfold.

Key Levels

Resistance: 54,000, 55,000, 56,000

Support: 53,000, 51,000, 49,000

Japan 225 Has a Good Base

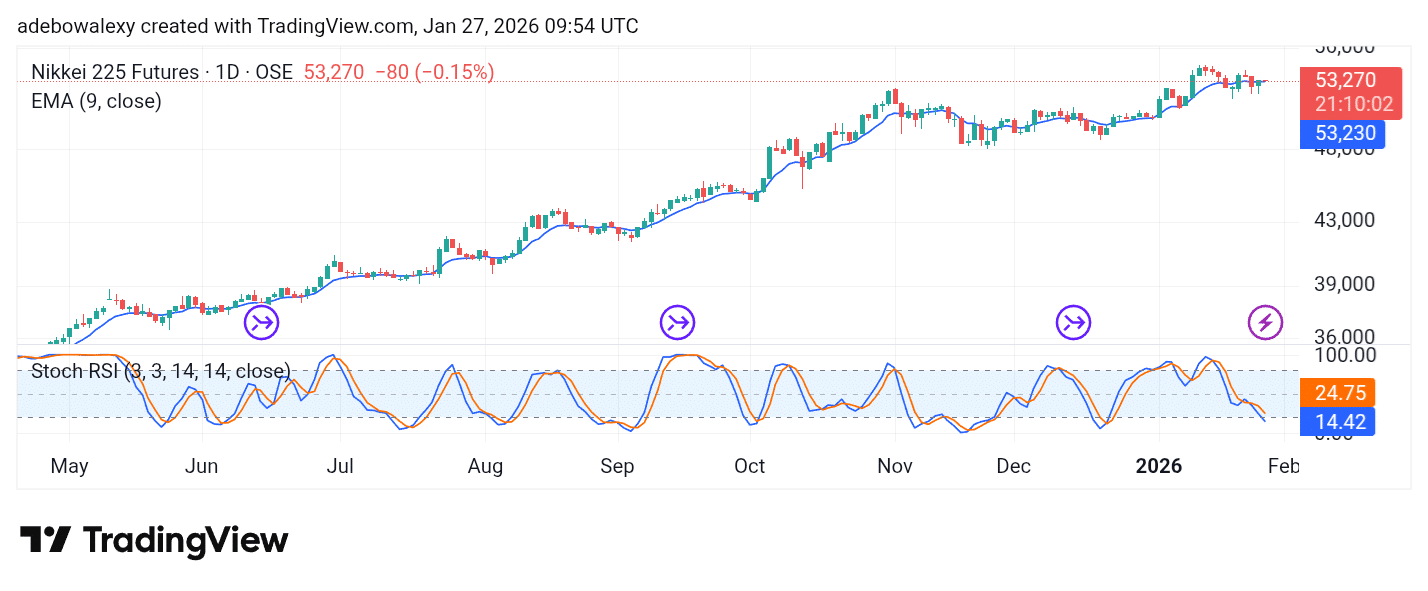

The NIKKEI 225 market appears to be making a solid recovery from its earlier dip below key levels. The previous session recorded a notable pullback that pushed the market back above the 9-day Exponential Moving Average (EMA).

However, the current session is represented by a red price candle, which has kept the market just above the 9-day EMA, showing only minimal downward movement. Meanwhile, the lines of the Stochastic Relative Strength Index (SRSI) indicator are still dipping into the oversold region.

NIKKEI Dip Looks Consistent

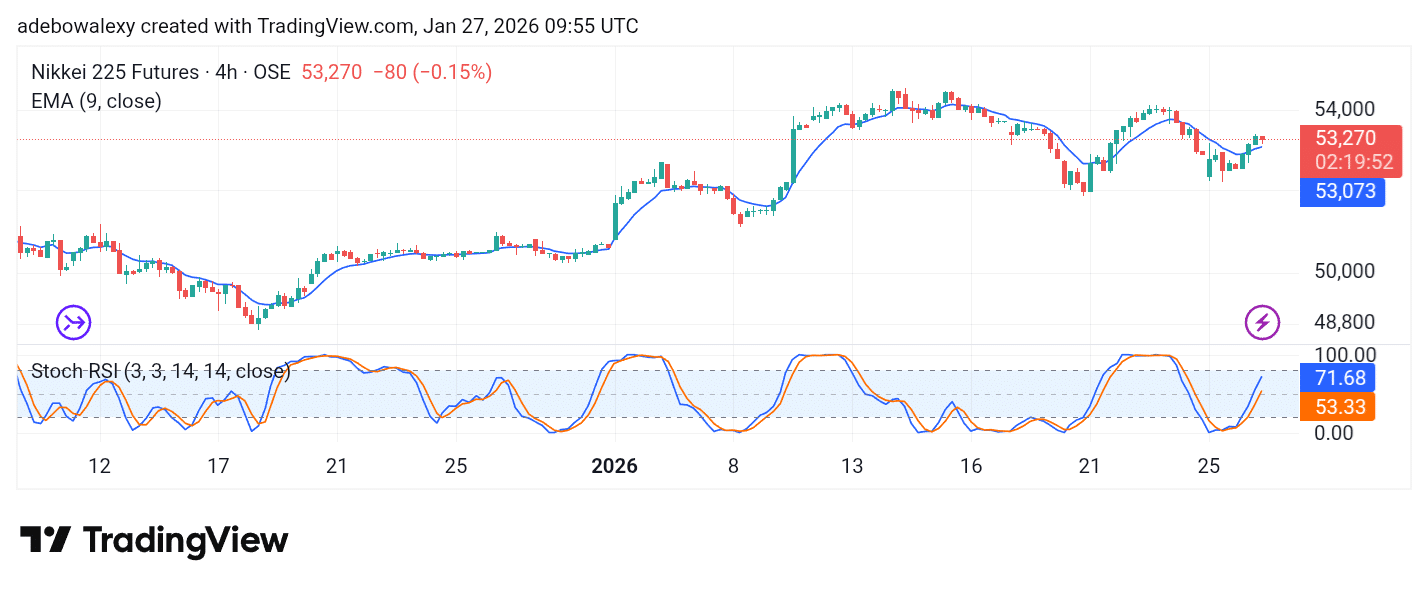

A look at the Japan 225 market on the 4-hour chart reveals that the recent dip occurred only during the latest 4-hour session. Despite this, trading remains above the 9-day EMA curve, and the market has seen an upward retracement over the past three sessions.

Consequently, the SRSI indicator lines are pushing upward toward the overbought region. At this point, despite the minor pullback, traders may still target the 54,000 level for short-term gains.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.