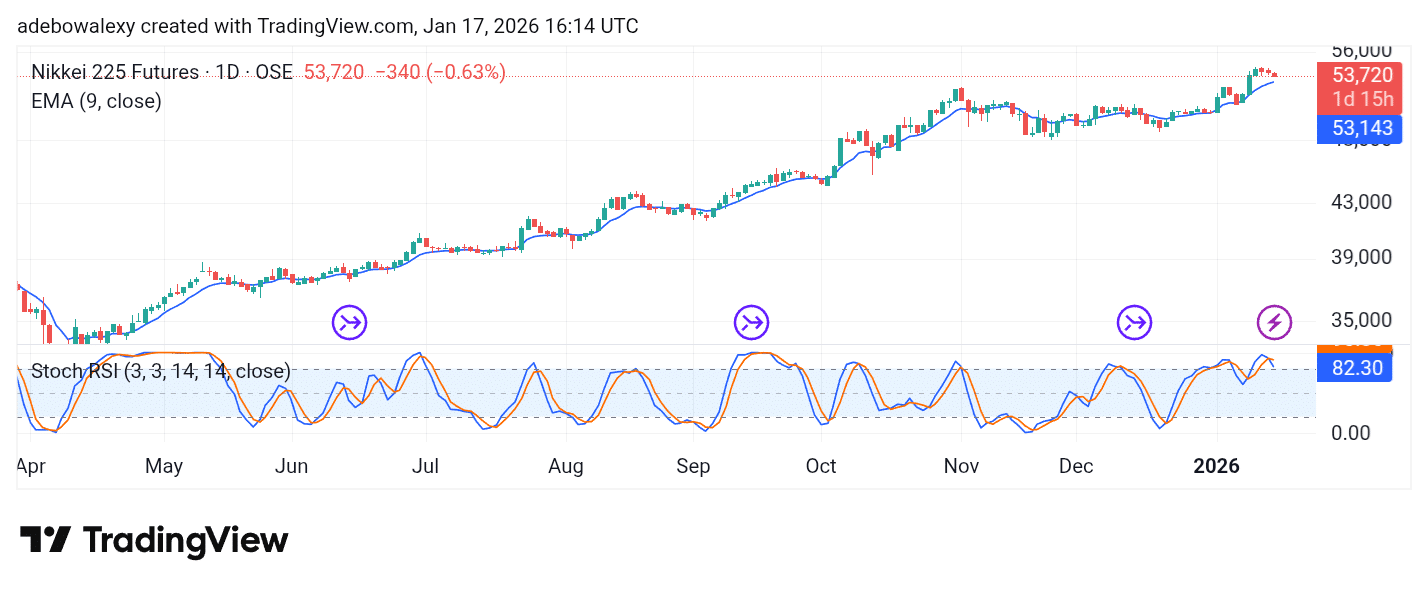

The Japan 225 market can be seen losing direction and bullish momentum near the 55,000 price level. This is happening at a time when the BoJ interest rate decision is approaching and inflation figures are being monitored.

Key Levels

Resistance: 55,000, 57,000, 59,000

Support: 53,000, 51,000, 49,000

Japan 225 Buyers Are Out of Breath

At the opening of the week’s trading, the NIKKEI 225 market had a good start as the market proceeded toward 55,000 as predicted. However, by midweek, the trend lost momentum, and downward forces started dominating. This brought the market to dip toward the 53,000 mark.

Albeit, on the daily chart, price action stands above the 9-day Exponential Moving Average (EMA) line. Also, the Stochastic Relative Strength Index (SRSI) indicator lines are still in the overbought region despite the fact that a downward crossover has occurred on the indicator. Therefore, while the market may dip, the general trend seems sustained and may resume if critical supports aren’t broken.

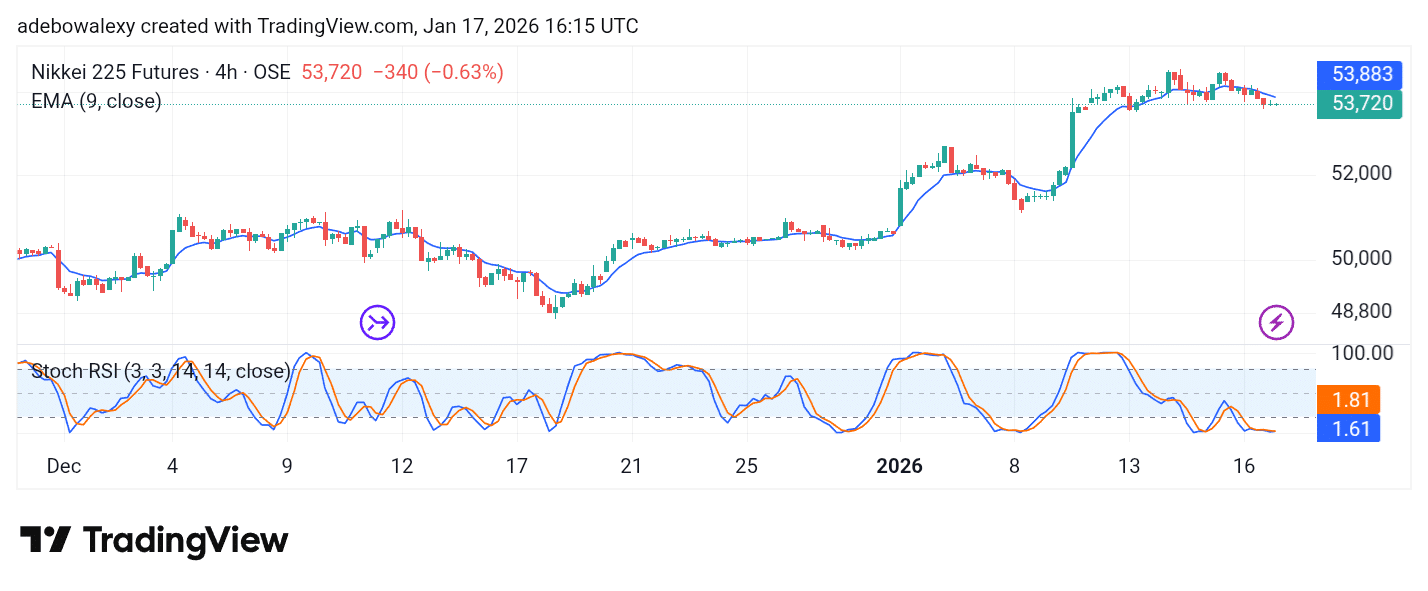

NIKKEI Seems to Be Applying the Brakes Weakly

The last two price candles on this chart are green. However, considering their heavily compressed appearance, it seems upside forces are acting only weakly. One striking fact is that this has persisted for two consecutive sessions and may be hinting at a shift.

However, price action lies below the 9-day EMA curve line. Also, the lines of the SRSI indicator are now moving sideways in the oversold region of the indicator. Considering the fact that there is no clear direction just yet, it appears the market may edge lower under the pressure of headwinds. However, traders can watch the 53,143 price level, as a fall below this price level may signal additional dips toward the 52,000 price level.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.