NAS100 Analysis – March 30

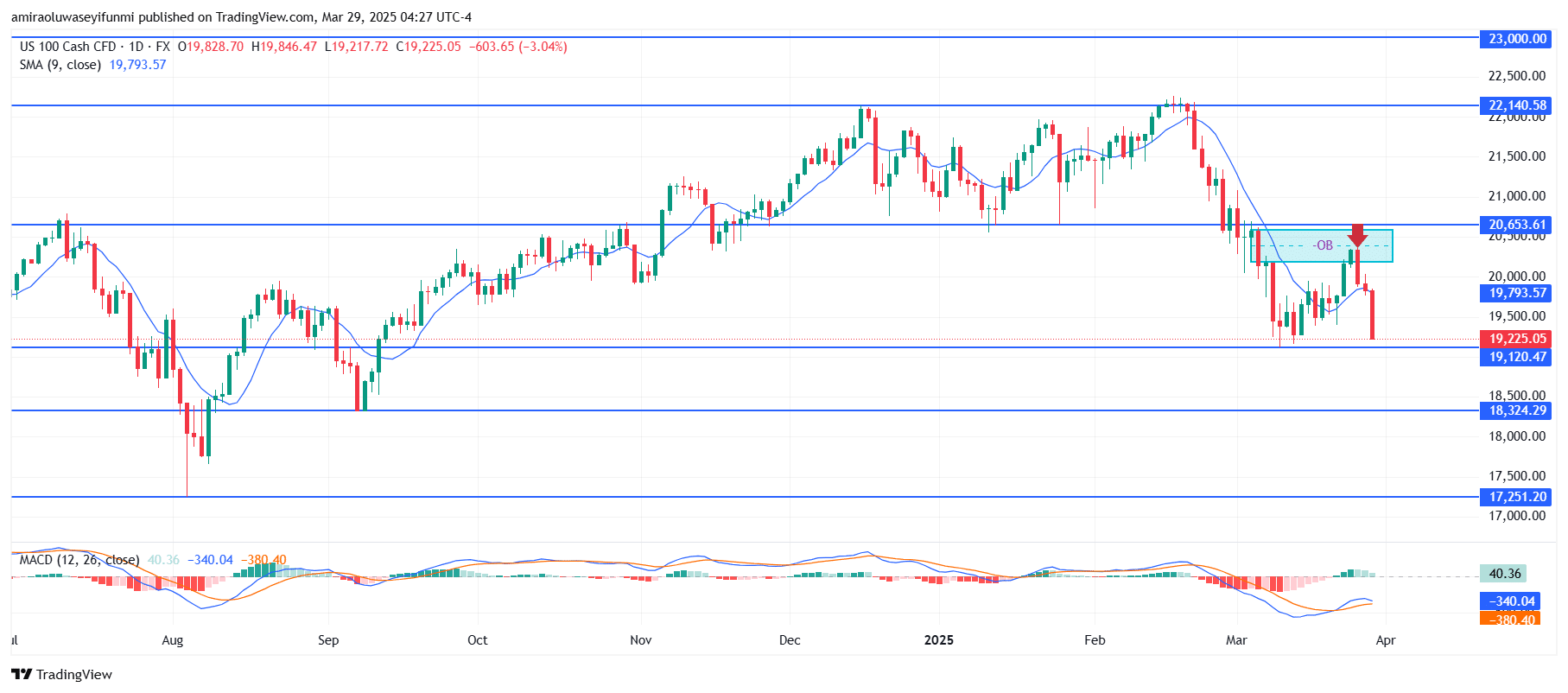

NAS100 is under strong bearish pressure following rejection from the supply zone. The 9-period SMA (Simple Moving Average) is currently positioned at $19,790, with NAS100 trading below it, confirming a bearish trend. The MACD (Moving Average Convergence Divergence) histogram is in negative territory at -380.40, with the signal line also below zero, reinforcing downward momentum. The sharp decline from recent highs suggests increased selling pressure, with the SMA now acting as resistance instead of support.

NAS100 Key Levels

Resistance Levels: $20,650, $22,140, $23,000

Support Levels: $19,120, $18,320, $17,250

NAS100 Long-Term Trend: Bearish

Price action shows that NAS100 was rejected at the $20,650 level, which corresponds to a bearish order block. The inability to break above this zone led to a sharp decline to $19,230. The presence of a large bearish candle confirms aggressive selling, with $19,120 as the next immediate support.

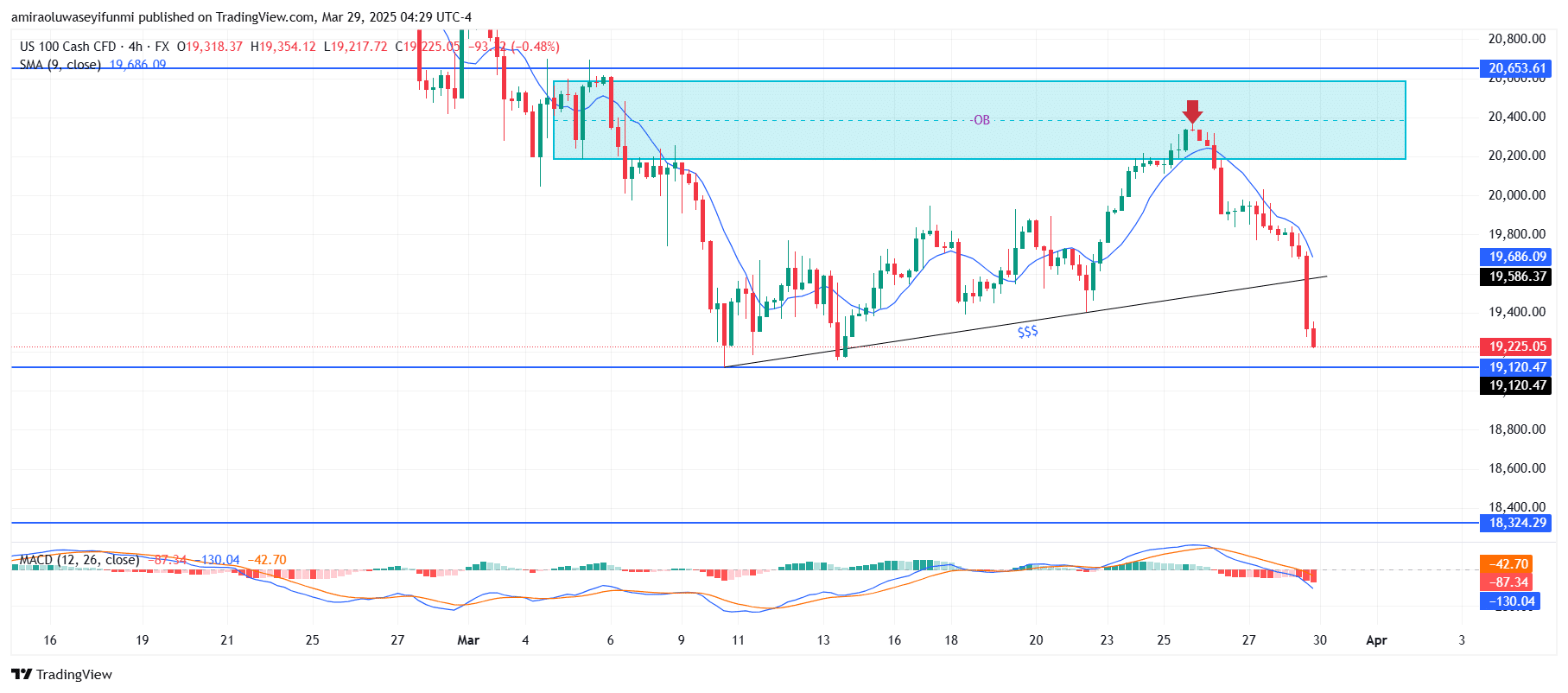

NAS100 Short-Term Trend: Bearish

NAS100 continues to confirm a strong bearish trend, trading below the 9-period SMA at $19,690. The sell-off intensified after price rejection at the $20,650 supply zone, breaking below the rising support line. The MACD indicates increasing negative momentum, with the signal line trending lower and the histogram at -130.04. If the decline persists, the next critical support levels to monitor are $19,120 and $18,320. Traders may consider using forex signals to navigate the ongoing volatility in the market.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.