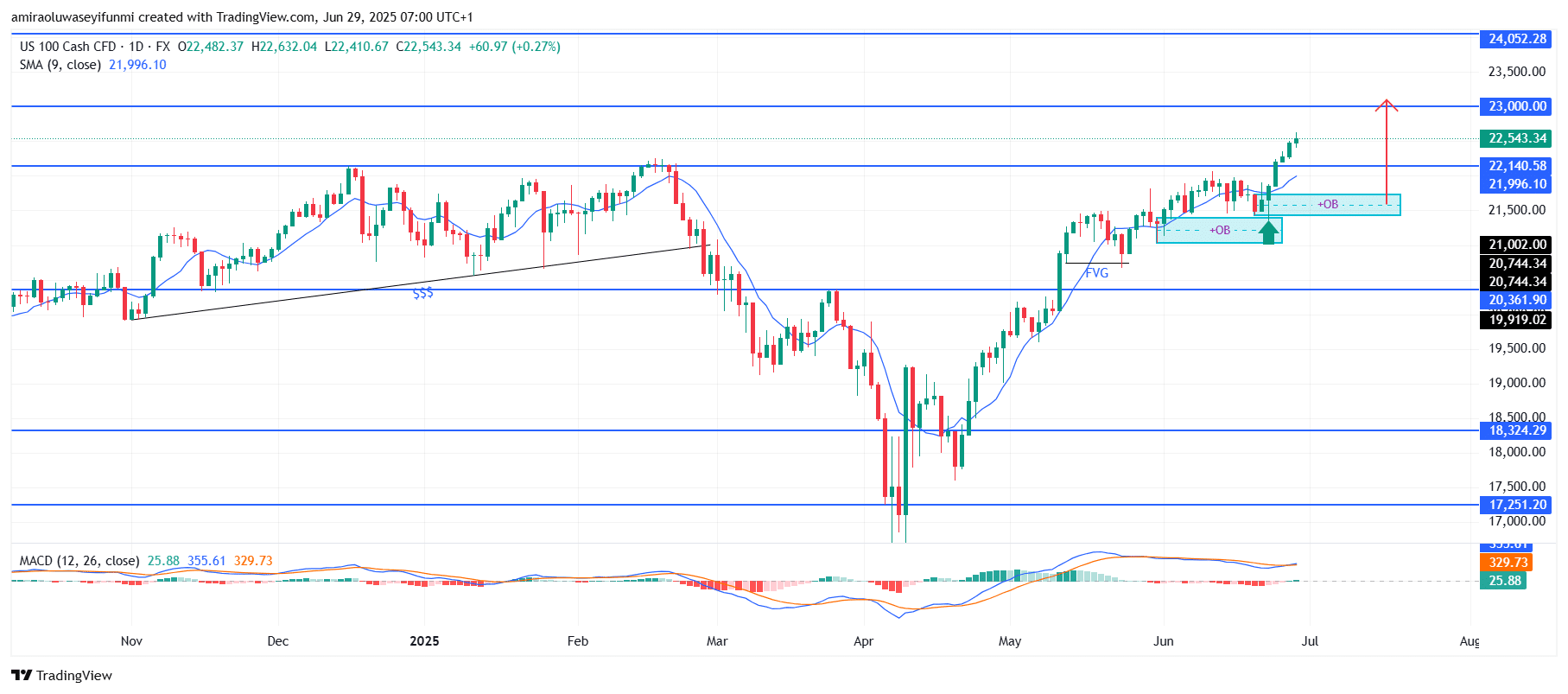

NAS100 Analysis – June 29

NAS100 has broken through resistance and is now targeting a higher bullish continuation phase. Strong market optimism is evident in the index’s consistent upward movement, which has kept it above the 9-day Simple Moving Average (SMA). A widening MACD histogram and signal lines positioned above the zero baseline support the current daily close near $22,540, signaling continued bullish momentum. The combination of bullish price action and positive momentum indicators indicates that buyers remain in control, with minimal short-term resistance anticipated.

NAS100 Key Levels

Resistance Levels: $22,140, $23,000, $24,050

Support Levels: $21,500, $20,360, $18,320

NAS100 Long-Term Trend: Bullish

The NAS100 recently bounced from a well-established bullish Order Block (OB) zone around $21,500, reflecting strong demand at that price level. This order block has been successfully mitigated, and the breakout above the earlier consolidation range confirms prior accumulation. Furthermore, the pattern shows that Fair Value Gaps (FVG) have been filled, allowing the price to move into new territories. The swift rebound from the previous pullback and the continuation of higher highs further confirm the current bullish structure.

With the prevailing market strength and structure, the index appears poised to continue its upward move toward the psychological barrier at $23,000 in the near term. A daily close above this level could trigger a fresh advance toward $24,050, which aligns with the next key resistance level on the higher time frame. Should a pullback occur, a return to the previous OB zone around $21,500 would present a prime opportunity for buyers to re-enter within the bullish continuation channel, supported by forex signals.

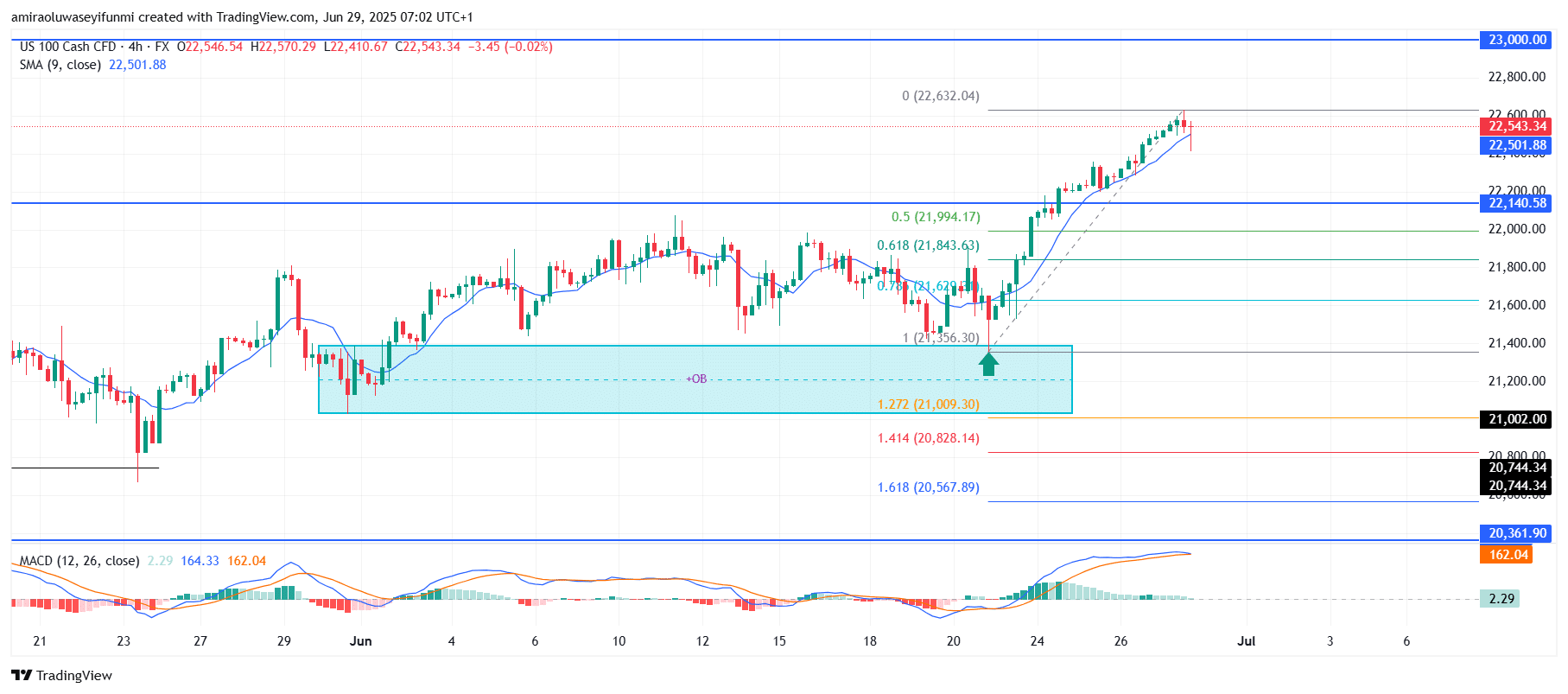

NAS100 Short-Term Trend: Bullish

On the four-hour chart, the NAS100 remains above the 9-period SMA, maintaining its bullish trajectory. After recently reaching a local high around $22,630, the price has begun a modest pullback.

The Fibonacci retracement levels between $21,840 and $21,620 highlight a discount zone that may attract renewed buying interest. As long as the price holds above $21,350, the bullish trend is expected to persist.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.