Market Analysis – June 30

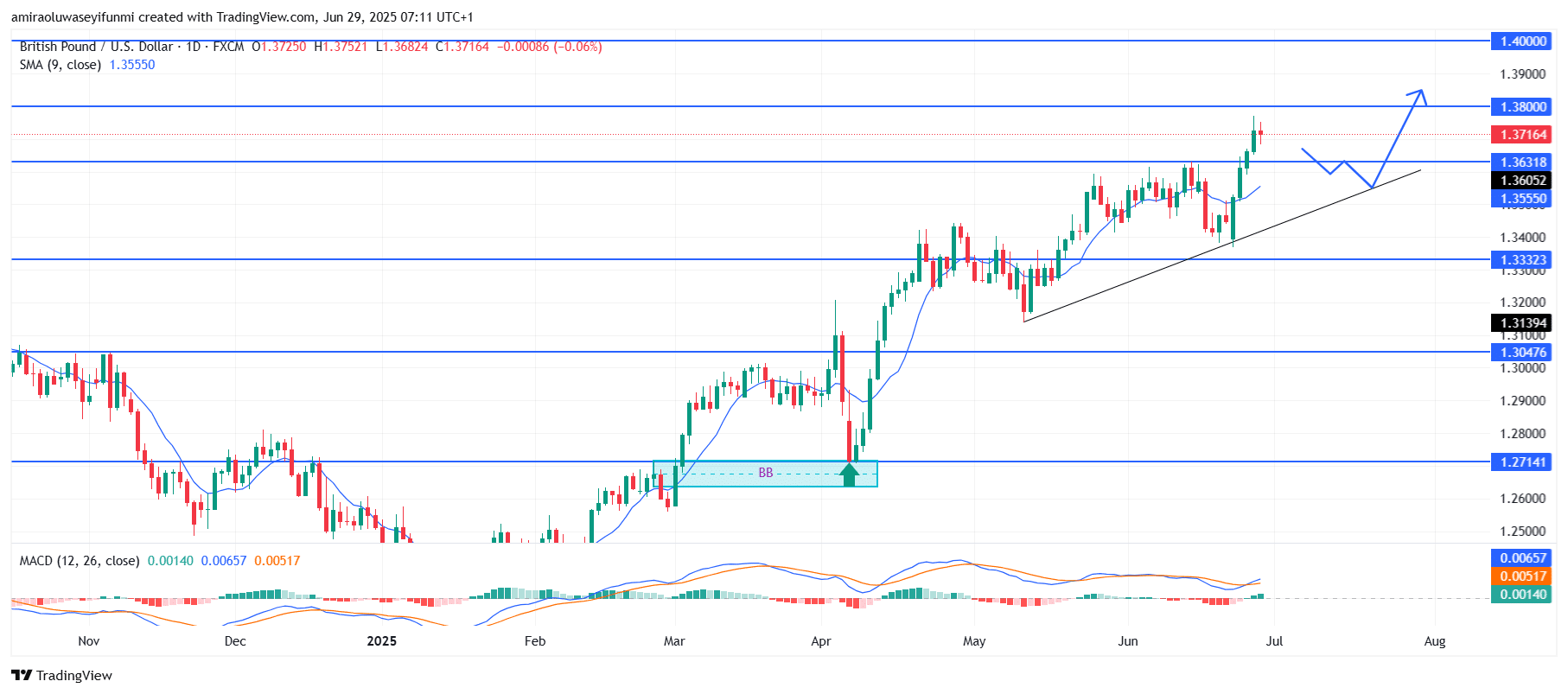

GBPUSD remains bullish while respecting its dynamic trendline support structure. The pair continues to exhibit an upward trend, consistently forming higher highs and higher lows in line with the ongoing bullish pattern. The 9-day SMA, currently positioned at $1.35550, is acting as dynamic support and reinforcing the prevailing positive market sentiment. Momentum indicators, particularly the MACD, remain in bullish territory, with an expanding histogram and an upward crossover that highlight continued buying pressure.

GBPUSD Key Levels

Supply Levels: $1.3630, $1.3800, $1.4000

Demand Levels: $1.3330, $1.3050, $1.2710

GBPUSD Long-Term Trend: Bullish

The market recently rebounded from the ascending trendline support while staying above a key horizontal level at $1.36050. This confluence of the trendline and support zone has fueled the latest bullish surge. The price is now approaching minor resistance at $1.38000, where a brief consolidation or retracement might occur before further gains resume.

Looking ahead, if GBPUSD breaks and sustains above the $1.38000 resistance level, bullish momentum could drive the price toward the psychological mark of $1.40000. Any short-term retracement is likely to find support along the trendline, preserving the overall bullish formation, especially with guidance from forex signals.

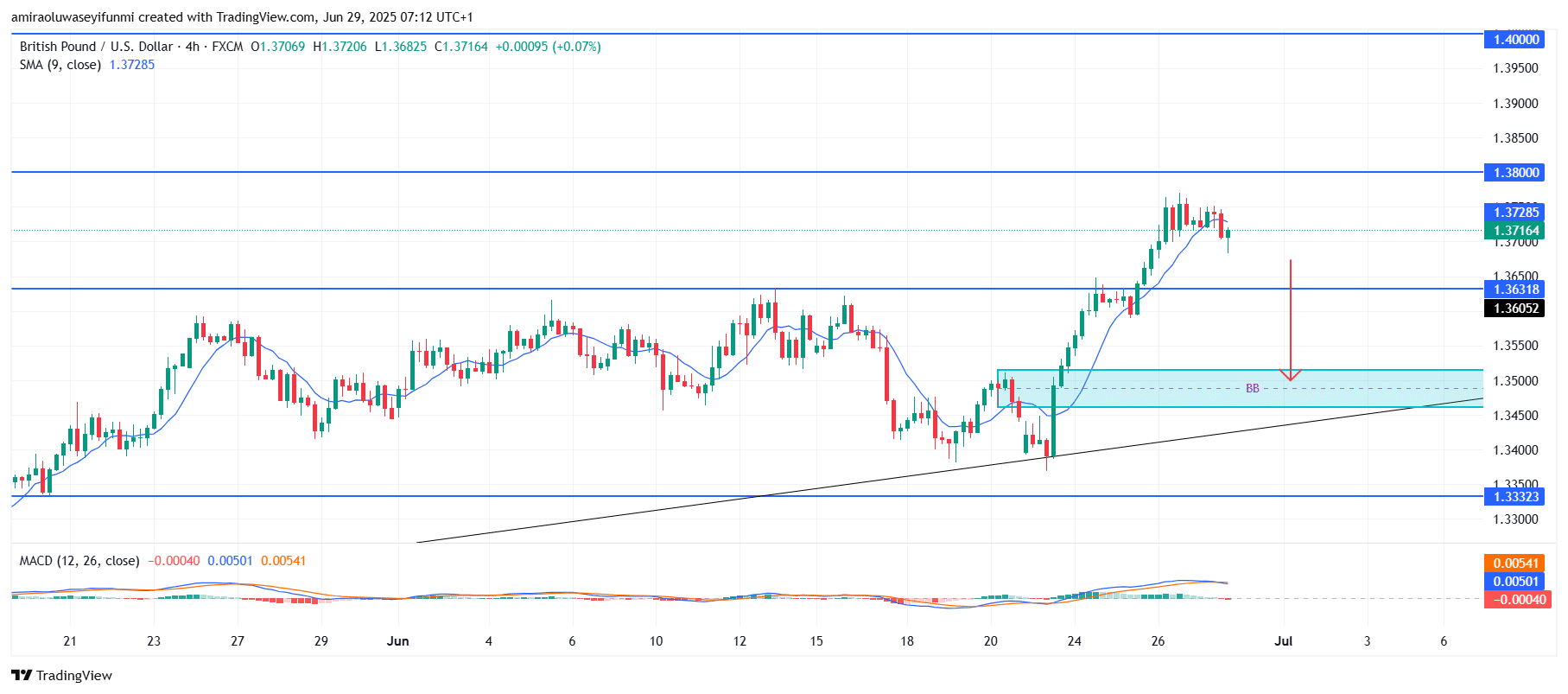

GBPUSD Short-Term Trend: Bearish

GBPUSD is currently undergoing a bearish correction after failing to breach the $1.3800 resistance level. The pair has formed a lower high and is now pulling back from recent peaks, reflecting reduced bullish momentum.

The projected downward target lies within the $1.35000–$1.34600 breaker block, which aligns with the rising trendline. A drop below $1.36320 would confirm a deeper correction toward the support area.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.