Market Analysis – June 23

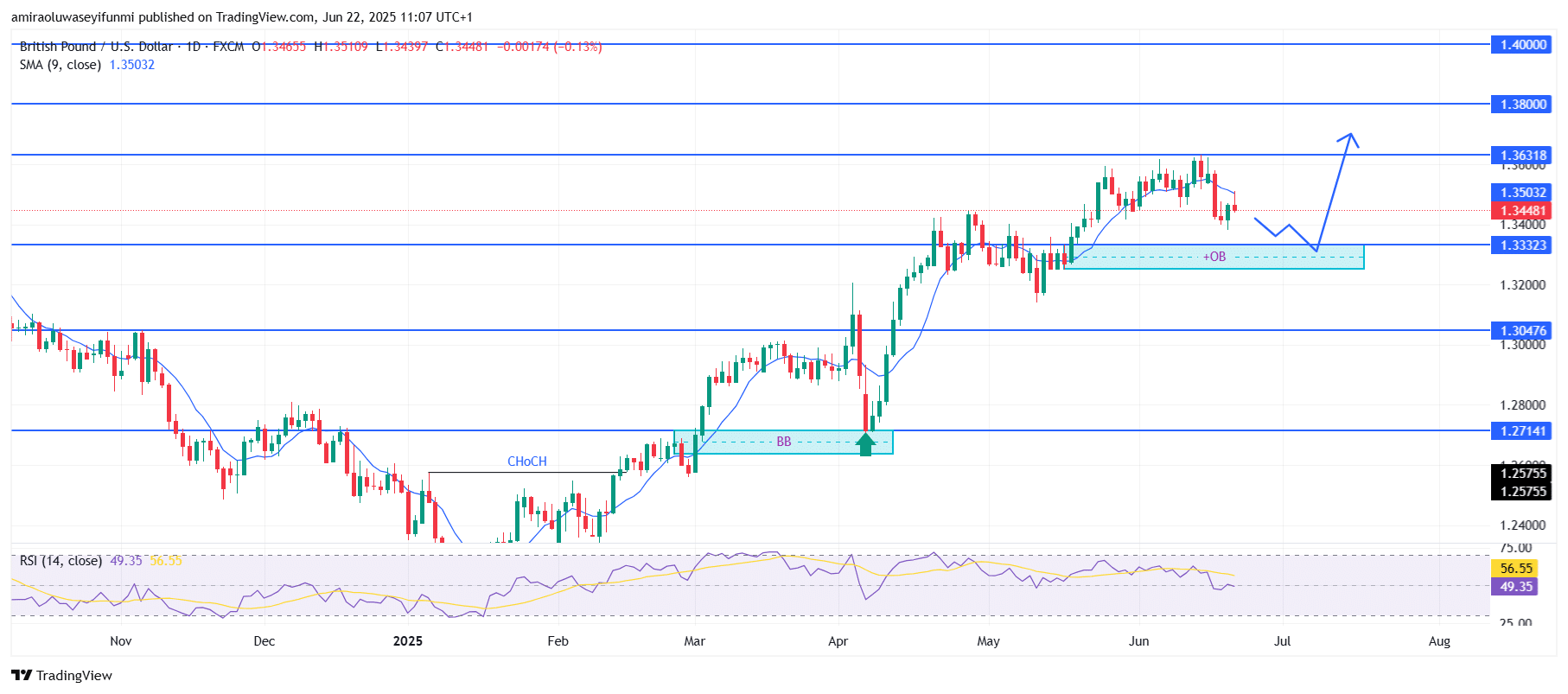

GBPUSD is building momentum from a structural demand zone, signaling a potential path for bullish continuation. The pair currently maintains a strong bullish structure, supported by a significant rebound from previous consolidation zones.

The 9-day Simple Moving Average (SMA), positioned at $1.35030, continues to act as dynamic support during pullbacks. Meanwhile, the RSI remains comfortably above 49, indicating consistent bullish interest without approaching overbought conditions. Since the March rally, the market has maintained its uptrend, reinforcing investor confidence as price action stays above key moving averages and reflects ongoing positive sentiment.

GBPUSD Key Levels

Supply Levels: $1.3630, $1.3800, $1.4000

Demand Levels: $1.3330, $1.3050, $1.2710

GBPUSD Long-Term Trend: Bullish

The pair recently retraced into a high-probability bullish order block (OB) located between $1.33320 and $1.34000. This demand zone coincides with a previous bullish breaker block (BB) and a change of character (ChoCH) area, signaling where significant buying activity previously occurred. Price action suggests accumulation in this region, with higher lows forming and strong rejections from intraday dips, pointing to institutional support within the zone. These technical signs support the view that the recent pullback is a retracement, not a trend reversal.

If the price remains above $1.33320, a bullish continuation toward $1.36320 is likely, serving as the next key resistance level. A break and close above $1.36320 could attract momentum-based buying, potentially driving the pair toward the $1.40000 level in the medium term. In this context, short-term dips into the $1.34000–$1.33320 range may offer attractive buying opportunities for trend-following traders. Utilizing forex signals in such scenarios could help refine entry points as the uptrend develops further.

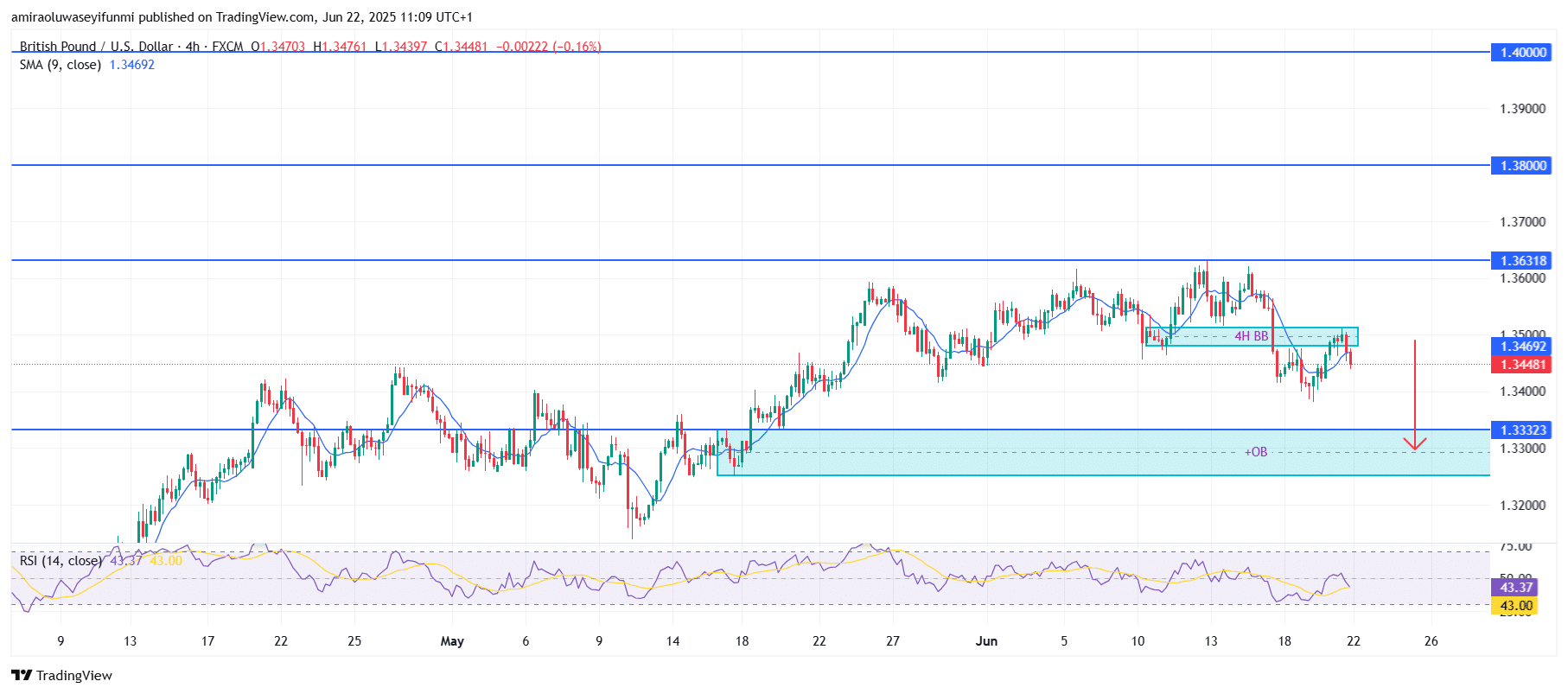

GBPUSD Short-Term Trend: Bearish

GBPUSD is currently rejecting the 4H breaker block near $1.34700 and has slipped below the 9-period SMA. The RSI is hovering around 43, reflecting weakening bullish momentum and suggesting the potential for further downside.

The price failed to hold above the breaker block and is now retracing toward the $1.33320 demand zone. Continued bearish pressure could lead the pair to test the origin block just below $1.33300, reinforcing the importance of this support area in the short term.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.