If you are planning to invest or trade online – you’ll need to open an account with a top-rated trading platform. Due to the rapid growth of the retail investor scene, there are now hundreds of trading platforms in the market.

Most of these providers can be given a wide berth – either because of a lack of regulation, support for limited assets, or uncompetitive fees. With that in mind, you need to do some homework to find which trading platform is right for your needs.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

To save you countless hours of research, this guide will review the Best Trading Platforms of 2023. Our top-rated picks all meet a range of criteria surrounding low fees, strong regulation, heaps of markets, and great customer service.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

0.0

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

1

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

Best Trading Platforms 2023 Reviewed

To reiterate, the top trading platforms reviewed on this page all meet a series of important metrics.

This includes:

- Low fees and commissions

- Tight spreads

- Heaps of asset classes and markets

- Tier-one regulation with the likes of the FCA, CySEC, or ASIC

- An abundance of research and analysis tools

- Top-notch customer service and user-experience

Taking all of the above into account, below you will find which providers made our list of the very best trading platforms of 2023.

1. AvaTrade – Best Trading Platform With Heaps of Techincal Analysis Tools

AvaTrade is another top-rated trading platform that specializes in CFD markets - all of which facilitate short-selling and leverage. This popular provider allows you to trade across several platforms - including MT4. It also supports third-party social trading tools like Zulutrade.

Or, if you want to trade directly on the AvaTrade website, the provider offers its own proprietary platform. And of course - mobile traders are not left out either, as AvaTrade offers a fully-fledged mobile app. This is available on both iOS and Android.

Supported markets on AvaTrade run into the thousands, covering everything from forex and commodities to stocks and indices. You can also trade cryptocurrencies, options, and futures. When it comes to trading fees, AvaTrade is a commission-free platform that offers tight spreads. This includes 0.9 pips on major forex pairs and 0.13 on blue-chip stock CFDs.

Although AvaTrade offers a demo account, you can also trade with small amounts on this platform. Deposits start at just $100 and you can fund your account with a debit/credit card or bank wire. Perhaps one of the biggest attraction of AvaTrade is that is licensed in several jurisdictions. This includes Canada, Australia, Europe, South Africa, Japan, and more.

- Reasonable minimum deposit of $100

- Regulated in multiple countries

- Heaps of commission-free assets to trade

- Inactivity fees considered high

2. VantageFX – Best Trading Platform for Beginners

VantageFX VFSC under Section 4 of the Financial Dealers Licensing Act that offers heaps of financial instruments. All in the form of CFDs - this covers shares, indices, and commodities.

VantageFX is arguably one the best trading platforms for beginners. This popular provider allows you to open an account in minutes and you will then have access to a fully-fledged demo account facility. This allows you to learn the ropes of online trading without risking any money. You can also make use of the many educational tools offered by VantageFX - such as guides and video explainers.

Open and trade on a Vantage RAW ECN account to get some of the lowest spreads in the business. Trade on institutional-grade liquidity that is obtained directly from some of the top institutions in the world without any markup being added at our end. No longer the exclusive province of hedge funds, everyone now has access to this liquidity and tight spreads for as little as $0.

Some of the lowest spreads in the market may be found if you decide to open and trade on a Vantage RAW ECN account. Trade using institutional-grade liquidity that is sourced directly from some of the top institutions in the world with zero markup added. This level of liquidity and availability of thin spreads down to zero are no longer the exclusive purview of hedge funds.

- The Lowest Trading Costs

- Minimum deposit $50

- Leverage up to 500:1

3. LonghornFX – Top-Rated ECN Broker With High Leverage

LonghornFX is a user-friendly trading platform that covers dozens of cryptocurrency and forex pairs. You can also trade stock CFDs and multiple indices. You will be able to trade with leverage of up to 1:500 at LonghornFX - irrespective of whether you are a retail or professional client.

In terms of fees, you will benefit from competitive variable spreads throughout the trading day. After all, LonghornFX is an ECN broker - so you will get the tightest buy/sell prices available in the industry. Commissions will vary depending on the asset but typically amount to $7 per $100,000 traded.

We like the fact that LonghornFX processes withdrawal requests on a same-day basis. Plus, the broker offers full support for MT4. The platform can be accessed online, via desktop software, or through a mobile app.

- ECN broker with super tight-spreads

- High leverage of 1:500

- Same-day withdrawals

- Platform prefers BTC deposits

4. EightCap – Trade Over 500+ Assets Commission-Free

Eightcap is a popular MT4 and MT5 broker that is authorized and regulated by ASIC and the SCB. You will find over 500+ highly liquid markets on this platform - all of which are offered via CFDs. This means that you will have access to leverage alongside short-selling capabilities.

Supported markets include forex, commodities, indices, shares, and cryptocurrencies. Not only does Eightcap offer low spreads, but 0% commissions on standard accounts. If you open a raw account, then you can trade from 0.0 pips. The minimum deposit here is just $100 and you can choose to fund your account with a debit or credit card, e-wallet, or bank wire.

- ASIC regulated broker

- Trade over 500+ assets commission-free

- Very tight spreads

- Leverage limits depend on your location

How to Find the Best Trading Platforms?

So now that we have reviewed the best trading platforms in the online market, we now need to explain the many metrics that you need to check before choosing one yourself. This is because no-two trading platforms are the same.

For example, while some platforms might stand out for their advanced trading tools and technical indicators – others might appeal to traders for their super low fees and spreads. As such, you need to assess what your main priority is when searching for the best trading platform for your needs.

The most important considerations to make are discussed in more detail below.

Regulation, Licensing, and Safety

The only way that you can make money by trading online is to deposit funds into your chosen platform. In turn, this means that there needs to be an element of trust from your end. After all, the trading platform in question will not only be responsible for connecting you to your desired financial market, but it needs to keep your funds safe.

With this in mind, you should only sign up with a trading platform if it authorized and regulated by at least one reputable body. In the online trading sphere, the most stringent financial regulators include the:

- FCA (UK)

- CySEC (Cyprus)

- ASIC (Australia)

- MAS (Singapore)

- FINRA (US)

- CFTC (US)

- SEC (US)

If your chosen trading platform is authorized by one of the above regulators, you can be sure that it does everything by the book. If it doesn’t, the regulator in question will have a range of sanctions at its disposal – such as monetary fines.

In more severe cases, the regulator can elect to revoke the trading platform’s license. In addition to having a watchful eye over your funds, choosing a regulated trading platform comes with a number of other key benefits.

This includes:

- KYC: Although KYC (Know Your Customer) controls can be a pain, they do keep you and your fellow traders safe from financial crime. When using a new-age broker like eToro, your documents will be validated in less than a couple of minutes.

- Client Funds: Regulated trading platforms must separate client funds from their own. This means keeping your money in a segregated bank account. Crucially, the trading platform in question cannot use your funds to service its own debts.

- Fee Transparency: By using a regulated trading platform, all fees, commissions, and spreads must be clearly accessible. You should have a full breakdown of any charges taken from your account via your dashboard. This ensures that you always know what you are paying when using the trading platform.

Ultimately, if you open an account with an unregulated trading platform – or one that is licensed in a shady offshore island, your money is at risk. That is why we at Learn 2 Trade only select the trading platforms that are heavily regulated by tier-one bodies.

Tradable Markets

There is often a huge disparity in what markets your chosen trading platform gives you access to. As we briefly noted earlier, some specialize in a single asset class while others cover thousands of financial instruments across stocks, forex, commodities, cryptocurrencies, and more.

With that said, there is one thing in particular that you need to explore in your search for the best trading platforms – and that’s whether you are investing in assets or trading CFDs.

Investment Trading Platforms

Put simply, if your chosen trading platform allows you to invest in an asset, you are buying it outright. This means that you will retain full ownership of the asset in question.

In particular, this includes assets like:

- Stocks and shares

- ETFs

- Investment Trusts

- Mutual Funds

- Bonds

When investing in the above assets via a trading platform, you are typically doing so via a long-term buy and hold strategy. In other words, you’ll buy the asset, leave the investment at your chosen trading platform, and then sell it several months or years down the line.

Along the way, you’ll be entitled to dividend payments, as you own the underlying stock or fund. In the case of bonds, you’ll be entitled to your share of coupon payments.

Although we cover trading platform fees in much more detail later, it is important that you select a provider that does not charge ongoing fees when you plan to invest in the long run. This is because you’ll want the option of keeping your investment for as long as you see fit without getting hammered by monthly or annual fees.

CFD Trading Platforms

At the other end of the spectrum, if you are a short-term trader that wants to deploy more sophisticated market moves, you will likely be suited for a CFD trading platform. CFDs – or contracts-for-differences, are financial instruments that track an asset in real-time. For example, if gold has a market price of $1,860 per ounce, as will the respective CFD instrument.

The key point to remember is that when you trade CFDs, you don’t own the asset. Although at first glance this might put you off, this actually comes with a number of core benefits.

For example:

- You can trade commodities like gold, oil, and natural gas without needing to worry or storage or distribution

- You can elect to go long or short on your chosen market

- You can apply leverage to your trades

On the other hand, it must be noted that CFD trading platforms are only suited for short-term strategies. This is because CFDs attract overnight financing fees that you need to pay for each you keep the trade open. Although typically minute, these fees will eat away at your potential profits. This is why a lot of CFD traders will take a day trading or swing trading approach.

Fees

The best trading platforms allow you to buy and sell assets in a cost-effective manner. With that said, these platforms are still in business to make money – so you should check to see what fees will be applicable to your chosen market or strategy.

The most important fees to explore before signing up are as follows:

Spreads

The spread is an indirect fee that a lot of newbies fail to recognize. For those unaware, there is always a gap in pricing between the ‘buy’ and ‘sell’ price of an asset that you trade online. For example, the buy price on Bitcoin might be $38,000 while the sell price could stand at $37,500. The difference between these two prices is known as the spread.

- If, for example, your chosen trading platform charges a spread of 3 pips on GBP/USD, this means that you need to make gains of 3 pips just to break even.

- Similarly, if the spread on silver CFDs amounts to 0.5%, you need to make gains of 0.5% to break even.

From the research we at Learn 2 Trade compiled, we found that the best trading platforms allow you to trade major asset forex pairs from less than 1 pip. In the case of major stocks and commodities like gold 0, the spread should never amount to more than 0.25%.

Commissions

While the spread is an indirect fee charged by trading platforms, commissions will come straight out of your account balance. This commission is charged when you place a buy or sell order. In most cases, the commission will be a variable percentage that is calculated against your stake.

- For example, if the trading platform charges a commission of 1.5% to trade natural gas, and you stake $1,000, you would pay $15 to enter the market.

- If you then sold your natural gas position when it was worth $1,100 – your 1.5% commission would amount to $16.50.

Although the above examples are arbitrary, they illustrate that commissions can quickly eat away at your gains. This is why most of the best trading platforms reviewed on this page allow you to trade online without paying any commission. Instead, these platforms make their money from the aforementioned spread.

Other Fees

There are several other fees that your chosen trading platform might charge, such as:

- Overnight Financing: As we noted earlier, if you decide to trade CFDs you will invariably need to pay overnight financing fees. Based on the market and size of your stake, the fee usually kicks in at a specific time of the day.

- Platform Fees: Otherwise referred to as maintenance fees, some platforms charge a monthly or annual fee. If they do, this is calculated against the amount of capital you have invested at the platform.

- Deposit/Withdrawal Fees: Keep an eye on deposit and withdrawal fees, as again, this can leave you at a disadvantage before you’ve even placed a trade.

The best trading platforms are crystal-clear on what fees they charge, so you should be able to view this via the provider’s website.

Platforms and Usability

Some trading sites offer their own native platform that was built from the ground up. In many cases, these are designed with beginners in mind. For example, eToro offers a proprietary trading platform that is super easy to use.

This is the case through its main website and even a mobile app. With that said, when using a newbie-friendly trading platform, your access to advanced tools and technical indicators may be limited.

Either way, it’s important to assess your own skill-set and experience when choosing a trading platform, as some are geared towards newbies while others are more suited for professionals.

Platform Tools and Features

There are many trading tools and features to consider when joining a platform. These are offered to aid you in your trading journey.

Some of the most notable tools offered by the best trading platforms that we reviewed include:

Social and Copy Trading

If you’re a complete newbie in the world of investments, you might want to consider a platform that offers social and copy trading features. eToro, for example, providers a ‘social media’ style platform that allows you to communicate and share ideas with other traders of the site.

Not only can you publish and reply to posts, but you also ‘like’ comments that you agree with. This creates a social-feel to trading that you won’t find at a traditional old-school broker. In addition to this, eToro also offers a copy trading tool that allows you to fully-automated your investment decisions.

Here’s how it works:

- You filter through the thousands of verified copy traders on eToro – looking at metrics like average monthly returns and preferred asset

- You invest $500 into your chosen trader

- The trader allocates 7% of their portfolio into PayPal stocks and 5% into Visa stocks

- In turn, you automatically invest $35 into PayPal stocks (7% of $500) and $25 into Visa stocks (5% of $500)

- When the trader sells their position in either PayPal or Visa, you will automatically do the same

All in all, the best trading platforms that offer social and copy investing tools are great if you don’t have much experience in the space. After all, you can rely on a seasoned investor to your bidding for you, subsequently allowing you to sit back and trade passively.

Leverage

If you don’t have access to a large amount of trading capital, you might find it difficult to make viable profits. Sure, you might make consistent gains of 10% per month – but if you only have a balance of $1,000 – that amounts to gains of just $100. In other words, unless you have a huge account balance at your disposal, you might find your profits somewhat uninspiring.

This is why the best trading platforms give you access to leverage. In applying leverage to your positions, you can trade with a lot more than you have in your account.

- For example, US traders can access leverage of up to 1:50 when trading major forex pairs like EUR/USD. This means that a $1,000 balance would permit a maximum position of $50,000

- European trading platforms typically cap retail traders to 1:30 on major currency pairs and less on other assets

- Other countries have no limits at all, meaning that some trading platforms will offer leverage limits in excess of 1:500

Just make sure you understand the risks of leverage trading. After all, you can boost your trading capital, which is great. But, you can quickly amplify your losses, too.

Technical Indicators

The most seasoned traders will rely heavily on technical indicators, as this allows them to analyze the price of an asset. This might be an indicator that analyzes liquidity, volume, or even volatility.

In other cases, although the trading platform might not offer technical indicators itself, it might be compatible with MT4, MT5, or cTrader. If it is, these third-party trading platforms come with all of the advanced chart analysis tools that you will need.

Deposits, Withdrawals, and Payments

We would also suggest checking what payment methods your chosen provider offers before going through the account opening and KYC process. After all, you don’t have to go through the rigmarole of uploading ID documents to then find that the platform doesn’t offer your preferred deposit method.

Make no mistake about it – the best trading platforms allow you to deposit and withdraw funds with a debit/credit card or e-wallet – such as PayPal. These are safe, secure, and perhaps most importantly – instant payment methods. As such, you’ll be able to deposit funds whenever you see fit – even when using a mobile trading platform app.

With that said, some trading platforms only support bank transfers – especially in the US. This means you will need to wait a few days before the funds are available to trade. Additionally, check to see what payment fees apply and whether an FX charge is expected of you.

Educational Resources

This particular metric might not be of interest to those of you that are seasoned trading pros – but it will if you are just starting out. Crucially, the best trading platforms that we have discussed today all offer an assortment of educational resources.

This includes everything from mini-courses, guides on technical analysis, market insights, podcasts, and webinars. By choosing a trading platform that offers these materials, you can learn how to trade in a risk-averse manner.

Getting Started With a Trading Platform – Walkthrough

Once you have found a trading platform that you like the look of, you then need to go through the process of opening an account, verifying your identity, making a deposit, and of course – placing a trade.

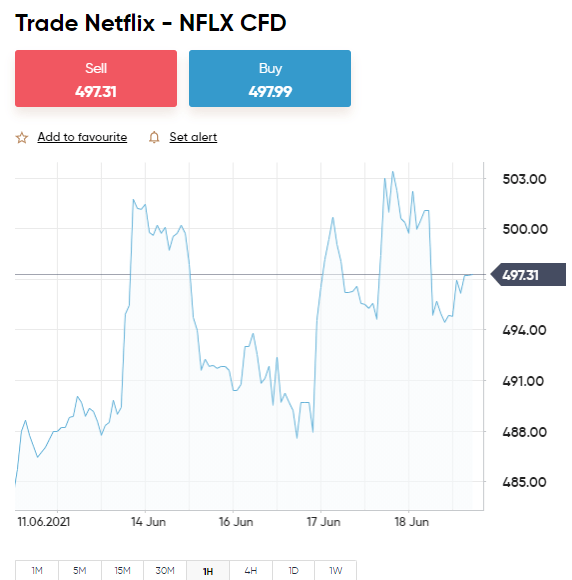

Below we walk you through the setup process with our top-rated trading platform Capital.com – which should take you no more than 10 minutes from start to finish.

Step 1: Register an Account

You will first need to open an account on the Capital.com website. You can do this online or via your mobile web browser.

Step 2: Verify Your Identity

As a regulated trading platform, Capital.com will need to verify your identity. This should take you no more than a couple of minutes, as the platform is usually able to verify documents straight away.

You’ll need to upload a copy of your passport or driver’s license and a document verifying your home address. This can be a utility bill or bank account statement at Capital.com. Digital copies are accepted, too.

Step 3: Make a Deposit

The minimum deposit at Capital.com is $200, or $50 for those of you based in the US. You can fund your account instantly when opting for one of the following payment methods:

Capital.com also supports local bank transfers, but this can take anywhere from a few hours to a few days to process.

Step 4: Search for a Trading Market

Once your deposit has been credited, you can start trading. Capital.com is home to thousands of markets across stocks, ETFs, indices, cryptocurrencies, commodities, and forex.

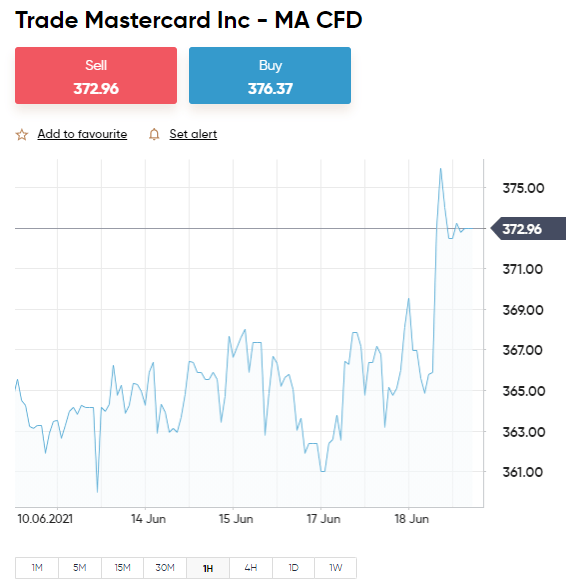

You can browse these markets by clicking on the ‘Trade Markets’ button. If you already know which market you wish to trade, enter it into the search box. Then, click on the ‘Trade’ button. In our example, we are looking for Mastercard.

Step 5: Place a Trade

An order box will now appear on-screen. This is where you need to enter the specifics of your trade.

Firstly, you need to select from a buy or sell order. By default, Capital.com sets the box to a buy order, meaning that you think the asset will rise in value. But, if you want to go short, you’ll need to change this to a sell order.

You then need to enter your stake in US dollars. We are opting for the minimum, which is $50. The minimum at Capital.com is reduced to $25 when you trade crypto.

Nevertheless, the enter our position we click on the ‘Open Trade’ button. And that’s it, our commission-free trade is confirmed!

Note: It’s also advisable to set up a stop-loss and take-profit order. This will ensure you have a clear strategy in place and that you are trading in a risk-averse manner.

Best Trading Platforms – The Verdict?

Finding the best trading platform for your needs is no easy feat in 2023. After all, there are now hundreds of providers active in this space – all of which are competing for your business.

Once you have ensured that the provider is regulated, supports your preferred markets, and offers competitive fees – you then need to look at metrics surrounding tools and features, payments, and user-friendliness.

All in all, we found that the best trading platform active in the online space right now is Capital.com. The regulated provider – which now has 17 million active traders under its belt, allows you to buy and sell thousands of financial instruments on a commission-free basis.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

FAQs

What is the best trading platform 2023?

Which trading platform is best for beginners?

Which trading platform has the most stock?

Are trading platforms regulated?

How much do you need to trade online?