Cryptocurrency, once a realm of limited options for traditional finance (TradeFi) investors, is undergoing a significant transformation. This shift is especially evident in the case of Bitcoin miners, who were once considered unappetizing choices in the crypto equities landscape.

Let’s delve into the exciting developments that are turning the tide and making crypto miners more appealing than ever.

Limited Options in the Crypto Cheese Shop: A Monty Python Scenario

TradFi investors seeking exposure to the crypto market have often found themselves in a predicament similar to John Cleese in a Monty Python cheese shop. The choices were constrained, with SEC-disapproved Coinbase and less-than-appetizing Bitcoin miners being the only viable options.

Mining ventures, whether in Bitcoin, gold, or other commodities, have historically faced numerous challenges, relegating them to niche investments for specialized individuals. The drawbacks include:

- Volatile spot prices

- High fixed costs

- Sky-high capital requirements

- Questionable governance

- Operational challenges

Bitcoin mining, in particular, presented unique obstacles with its association with the highly volatile crypto market, rapidly depreciating mining rigs, and diminishing rewards with each Bitcoin halving. In economic downturns, Bitcoin mining seemed to be one of the least appealing business models globally.

Changing Dynamics: Bitcoin Miners Breaking Free from Bitcoin’s Shadow

The imminent approval of a spot Bitcoin ETF in January is poised to reshape the landscape for Bitcoin miners.

No longer merely proxies for Bitcoin, miners will now need to attract investment capital based on their individual merits. Surprisingly, this shift is occurring at a time when Bitcoin miners are transforming into more robust and diversified businesses.

1. Transaction Fees: A Game-Changing Revenue Stream

Transaction fees, a significant revenue source for miners, are experiencing a substantial surge with the introduction of Ordinals. This is driving the demand for Bitcoin blockspace to all-time highs, with roughly 25% of mining revenue now derived from transaction fees—a significant departure from near-zero levels.

2. Declining Electricity Costs: Embracing Renewable Energy

Electricity costs are on the decline as miners increasingly adopt cheap renewable energy sources. Some miners are even co-locating with power plants, utilizing otherwise stranded energy. This trend not only contributes to the sustainability of mining operations but also positively impacts the bottom line.

3. Revenue Diversification: AI and Beyond

Revenue diversification is becoming a key trend among Bitcoin miners. Some miners are tapping into the growing demand for computing capacity in the AI industry. By offering specialized Bitcoin GPUs with the density required for AI computing, miners are entering the realm of ‘GPU as a service’—a business model that is proving to be profitable, with AI contributing to increased profits faster than costs are rising.

Attractiveness Peaks: The Current State of Bitcoin Mining Economics

Bill Papanastasiou, a research analyst for digital assets at Stifel Financial, underscores the attractiveness of Bitcoin mining economics at the moment. The payback period for new mining equipment is less than a year—a return that should capture the interest of investors across the spectrum.

However, institutional investors remain cautious, recalling the industry’s near-bust during the recent downturn. Understanding the intricacies of valuing mining stocks, such as the “EV-to-contracted hashrate” metric, may take time for non-specialists.

As a result, the sector may continue to be a niche interest for TradFi enthusiasts.

Looking Ahead for Bitcoin Miners

Despite the potential cyclical nature of mining businesses, the positive trends in transaction fees, energy costs, and AI revenue suggest a more structural evolution for Bitcoin miners.

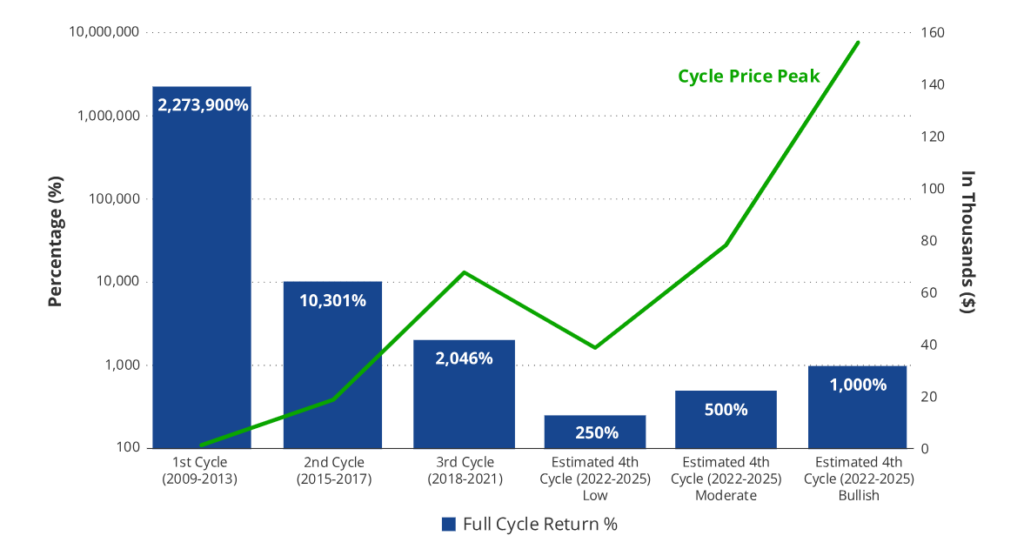

The sector has already witnessed significant growth, with some stocks experiencing a 3x or 4x increase. Predictions from the digital assets group at VanEck even anticipate a potential 10x increase for at least one publicly traded mining stock by the end of the year.

Final Word

The once-unappetizing options in the crypto-equities cheese shop are evolving. The unique confluence of factors, including increased transaction fees, reduced energy costs, and diversification into AI-related revenue, paints a promising picture for the future of Bitcoin miners.

As the sector undergoes this transformation, investors might find the selection at the cheese shop much more palatable and potentially profitable.

It’s indeed an exciting time to be a Bitcoin miner, breaking free from the shadows of volatility and embracing a future of diversified, sustainable, and lucrative operations.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.