CryptoQuant data shows that Bitcoin miners are actively selling their mined coins at a pace exceeding their production rate. According to the data, miners are capitalizing on the current high price of Bitcoin, which has surged by more than 12% in the last 30 days, according to CoinMarketCap.

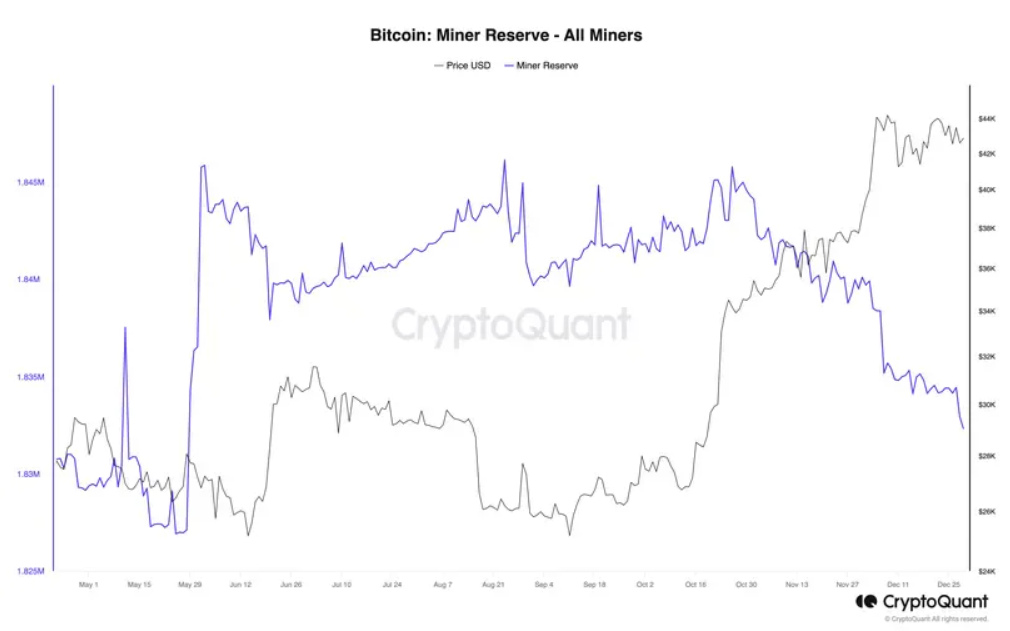

The data reveals that miner reserves, measuring the quantity of bitcoins stored in miners’ wallets, have plummeted from 1.845 million BTC in October to 1.832 million BTC as of December 28.

This significant drop indicates that miners have expedited the movement of over 13,000 BTC, valued at approximately $560 million, to various crypto exchanges for potential conversion to fiat currency or other cryptocurrencies.

Prominent crypto analyst Ali Martinez reported a noteworthy development, citing that miners sold a substantial 3,000 BTC, equivalent to around $129 million, within the past 24 hours alone.

In a notable move, #Bitcoin miners have sold over 3,000 #BTC in just the last 24 hours, amounting to approximately $129 million. This substantial sell-off could influence the price of $BTC. pic.twitter.com/mUl4ebDwpm

— Ali (@ali_charts) December 28, 2023

This influx of selling pressure has correspondingly led to a 4% decline in the price of Bitcoin, dropping from yesterday’s high of $43,811 to $42,072 at the time of this report.

Bitcoin Is Going “To the Moon” in 2024

However, industry experts caution that this selling spree may be short-lived. Anticipation is building for significant events in 2024, including the potential approval of a spot ETF in the US and a scheduled halving event in April. The halving event is poised to halve the number of bitcoins rewarded to miners for each new block, reducing it from 6.25 BTC to 3.125 BTC.

Analysts posit that this impending halving could trigger a supply shock, with the demand for Bitcoin outpacing its production. Bold predictions circulate, suggesting that Bitcoin’s price might soar to unprecedented heights, ranging between $100,000 and $160,000.

In light of these potential future gains, some miners may opt to retain their coins, anticipating more substantial returns down the line. On the other hand, others may persist in selling, either to cover operational costs or to diversify their crypto portfolios.

As Bitcoin’s trajectory remains dynamic, the market eagerly awaits the unfolding of these anticipated events, which could significantly impact the digital currency landscape.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.