In the world of cryptocurrencies, none stands as tall as Bitcoin. It’s the trailblazing digital asset that’s changed the way we perceive money. But behind its meteoric rise lies a secret weapon—the Bitcoin halving. In this illuminating guide, we’ll unveil the mysteries of Bitcoin halving, exploring its origins, mechanics, and why it’s a game-changer.

The Genesis of Bitcoin Halving

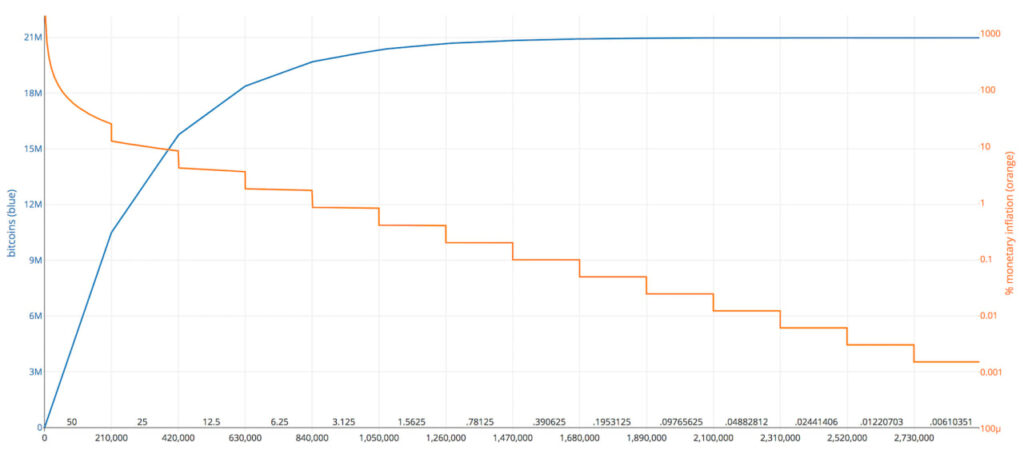

- The Quest for Scarcity: Imagine a digital currency with a controlled supply—a concept that fascinated Satoshi Nakamoto, Bitcoin’s enigmatic creator. Enter Bitcoin halving, a mechanism that halves mining rewards at set intervals. This engineered scarcity over time has bestowed upon Bitcoin an irresistible allure as a deflationary asset.

- The Inflation Antidote: The halving event isn’t just about scarcity; it’s also a potent antidote to inflation within the Bitcoin ecosystem. Reducing the block reward curbs the influx of new Bitcoin into the market, creating a finely tuned balance that aims to preserve Bitcoin’s long-term stability and value.

- Economic Dynamics: BTC halving isn’t just a numbers game; it has profound economic consequences for miners and the broader market. Miners must adapt to leaner rewards, sparking fierce competition and sidelining less efficient miners. This ripple effect can reshape the network’s security and decentralization.

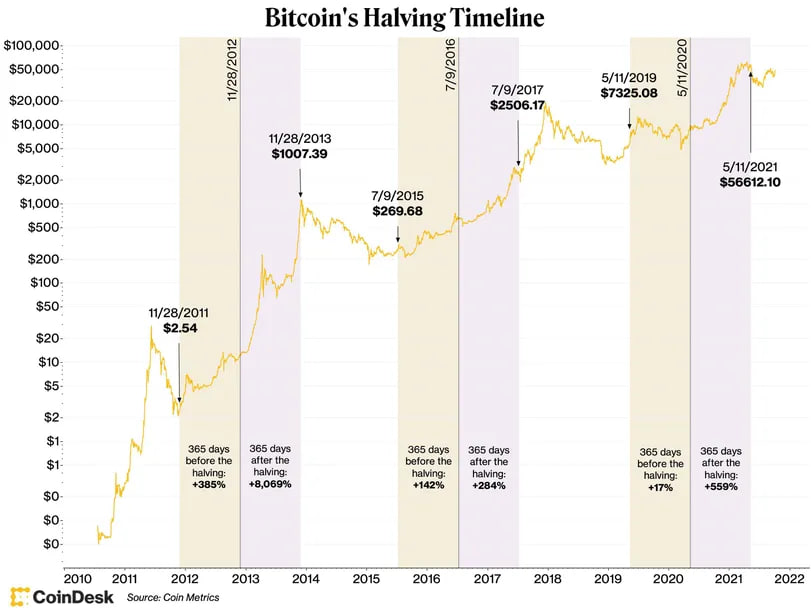

- The Price Puzzle: Historically, BTC halving has been linked to price surges. The mere anticipation of reduced supply and heightened demand triggers optimism and price appreciation. However, remember that past trends don’t guarantee future outcomes, and Bitcoin’s price dances to multiple tunes.

The Significance of Bitcoin Halving

Post-halving, Bitcoin becomes a hotbed of activity. Here’s why:

- Media Spotlight: Halving events thrust Bitcoin into the media spotlight, captivating both newcomers and seasoned investors.

- Privacy Allure: Bitcoin’s anonymity appeals continue to draw interest and investments.

- Real-World Relevance: As Bitcoin’s real-world applications expand, its utility as a digital currency becomes more evident.

While history suggests that Bitcoin halvings are bullish drivers, the upcoming event in April 2024 promises to reshape the BTC ecosystem as miners face tougher economic prospects.

A Glimpse into Bitcoin’s Halving History

Bitcoin’s journey is marked by halving events, each leaving a lasting imprint:

- In 2012, the first halving occurred when Bitcoin traded at a mere $12. A year later, it catapulted to nearly $1,000.

- The 2016 halving saw Bitcoin dip to $670 before skyrocketing to $2,550 by July 2017.

- After the 2020 halving, Bitcoin reached an all-time high, flirting with $69,000 in November 2021.

Bitcoin’s inflation rate has steadily declined, fueling its value. The next halving will require a substantial price surge for miners to stay profitable, prompting demand for more efficient technologies.

The Ripple Effect of the Bitcoin Halving Event

Halving events diminish miner rewards, slowing the influx of new Bitcoin. This dynamic sets the stage for supply and demand dynamics, affecting Bitcoin’s price.

Miners must evolve, and energy-efficient technologies will be in high demand to maintain competitiveness.

Moreover, as nations embrace Bitcoin and its visibility soars, prices could see an upward trajectory. Increased adoption from businesses and institutions could further boost transaction volumes.

The Miner Exodus Dilemma

If a large number of miners suddenly exit the Bitcoin mining scene, repercussions are imminent. The network’s hash rate, representing its computational power, will decline, leading to longer block formation times and compromised security.

However, history shows that Bitcoin’s resilience shines through. Following the 2012 halving, the hash rate initially dipped but then rebounded alongside mining profitability. A similar pattern unfolded post-2016, albeit with a more extended recovery period.

Final Word: When’s the Next Halving?

Approximately 89% of the 21 million Bitcoins that will ever exist are already in circulation, leaving around 19 million BTC. As halvings continue, the rate of new Bitcoin supply will diminish, ultimately reaching the projected culmination in 2140.

The next halving event is expected around April 2024, after mining the 840,000th block since the last halving. This will reduce the block reward to 3.125 BTC, ushering in a new era for Bitcoin miners.

Finally, Bitcoin halving is a pivotal chapter in the cryptocurrency’s journey, shaping its supply, demand, and price dynamics. While the future holds uncertainties, Bitcoin’s resilience and the innovations it inspires continue to captivate the world. As we anticipate the 2024 halving, the Bitcoin landscape stands poised for transformation, carrying its legacy forward.

Find Out More About Learn2Trade With Our FAQ. Click Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.