Indices enable people to capitalize on the price movements of some of the best-performing stocks in the world – without studying heaps of different company financial reports etc.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

If you want to trade a whole basket of stocks via one single trade – you need to learn how to trade indices!

In this ultimate guide, we get into the nitty-gritty of gaining exposure to the world’s most desirable stocks in this way. We also share the result of hours of extensive research by divulging our top 5 best brokers to trade indices. Additionally, we discuss index CFDs, ETFs, order types, potential broker fees, important metrics to finding a good trading platform, and more.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

Part 1: Understand the Basics of Trading Indices

Before you can learn any new skill in life – it’s important to first get to grips with the basics. This is going to be your foundation moving forward – as a result, making the more complicated stuff easier to comprehend.

What are Indices?

With that said, let’s start from the very beginning. Indices are stock indexes that track the performance of multiple stocks. For instance, the most well-known is probably FTSE 100, which is tasked with measuring the performance of 100 of the biggest large-cap stocks listed in the UK.

Companies you might have heard of in this index include BP plc, Rolls Royce Holdings, Barclays plc, Royal Dutch Shell, Tesco plc, Smith & Nephew plc, Natwest, Hargreaves Lansdown, British American Tobacco plc, and more.

Indices double up as a universal benchmark as to how stocks are performing in the markets. Another example of a well-known index is S&P 500 – tracking the performance of the top 500 companies on US stock exchanges.

Just some of the companies on the S&P index are Apple Inc, Microsoft Incorporation, Amazon.com, Facebook, Alphabet Inc (Google), Tesla, Visa, Johnson & Johnson, Starbucks Corporation, PayPal, McDonald’s Corporation, Netflix, Walmart Inc, and many more.

NASDAQ100 is another well-known index – this time comprising of 102 equity securities made public by 100 of the biggest companies listed on the NASDAQ stock market. This mainly comprises companies in the technology sector. To give you an idea, companies include Adobe, Amazon, eBay, Cisco, Intel, Marriott, Chubb Limited, and more.

You will be unable to invest in the aforementioned indices in a direct manner – instead, you will trade indices via CFDs and ETFs. For those unaware of CFDs and ETFs, we elaborate on both later.

How is the Price of Indices Determined?

Now that you know what indices are, we can talk about how the price will be determined. This is an essential part of learning how to trade indices, as it will make your decision-making process so much easier and more effective. Put simply the price is calculated from a weighted average, which is determined by the value of each stock.

- Individual Company Finances: A singular company’s gains and losses can lead to a rise or fall in share prices. Which can, in turn, affect the price of the index as a whole

- Addition or Removal of Companies: If any new companies are added to the index, or old ones removed, weighted indices will naturally experience a price shift

- Economic Events: A change in market sentiment, company, payroll reports, announcements from big banks, economic news, and more

- Company Statements: Any change in a company can cause indices to see a price fluctuation, such as a change in management, or an announcement of an upcoming merger

- Commodity Price Fluctuations: Any change in the value of commodities can impact the price of your chosen index. For instance, FTSE 100 tends to include over 10% in commodity stocks.

As is clear, various factors determine the price of indices. We mentioned commodities affecting the price of indices. To further elaborate, if there is any fear of inflation in the market, due to rising commodity prices – the chances are FTSE 100 will take a tumble. Ergo, speculation on deflation can cause the index to increase in value.

How to Trade Indices: Short-Term or Long-Term

When trying to learn how to trade indices it’s a good idea to think about whether you see yourself as a short-term or long-term trader. In a nutshell, there are two common ways to trade indices, and they are CFDs (Contract for Difference) and ETFs (Exchange Traded Funds).

Index CFDs

CFDs enable traders of all levels of expertise to be able to buy and sell indices. If you see yourself as a short-term trader and want to buy and sell again within hours or days (or sell and buy depending on market sentiment) – Index CFDs could be for you. This strategy involves making low-key profits, on a frequent basis.

Furthermore, instead of investing in the underlying asset, you will simply speculate on the future price of the index. Let’s say you are trading FTSE 100. The FTSE CFD tracks the real-world price of the index using a benchmark and mirrors it.

See an example of an index CFD below to clear things up:

- The FTSE 100 benchmark is valued at $6,662.00

- As such, the FTSE 100 CFD is also priced at $6,662.00

- If FTSE 100 rises or falls in value – your CFD will mirror this

To begin to learn how to trade indices and make a profit doing so – you must correctly predict the rise or fall in the value of the index. There are many tools available to help you perform your own research. CFDs also have the added benefit of leverage. All of which we discuss later in this guide.

Importantly, when you are looking to trade indices via CFDs you will be liable to pay a fee for every day the position remains open. This is called an ‘overnight financing fee’, or a ‘swap fee’ and will come at a higher rate over a weekend.

Whilst the fee is usually small – it does depend on the asset you are trading, as well as leverage applied (if any). If you plan on keeping your position open for longer, then you might want to consider trading indices via ETFs. Please note that CFDs are prohibited by law for clients residing in the US.

Index ETFs

Index ETFs monitor indices – such as FTSE 100 – by purchasing shares at a weight in proportion to individual companies’ market capitalization or value. ETFs are usually traded by long-term traders who purchase indices and then hold onto them for weeks, months or years – until they feel it’s the right time to make worthwhile gains.

Put simply, the ETF buys shares so that you don’t have to, leaving you to simply concentrate on its rise or fall in value. After all, this is where your profits lie. Furthermore, if the underlying stocks of the index pay dividends, you will still receive dividends via the ETF.

Our guide found that the vast majority of brokers pay investors every 3 or so months. The reason is that indices are often made up of hundreds of companies, who may all pay dividends at different times. The trading platform will instead fund your trading account at regularly occurring intervals.

Index ETFs will invariably mirror the price of the indices they monitor – like CFDs. At regulated trading platform eToro, you can access indices via both CFDs and ETFs, without paying a cent in commission. Crucially, ETFs do not come with an overnight financing fee.

Part 2: Learn Index Orders

Before you can effectively learn how to trade indices you need to learn index orders. As such, below we talk about the key orders you need to be aware of to trade indices to the best of your ability.

Buy Orders and Sell Orders

‘Buy’ and ‘sell’ orders are rudimentary, you must choose between one of the other to enter the indices market.

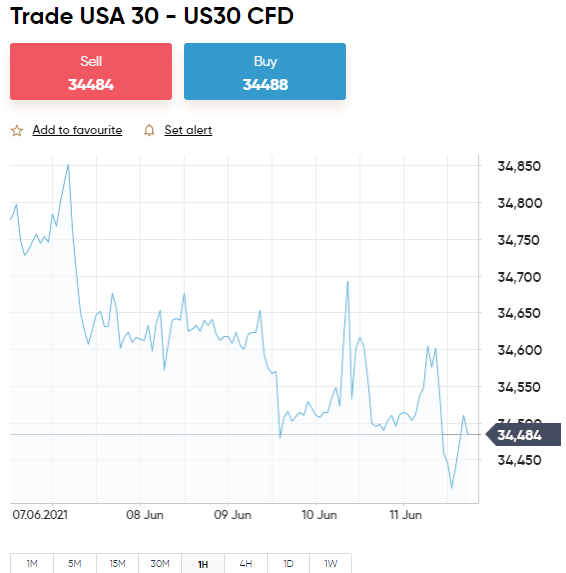

For example, let’s say you are trading a Dow Jones Industrial Average ETF:

- If you think the SPDR Dow 30 ETF will see a price increase – you need to place a buy order with your broker

- Alternatively, if you think Dow will see a decrease in price – you should place a sell order with your broker

Notably:

- If you enter the market using a buy order – you must exit with a sell order

- Ergo, if you enter the market with a sell order – you must exit with a buy order

Of course, which order you choose will depend entirely on whether you think the price of this ETF will rise or fall.

Market Orders and Limit Orders

When electing to learn how to trade indices, you will notice that as well as a buy or sell order – you will also be required to choose between a ‘market’ or ‘limit’ order.

Market Order

Put simply, a market order is used when you like the current market price – and therefore want the order to be actioned as a matter of urgency.

Limit Order

A ‘limit’ order allows you to be specific about what price you want to enter your index at. Let’s say you are trading the Dow index via CFDs.

See an example below:

- The Dow CFD is priced at $320.00

- Based on research – you are not interested in entering the market until Dow has risen to $333.00

- Consequently, you must set your limit order to $333.00

- If or when the index rises to $333.00 – the broker will close your order automatically

- If Dow fails to reach that price point, your order will remain open until you close it manually

Stop-Loss Orders and Take-Profit Orders

These orders will be an invaluable part of your trading strategy. See below for an explanation of each.

Stop-Loss Orders

When looking to trade indices, ‘stop-loss’ orders quite simply allow you to predefine when your trade will be closed. This prevents losses from getting out of hand.

See an example of how a stop-loss order is used below:

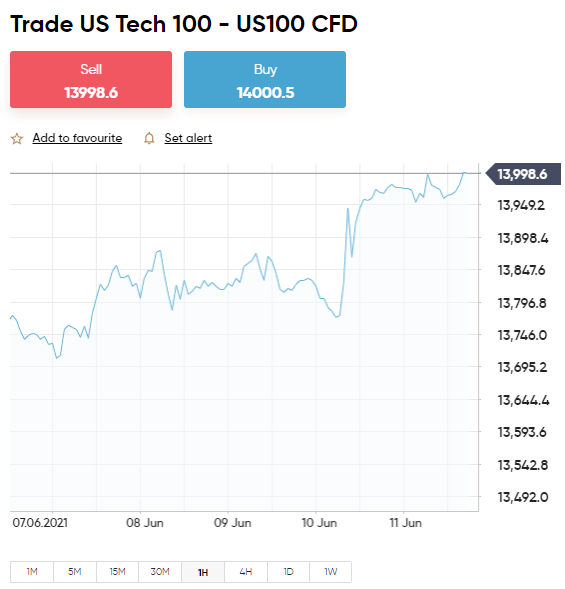

- Let’s say you are trading the NASDAQ 100 Index

- You think the price is due to see a decrease so want to go short – but are not willing to lose more than 3%

- In this case, you must set a stop-loss order at a price 3% above the position value

- In contrast, if you see an opportunity in going long on NASDAQ 100 – you should set the stop-loss price to 3% below the position value

To clarify:

- NASDAQ 100 is priced at $13,225.00

- If you are short on the index – your stop-loss order will be $13,621.75 (13,225.00 + 3%)

- If you are long on the index – your stop-loss order will be $12,828.25 (13,225.00 – 3%)

This is a great way to avoid having to time the markets and manually close any index positions. Simply include a stop-loss on every single trade and your position will be closed automatically by the online broker – to stop any losses spiraling.

Take Profit-Orders

Take-profit orders don’t need much explaining as they are very similar to stop-loss orders. The biggest difference is that whilst stop-loss orders are great for keeping losses under control – take-profit orders are superb for locking down gains.

By this point in placing your order you will see the following:

- Buy or sell order: do you think the index will see an increase or decrease in value?

- Market or limit order: do you like the current price of the index, or would you rather enter the market at your own price?

- Stop-loss order: how much are you able to lose before cutting your losses and closing the trade

Now, you can add ‘take-profit’ to your order to trade indices:

- Let’s say you want to make a 5% profit when trading indices

- If you are short on the index – set your take-profit to 5% below the initial price

- Alternatively, if you are looking to go long – set the take-profit price to 5% above the initial price

It’s that simple. As we said, these orders are automatic so there is no need to manually close your order – with that said, you may close your position whenever you like.

Part 3: Learn Index Risk-Management

Especially in the early days of learning to trade indices, it’s important to be mindful of index risk management. Although with that said, this is going to be useful at all stages of your learning process.

Percentage-Based Bankroll Management on Indices

A popular strategy used by both newbies and seasoned traders is percentage-based bankroll management on indices. It’s a useful way to maintain control over your trading finances.

Trading Indices via a Risk and Reward Ratio

Starting with risk and reward ratio. This really is as simple as it gets, in terms of strategies for trading indices.

- If you decide that for every $1 you risk, you want a reward of $3 – this would be a risk/reward of 1:3

- Some traders use a risk and reward ratio of 1:2 or 1:4

This strategy is easy to use as the risk/reward ratio can always be recalculated as your trading account balance fluctuates. Furthermore, you may have noticed that this system is perfectly suited to stop-loss and take-profit orders.

Leverage on Indices

For those unaware, leverage allows traders to create positions on indices, at a higher value than their trading account allows. Leverage is usually shown as either a ratio or a multiple – for instance 1:2 or x2.

If you apply leverage and the trade goes your way – you are also boosting any gains. If the trade doesn’t go the way you expected it would – your losses will be boosted as well – this can lead to liquidation.

In terms of leverage, major indices are capped at 1:20 for the UK, Australia, and parts of Europe. This means you can open a position worth 20 times more than what you have. Whereas non-major equity indices are restricted to maximum leverage of 1:10.

As we said US clients are unable to access CFDs as they are illegal. In other parts of the world, you may be offered as much as 1:100 leverage as there are no restrictions. Either way, always tread carefully with leverage.

Part 4: Learn How to Analyze Index Prices

As we said, many things can determine the price of indices. As such it’s important to have a firm grasp of how prices can be analyzed. This is going to aid you in making touch trading decisions down the line.

Fundamental Analysis in Indices

Fundamental analysis generally means keeping abreast with any global affairs that may affect the index you are actively trading. Of course, supply and demand are the main cause of price fluctuations.

However, it’s important to remember that supply and demand are affected by many outside factors. As we mentioned earlier, news such as a change in management or a merger can affect indices, as well as economic changes, commodities, change in share prices, and much more.

There are heaps of trading tools and services available at your fingertips to help you in this department. Many traders opt to sign up for news subscription services, meaning you receive live updates and relevant news. There are also plenty of free websites that include live feeds, economic updates and forecasts, and much more.

Technical Analysis in Indices

Technical analysis is undoubtedly more complex than fundamental, and probably more important.

This is more of a trading discipline and will see you studying historical price charts of various timeframes. You will also be looking at market data like price movement and volume, trends, and indicators.

Technical analysis is an important part of the research process when you learn to trade indices.

Some of the most used trading indicators include:

- Moving Average Convergence Divergence

- Ichimoku Cloud

- Average Directional Index

- Bollinger Bands

- Stochastic Oscillator

- Standard Deviation

- Fibonacci Retracement

- And heaps more

If you haven’t got a clue where to begin, there are heaps of courses available on how to perform technical analysis.

Signals for Indices

If you are new to the game and are a little overwhelmed by the idea of learning all of the aforementioned analysis- consider signing up to a signal service. Index signals are, in their most basic form, trading tips.

Each signal will include:

- The name of the index

- Whether to buy or sell

- Limit price

- Stop-loss price

- Take-profit price

This is a partly passive way to trade, as when you receive the signal it’s up to you whether you head over to your broker to place the order. Here at Learn 2 Trade, we have heaps of signal services to choose from.

Part 5: Learn How to Choose a Good Index Broker

When it comes to research, we don’t do things by halves. You will find a list of our best brokers to trade indices, along with a review, in the next section of this guide.

However in case you are yet to decide on the right broker for you – please find a list of key considerations below.

Regulation

Regulation is super important, especially when dealing with finances. We find the best brokers hold a license from one or more regulatory bodies.

Some of the most respected financial organizations, tasked with keeping the trading space clean, are:

- FCA (UK)

- ASIC (Australia)

- CySEC (Cyprus)

- FINRA (US)

By sticking like glue to trading platforms that are bound by regulation you know your funds are separate from the company’s, regular audits are submitted, KYC is followed and fee transparency is a must.

Fees and Commissions

When signing up with any company online, one of the first things to investigate is potential fees payable. This way you can avoid any nasty surprises and work out your gains and losses easier.

More often than not you will find that to trade indices you will pay a variable fee.

See below for a clear example of a variable fee:

- The trading platform charges 0.3% for each and every trade

- If you place an order on indices worth $1,000

- You must pay $3 (1,000 * 0.3%)

- Let’s say you feel ready to cash out and your position is now worth $1,800

- As such, again you must pay 0.3% – which this time is $5.40 (1,800 * 0.3%)

If you instead trade indices via a broker such as eToro – you will not pay a single cent in commission. Therefore, on this trade, you would have saved $8.40 towards your next index investment.

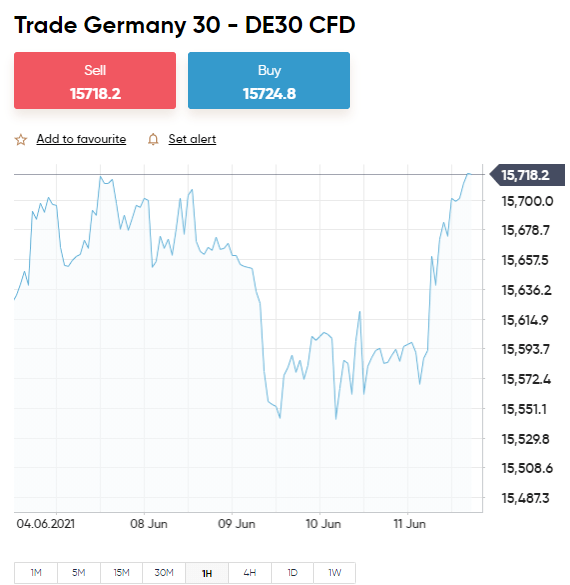

Spreads

The spread is quite simply the difference between the buy price and the sell price of the index, according to the markets. When trading indices you will always see these two prices (sometimes called ‘ask’ and ‘bid’).

- The buy/ask price shows us what the market is willing to buy the index for

- The sell/bid price shows us what the market is willing to sell the index for

- The buy price of the US Dollar Index is $89.50

- The sell price of the US Dollar Index is $89.54

- The spread on this index is 4 cents

Spread is generally shown as pips, percentages, or cents. Pips are usually used in the forex market. Importantly, whatever the spread is will be the small indirect fee to your broker. As such, if the spread is 4 cents and the US Dollar Index rises in value by 4 cents – you break-even. Anything over 4 cents will count as profit from this trade.

Payments

Accepted payment types should not be overlooked when looking for a broker to trade indices. The vast majority of modern online trading platforms are accepting of multiple payment types. This is often inclusive of credit and debit cards, and e-wallets such as Skrill.

At eToro, for example, you can deposit funds into your account using credit/debit and also bank transfer. The platform also accepts e-wallets such as Neteller, Skrill, and even PayPal.

Best Brokers to Trade Indices Online

The chances are you are keen on learning to trade indices in a practical sense. First, you need to find that all-important broker to offer access to such markets.

We have provided a useful checklist of how to find a good broker. However, to save you hours of research, we have also listed our 5 best brokers to trade indices below.

1. AvaTrade – Index CFDs and Advantagious Techincal Analysis Tools

AvaTrade has been around for well over a decade now and in that time has obtained regulatory licenses from a variety of different juresdictions, including the UK, Australia, Japan, UAE, South Afrcia, EU, and more.

There are heaps of different assets to choose from at this online brokerage. CFD indices include US 500, FTSE 100, FTSE Taiwan, Cannabis Index, India 50, SPI 200, and many more. If you are a long-term trader you can also access ETF indices. AvaTrade is a commission-free broker, so the only fee you need to factor in is the spread - and the overnight financing fee if you are trading index CFDs.

The 'AvaTradeGO' app is compatible will all iOS and Android phones and tablets. This enables you to trade indices no matter where you are (as long as you have an internet connection). The app enables you to monitor and deposit into your account - not to mention being full of advanced trading tools, social trading features.

Speaking of features, the AvaTrade platform itself is packed with educational content. This includes trading simulations, demo portfolios, risk-management tools, and guides aimed at specific financial instruments. If you like the idea of social media but made for the trading community - you can easily connect your account to DupliTrade or Zulutrade.

You can deposit funds into your account to trade indices using wire transfers, debit and credit cards, and also e-wallets. Australian, Canadian, and EU clients will not be able to fund their accounts using e-wallets. However, in other parts of the world, you can use WebMoney, Neteller, and Skrill. Note that at AvaTrade wire transfer can take up to 7 days to clear.

- Minimum deposit $100 to trade indices

- Regulated in heaps of places such as the UK, EU, and Australia

- Trade indices with 0% commission

- Admin fee expensive after 12 months without trading

2. VantageFX –Ultra-Low Spreads

VantageFX VFSC under Section 4 of the Financial Dealers Licensing Act that offers heaps of financial instruments. All in the form of CFDs - this covers shares, indices, and commodities.

Open and trade on a Vantage RAW ECN account to get some of the lowest spreads in the business. Trade on institutional-grade liquidity that is obtained directly from some of the top institutions in the world without any markup being added at our end. No longer the exclusive province of hedge funds, everyone now has access to this liquidity and tight spreads for as little as $0.

Some of the lowest spreads in the market may be found if you decide to open and trade on a Vantage RAW ECN account. Trade using institutional-grade liquidity that is sourced directly from some of the top institutions in the world with zero markup added. This level of liquidity and availability of thin spreads down to zero are no longer the exclusive purview of hedge funds.

- The Lowest Trading Costs

- Minimum deposit $50

- Leverage up to 500:1

Part 6: Learn How to Trade Indices Today – Walkthrough

In order to learn how to trade indices today – you need to sign up with a regulated broker! To keep things super simple, we are using Capital.com for our walkthrough.

Step 1: Open an Account & Upload ID

Head over to the Capital.com website and click ‘Join Now’ to sign up. As you can see below, a sign up box will appear asking for some basic information about who you are.

As per KYC rules, the online broker must obtain proof of identification. The majority of traders use a passport or driver’s license. You are also going to need to upload a clear copy of a bank statement or utility bill from within the last 3 months – this is your proof of address.

You can leave the uploading of documents until later on, but you will have to complete this part of setting up your account anyway. This will need to be carried out before you can make a withdrawal, or fund your account with $2,225 or more.

Step 2: Deposit Some Trading Funds

You will receive confirmation of your new account via email. Now you can deposit some trading funds into your account.

This part is easy, enter the amount you wish to deposit in the relevant box and select your desired deposit method from what’s available. As we said, payment type availability will depend on your location.

Step 3: Search for Indices

At this point, you have a new trading account at Capital.com

and have funded your account to trade indices. Next, you need to find an index to trade.

This is simple at Capital.com as the site is so easy to navigate. As you can see, here we are searching for Dow Jones 30 (DJ30).

For those who have yet to decide, click ‘Trade Markets’, followed by ‘Indices’ and you will see all available indices laid out clearly in front of you.

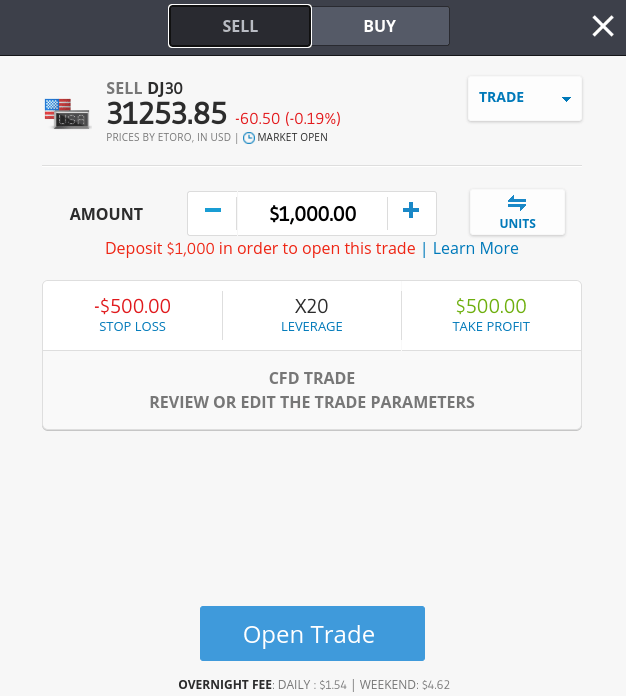

Step 4: Start Trading Indices

Having found the index you want to trade, simply click ‘Trade’ and an order box will appear.

Your order box should contain the following information, as chosen by you (or your signal service for indices):

- Buy or sell order

- Stake value

- Market or limit order

- Stop-loss price

- Take-profit price

Crucially, always check the details you have entered – before clicking ‘Open Trade’ to action your order. At this point Capital.com

will execute your order automatically.

Learn How to Trade Indices – The Verdict

Hopefully, this Learn how to Trade Indices guide has provided you with a good deal of insight, in terms of how the market works. Importantly, you should always conduct your own research when looking for a broker.

We think that regulation is super important, especially in this industry. By sticking to regulated brokers your funds will be segregated for your protection. Furthermore the platform is held accountable and therefore must follow strict rules on fee transparency, detailed audits and more.

Capital.com is regulated by FCA, ASCI, CySEC, and NBRB as well as being registered by FINRA in the US. The platform is beginner-friendly, has heaps of assets and you can trade indices whilst paying ZERO commission. Sign up today in 10 minutes or under using your preferred credit/debit card or e-wallets like PayPal.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

FAQs

What is the easiest way to trade indices?

What are the most traded indices in the world?

Why might indices be better to trade than stocks?

Can I trade indices for free?

How is the price of indices determined?