Despite it being a somewhat new phenomenon for retail clients, online forex trading has become progressively more popular in the past few years. As a result of this, there is a substantial number of brokers and service providers available at your fingertips to learn forex trading.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Before deciding which broker you opt for, you will first need to learn forex trading from top to bottom.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

0.0

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

1

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

With this in mind, we’ve put together a guide to all things forex; This includes everything from the types of currencies you can trade, leverage, market orders, risk management tools, and more!

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

Learn Forex Trading – The Basic

With an average turnover of over 5 trillion dollars per day, forex is the biggest financial market on the planet. It is essentially a marketplace for all currencies, worldwide. Currencies will be traded on the forex markets, much like stocks which are traded on the stock exchange.

One slight difference between the two asset classes is that during forex trading sessions, currencies will be traded over the counter – whereas stocks will be traded on more centralised exchanges. Currencies are traded during four main forex sessions, these are; the London session, the New York session, The Tokyo session, and the Sydney session.

Particularly when the London and New York sessions overlap (usually for a few hours each day), the vast bulk of forex trading is usually carried out during these two sessions. Transaction fees will usually be lower when trading within the London and New York overlap period, as that’s when the market will be at its most liquid.

The lowest increment a currency pair can modify in value is known as a ‘pip’. Forex market exchange rates are generally conveyed with 4 decimal places, the final decimal place being a ‘pip’. The main exception to this rule is when pairs are denominated in Japanese yen.

Forex Currency Pairs

All presented in pairs, currencies can easily be divided into three main categories:

Major Pairs: The most liquid pair here is probably EUR/USD. Major currency pairs are essentially currencies which will be traded against the USD (which is the world’s reserve currency). An example of other pairs includes; GBP/USD and USD/JPY.

Minor Pairs: Sometimes called cross pairs, these pairs offer less liquidity when you are trading, as they do not trade against the USD (for example GBP/EUR or CHF/EUR).

Exotic Pairs: Linked with currencies from developing worldwide economies like Turkey (Turkish Lira), South Africa (South African Rand), and Brazil (Brazilian Real). Sometimes exotic pairs can be referred to as minor pairs.

Ultimately, the US Dollar plays a very important role in the forex trading space. Such pairs come with low levels of liquidity and volatility and typically come with tighter spreads.

Learn Forex Trading With an Example

The overarching concept of forex trading is to speculate on the future direction of a currency pair. If you speculate correctly, you make money. If you don’t – the opposite happens.

For example:

- Let’s suppose that you are trading GBP/EUR.

- The current price of the pair is 1.1760.

- You think that GBP will increase in value over EUR, so you place a ‘buy order’.

- A couple of hours later, GBP/EUR increased by 1.2%.

- You are happy with your profits, so you decide to cash in by placing a ‘sell order’.

As per the above, you made a profit of 1.2% by speculating that the price of GBP/EUR would increase. If you thought that the opposite would happen, then you would have needed to place a ‘sell order’.

Either way, the beauty of the online forex trading scene is that you can set your own stakes. For example, had you staked $500 on the above trade, you would have made a profit of $6. Had you stakes $5,000 – your profit would have stood at $60.

Learn Forex Trading: The Spread

Every single market has a spread of some description, forex is no different. For those unaware, the spread is the difference between the asking price (how much they will sell for) and a bid price (how much you buy for). For example, if the buy price is 2.3100, and the sell price is 2.3106, the spread here would be 6 pips.

This is a classic case of supply and demand. Bear in mind that in this instance the broker in question won’t need to charge you a higher spread, because they shouldn’t have any problems at all selling off the (in this example) dollars they just bought.

Try your best to avoid selling or buying using currencies which have a lower demand, as it will always cost you significantly more due to a higher spread. Generally speaking, the more exotic (for want of a better word) the currency is, the higher the spread will be. On the other hand, the more broadly used the currency is, the lower the forex spread will be.

Seasoned forex investors will sometimes trade in 7-figure currency units, so if the spread is .0005 (in other words 5 pips), it might cost you 500 units of whatever currency you are trading in.

Trading Suite Tools

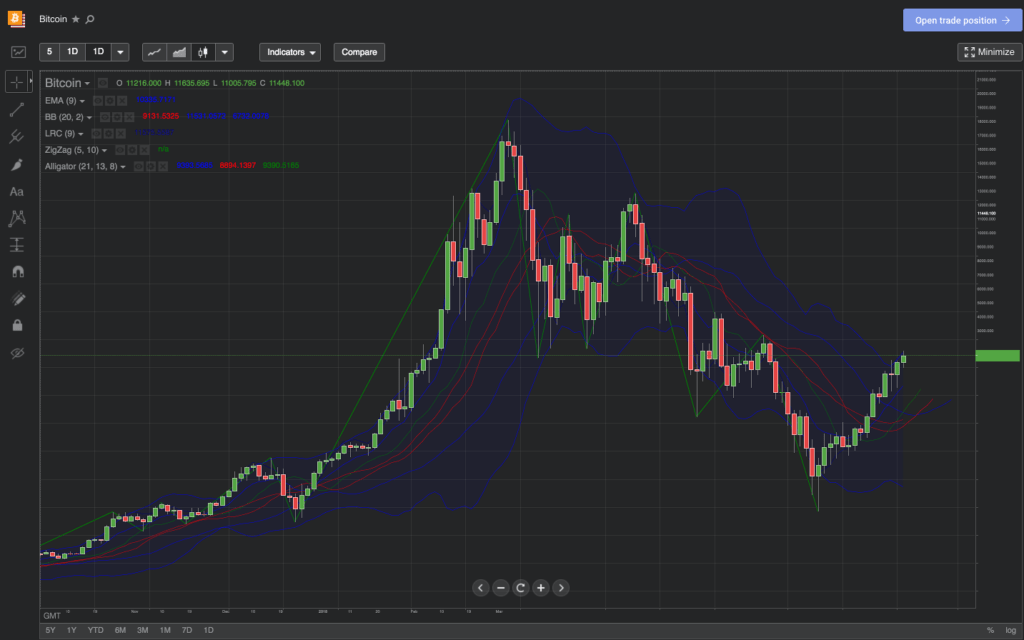

Each forex broker will have trading tools – otherwise referred to as technical indicators. These can be found on the platform’s ‘trading suite’. Usually, forex traders will use technical indicators, chart overlays, and statistics in order to help make better choices.

Some of the most convenient tools used by forex traders, and ones to look out for are as follows;

MACD: Meaning ‘moving average convergence divergence’, this tool will spot new trends based on moving averages. Trends are where the money is in forex.

Bollinger Bands: This technical indicator might aid you in spotting the direction in which a trend will go. An indicator will outline a channel around an assets price movement. Channels are relative to a moving average and standard variations.

ADX (Average Directional Index): In order to establish how strong a trend is, you might use the ADX. Trends will always be either up or down, a negative directional indicator will be displayed as -DI, and a positive will be +DI.

RSI (Relative Strength Index): This momentum oscillator will measure the change of price movement as well as the pace of rising and falling stock prices.

Ichimoku Cloud: Commonly referred to as the Ichimoku Kinki Hyo, this one is a multifaceted indicator which offers trading signals, trend direction info, assess momentum, both resistance, and support. At a glance, you can gain some insight into trends, and also the potential signals within it.

Stochastic: This momentum oscillator is a good buy and sells indicator, looking at the history of a forex pair price, in order to envisage the continuation in direction.

SAR (Parabolic Stop and Reverse): Focused on short-term price reversal points helping you decide where to place stop orders.

Learn Forex Trading: Trading Platforms

Specialising in the forex market, the MetaTrader4 (MT4) platform can facilitate advanced trading, which holds dozens of technical analysis (analysing pricing trends) and is fully compatible with trading robots.

Fellow counterpart MetaTrader 5 (MT5) will allow you to carry out technical trading operations, and analysis in forex trading markets. MT5 was initially created to provide its traders with access to stocks, futures, and CFDs.

On a side note, unlike the forex space, CFD trading doesn’t involve buying or selling any underlying assets you might have.

What’s Leverage Trading in Forex?

The basic principle of leverage in forex trading is to enable you to trade with a greater amount of cash than you’ve currently got in your account. It’s worth noting that this can accelerate your losses, as well as winning trades.

So, imagine you’ve got a balance of $1,000 – when applying leverage of 10x you would then be able to trade with $10,000.

To explain leverage a little further:

- Let’s say you wish to place an order on GBP/USD because you are feeling bullish on the British pound.

- The current price of the pair is 1.2623.

- You’ve got $500 in your forex trading account, and then you apply for leverage of 20x.

- Your ‘buy order’ is now worth $10,000 ($500 x 20).

- Let’s say a few hours later, the price of the GBP/USD has increased by 2%, as a result, you decide to lock in your gains and exit the position.

- Under normal circumstances, 2% on a $500 stake would result in gains of $10.

- However, because your trade had the leverage of 20x applied, this means you really made $200 ($10.00 x 20).

The Significance of Genuine Brokerage Reviews

As a newbie investor, you need to be especially careful when it comes to the platform you are trading with, due to the unforeseeable risks it may involve.

A crucial part of choosing a broker is doing a significant amount of research before you make your decision.

One of the ways to do this is to read the reviews on the broker platform, to give you an insight into other traders’ experiences with the brokerage site in question. You can also check out broker reviews like ours which are unbiased and based on research done by experts. More on that later.

Choosing a Forex Trading Provider – What to consider

In the highly competitive forex broker market, you will find there are hundreds of platforms to choose from, with a large number offering UK traders their services at the click of a button.

Learn Forex Trading: Legislation and Regulation

A good place to start is to check that the broker you are considering has a legal remit in order to take on UK traders. It is compulsory for brokers based in the UK to have an FCA (Financial Conduct Authority) trading licence.

If the broker is licensed by the FCA, you can be safe in the knowledge that the platform is conducting its business according to UK and EU legislation.

With that said, there are a number of non-FCA forex brokers active in the space that also offer several safeguards and regulatory protections. This is because they choose to obtain a license from other tier-one bodies – such as CySEC (Cyprus) and ASIC (Australia).

Segregated funds

The vast majority of online forex brokers now ensure that segregated funds are the norm. As such, this is something you might want to look out for when selecting your broker platform.

Put simply, if your forex broker offers segregated funds, this means that any trading capital you have will be kept safely away from the funds your broker is using for the operation of the business.

Always check the regulations of the particular broker though, as platforms will differ in how they operate, and in the case of bankruptcy; your funds might not be 100% protected.

Deposits and Withdrawal Options

When it comes to depositing into your forex broker account or withdrawing your profits, your experience should be fast, simple, and also transparent.

Whilst a lot of platforms will process your deposit straight away, it is always a good idea to double-check that your broker, or payment method, isn’t going to take a little longer.

Be aware that some brokers will charge you an inactivity fee. It is usually a payment as small as a few pounds/dollars/euros, so always read the terms and conditions attached.

Some of the most common payment/depositing options available include; Visa, Mastercard, e-wallets (such as PayPal), American Express, and a bank transfer.

Learn Forex Trading: Customer Service/Support

Customer support is a vital part of having a good experience with any company. Whilst the majority of forex brokers offer a great customer support service, it is always advisable to do some research before making your final decision.

Some brokers will offer you a free online consultation, the best will offer you support every step of the way.

Customer support options will vary but options usually include; live chat, email, telephone, and even social media. A lot of platforms provide 24-hour assistance with any problems or queries you might have.

Low Commissions and Trading Fees

This one’s self-explanatory, but forex brokerage fees can vary quite wildly. Nevertheless, fees typically come as a ‘trading commission’ – which is a percentage multiplied by your stake.

For example, let’s suppose that the forex trading site charges 0.2% and the size of your order is $3,000. This means that you will pay a commission of $6. If you then closed your position when the order was worth $3,500 – your commission would stand at $7.

As we discussed earlier, you need to ensure that your chosen broker offers low spreads. In this respect, aim for forex trading sites that offer spreads of below 1 pip on major pairs like EUR/USD. The only exception to this rule is if you are using a commission-free broker, as naturally, you will find the spreads are slightly higher.

Other Points to Consider

- Multiple forex pairs: Again, the more options the better – especially when it comes to tradable instruments. While some brokers might have a few pairs, others might offer a surplus of 100. You can check this before signing up.

- A good variety of technical indicators: These statistics and overlays will aid you in making better trading decisions, due to the insight they provide. As such, make sure your chosen broker offers heaps of technical indicators and advanced chart reading tools.

Ultimately, it’s always advisable to check the terms and conditions, fees, stats and reviews before you steam in.

Best Brokers to Learn Forex Trading Within 2023

If you are just starting out in the world of online trading, it is imperative that you use a broker that is tailored to the newbie investor. Taking all of the aforementioned metrics into account – below you will find a list of the best online brokers in 2023 to learn forex trading.

1. AVATrade - Established Forex Broker With Tight Spreads

Founded in 2006 and regulated in four continents, this broker offers traders over 50 currency pairs, super tight spreads and a superb range of other asset classes if you are planning to diversify.

Some of the trading platforms available with this broker are MT4, MT5, and its own web trading software. AVAtrade offers a wide variety of trading options and helpful features, including leverage of up to 400:1 on forex, and competitive spreads as low as 0.8 pips.

The broker also offers risk management features such as stop-loss and take-profit orders, so this will help you assess any risks involved.

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

2. VantageFX – Ultra-Low Spreads

VantageFX VFSC under Section 4 of the Financial Dealers Licensing Act that offers heaps of financial instruments. All in the form of CFDs - this covers shares, indices, and commodities.

Open and trade on a Vantage RAW ECN account to get some of the lowest spreads in the business. Trade on institutional-grade liquidity that is obtained directly from some of the top institutions in the world without any markup being added at our end. No longer the exclusive province of hedge funds, everyone now has access to this liquidity and tight spreads for as little as $0.

Some of the lowest spreads in the market may be found if you decide to open and trade on a Vantage RAW ECN account. Trade using institutional-grade liquidity that is sourced directly from some of the top institutions in the world with zero markup added. This level of liquidity and availability of thin spreads down to zero are no longer the exclusive purview of hedge funds.

- The Lowest Trading Costs

- Minimum deposit $50

- Leverage up to 500:1

Learn Forex Trading – How to Get Started

So you’ve chosen a forex broker you are interested in signing up with, but don’t know where to start? We’ve compiled a simple list of step by step instructions to get you trading in minutes.

Step 1: How to open an account

Once you’ve selected your preferred platform, you can visit its web page and begin the process of opening your account. Like with most new accounts or anything you need to sign up for, you are going to need to enter some personal information to get the ball rolling.

This part is pretty standard; you will always need to enter your full name, date of birth, contact details (usually mobile number and email), residential address, and in this case your tax status.

As well as your tax status, you are going to need to provide your broker of choice with some other information, in relation to your finances.

Generally speaking, the financial information required of you will be your net worth, your regular income, and your employment status. The forex broker will need this information in order to provide you with a real-money account, as well as the right products, tailored to your financial situation.

Step 2: Previous Trading Experience

Here you are going to have to answer some questions (usually multiple choice), based on your previous trading experience.

Essentially, regulated forex brokers will need to make sure you know what you’re doing. Forex trading is made up of highly developed financial instruments, so having some prior experience in this trading arena is quite important.

You might find that you are unable to trade on with margin if you fail to answer some of the questions correctly.

Step 3: Identity verification – KYC

Next, you will need to prove that you are who you say you are. Commonly called KYC, or Know Your Customer, confirming your identity is an absolutely essential part of signing up to any broker.

Whilst brokers will usually request scanned copies of documentation when proving your identity; depending on local regulations, some brokers will actually verify your identity via video. In either case, you will need to make sure you have your passport, or national identification ready.

In the case of video verification, an external fully verified provider (& EBH partner) will conduct the video, on a verified platform at the end of your registration process. Video verification will require an operator, and therefore will have certain hours when it is available, usually normal business hours.

Proof of address usually requires just one document, from a list of accepted documents. Usually, a copy of a bank statement or a utility bill (electricity, water, gas, or even a phone bill) will be sufficient when confirming your address.

Once your identification has been verified you officially have an account and can begin the next step, which is to add some funds to your forex broker account.

KYC processing times can vary, but if you feel like you have waited too long for confirmation, you can always contact the broker’s customer support team, and they will be happy to chase this up for you.

Step 4: Deposit Funds

As soon as your identity has been verified by the forex broker, you can deposit some funds into your account.

If you have a specific payment method you need to use, you should always check that the particular broker accepts such a payment method, as they do vary.

If your payment of choice is a debit/credit card, the likelihood is that your deposit will be credited to your account immediately. With a bank transfer, for example, it may be a few days before your deposit is cleared.

A few payment methods usually accepted are; Debit/Credit cards, bank transfers, and e-wallets.

Step 5: Begin Trading

It is definitely recommended that before you begin to trade, you have a basic understanding of how it works, as well as how to enter and exit positions.

Before you make an actual transaction, a great way to prepare for your first forex trade is to start with a demo account.

This is a sensible way to avoid the high risk of practising using your real trading funds, and also helps you familiarise yourself with the platform when it comes to the real thing.

You can now create a forex order, basically a command for your broker.

Once you’re at the stage where you have opened an account, verified your identity and added funds by depositing some money into it. – now, it’s time to start trading with real money It’s a good idea to start with very small stakes, as it makes sense to get your head around how everything works before taking any major risks which you might regret later.

Learn Forex Trading: Conclusion

Due to somewhat of a forex revolution over the past few years, a financially independent lifestyle is now available to just about any trader.

Hopefully, after reading this guide, you have a much better understanding of the inner mechanics of how forex works, as this knowledge will ensure you get your trading career off on the right foot!

AvaTrade - Established Broker With Commission-Free Trades

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Awarded Best Global MT4 Forex Broker

- Pay 0% on all CFD instruments

- Thousands of CFD assets to trade

- Leverage facilities available

- Instantly deposit funds with a debit/credit card