Paper trading is the process of buying and selling assets via a live demo account. You will be doing this through an online broker with the sole purpose of replicating real-world market conditions without risking your own capital.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

This is beneficial for a number of reasons. For example, paper trading accounts are great for those of you that have little to no experience of how online investments work.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

0.0

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

1

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Similarly, the process is also conducive if you want to test out new strategies, or if you’re looking to assess the effectiveness of an auto trading robot.

In our Learn 2 Trade 2023 Guide On Paper Trading, we explain everything there is to know about live demo accounts. We also give you a step-by-step guide on how to get started with a paper trading platform, as well as the best five brokers to do this with.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

What is Paper Trading?

In a nutshell, paper trading refers to the process of buying and selling financial instruments without risking any money. Instead, you will be trading with demo account funds via an online broker. The overarching objective is to test out real-world market conditions in a risk-free environment. In the vast majority of cases, you will need to use an online broker to gain access to a paper trading account.

What are the Pros and Cons of Paper Trading?

The Pros The Cons

Who is Paper Trading Suitable for?

Make no mistake about it – paper trading platforms are not just for newbie investors. On the contrary, they offer an effective way to test out a range of strategies and trading processes in a risk-free environment.

Below we list some of the many reasons why you might want to consider an online broker that offers a fully-fledged demo account facility.

New to Trading

The obvious starting point is those that have little to no experience of how online trading works. Crucially, if you’ve never placed a buy or sell order before with real-world money, it’s probably best that you start with a demo trading account. In doing so, you can learn the ins and outs of how online trading platforms function in a 100% risk-free environment.

Things that you are likely to learn by paper trading are:

Market Orders

First and foremost, a paper trading account will allow you to gain a firm understanding of how market orders work. This includes everything from buy and sell orders, limit orders, stop-loss orders, take-profit orders, and trialling stop-loss orders. These order-types sit at the core of online trading – as it lets the broker know what it is you are looking to achieve.

Pricing Movements

Once you have figured out how market orders work, you should then spend some time analyzing market trends. This will give you the best chance possible of understanding how instruments typically move in the financial markets.

Risk Management

Paper trading accounts are also great for building your own risk management strategies. This is a crucial part of the online trading process as your orders should always be protected from a sudden market movement in the wrong way. Those without sufficient risk management strategies are doomed to lose money in the long run.

Spread

If you still haven’t quite figured out how the spread works – you should use a paper trading account. After all, the spread can have a major impact on your ability to profit from a trade. Moreover, the spread will typically fluctuate throughout the trading day, so a demo account will demonstrate this in real-world market conditions.

Leverage

Leverage is a tool used by most skilled traders, as it gives them the chance of amplifying their positions. With that said, it can also amplify your losses. As such, we would suggest testing out leverage via a paper trading account before risking your own money. In doing so, you’ll get to see both the good and bad side of trading on margin.

Testing out a Broker

On top of being a great tool for newbies to learn the ropes of online trading, demo accounts are also a great option when it comes to testing out a new broker. This is because you will get to see how the trading platform functions in a live trading arena without needing to deposit any funds. Then, if the paper trading phase returns good results, you can process to open a fully-fledged account.

Learning Technical Analysis

Technical analysis is one of the most important things that you will need to master if you wish to make a success of your online trading endeavours. For those unaware, technical analysis is the process of reading charts. The key objective is to look at historical pricing trends, and how these trends relate to current and future prices.

And what better way to do that than a paper trading account? Crucially, you can make as many mistakes as you see fit – as you won’t be risking a single cent!

Testing new Strategies

Let’s suppose that you are a seasoned trader that has been buying and selling currencies for a number of years. While you have had good success, there might come a time where you decide to take a new approach. After all, the financial markets operate in an ever-changing industry, so what worked yesterday might not necessarily work today.

With this in mind, if and when you decide to start working on a new trading strategy, you will want to test this out in a risk-averse manner. The best way to do this is to utilize a paper trading account. This will allow you to make tweaks and adjustments as and when you see fit.

Then, when you feel that your new strategy is ready to start trading in the real world, you can deploy it!

Trialling Trading Signals

One of the best advantages of using a paper trading account is that it allows you to test out a new signal service without risking any money. Sure, you might need to fork out a bit of cash to activate the signal service for the first month, but other than that, a demo account facility will allow you to test the suggestions before making a longer-term commitment.

This is something that we at Learn 2 Trade actively encourage to our readers. Crucially, our forex and cryptocurrency signal service comes with a water-tight 30-day money-back guarantee. As such, this gives you ample time to test out our signals via a live paper trading account. Once you have performed your analysis, you can decide whether or not the signals work for your long-term trading goals. And if they don’t – that’s fine, simply request a full refund and it’s cost you nothing!

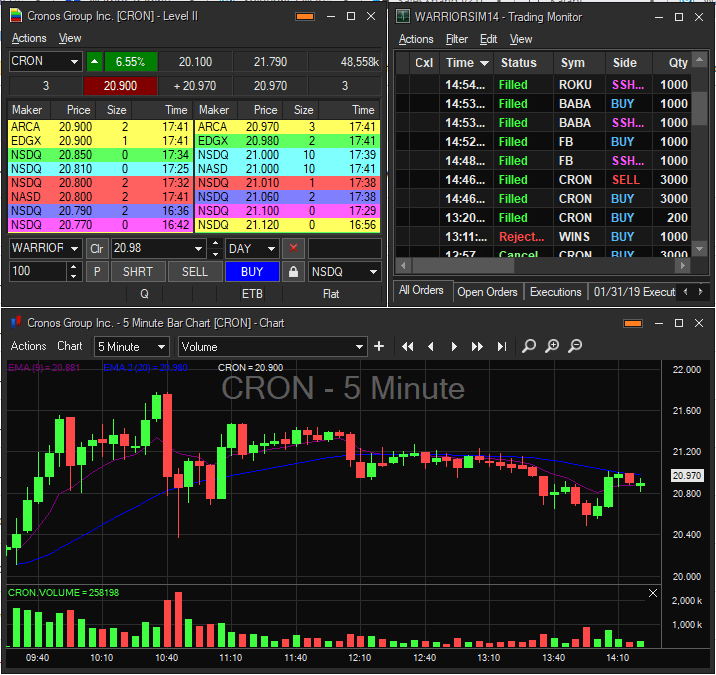

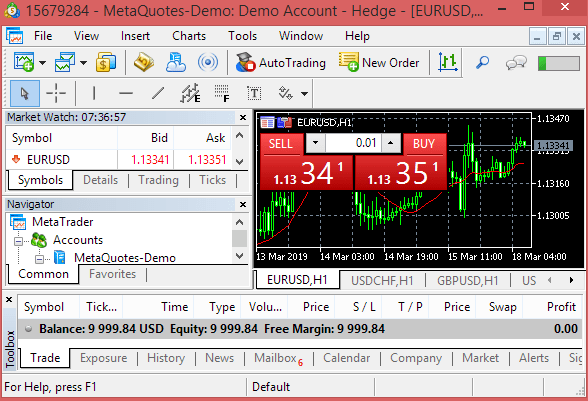

Trialling Auto Trading Systems

In some cases, paper trading accounts allow you to test out auto trading systems like forex robots and EAs (Expert Advisors). Now, you will need to be using an online broker that gives you access to the MT4 or MT5 platform. If they do, you can then open up a demo account and download the MT4/M5 software to your device.

The Pitfalls of Paper Trading Accounts

As great as paper trading accounts are – they do come with a number of pitfalls. At the forefront of this is a false sense of security. For example, let’s say that you have been using a demo account for a number of weeks – and over the course of the testing phase you made returns of 45%.

The inexperienced trader would no doubt head straight over their broker, open a real trading account, and deposit funds. Thinking that online trading is a breeze, they would then look to replicate the success that they encountered via their demo account facility.

In truth, such a strategy is never going to end well. Crucially, when you are paper trading with demo funds, it is all but certain that you will take risks that you ordinarily wouldn’t in a real-world environment. This is because you never stand the risk of losing money when you paper trade, so everything you see on screen is somewhat deceptive.

The Emotional Side Effects of Trading

Whether its a newbie trader or seasoned investor with years of experience under their belt – all traders will encounter losses. This might be an occasional position that goes against them, or a number of weeks or months in the red. Either way, losses are just part and parcel of the online investment scene.

The key point here is that a paper trading account will not introduce to the emotional side effects of trading. Sure, you will still encounter losses on your demo account facility – but, this won’t feel the same as losing real-world money. With that in mind, you will only get to know the ins and outs of ‘trading psychology’ once you being to trade with your own capital.

How to Choose a Paper Trading Account?

So now that you know both the advantages and disadvantages of paper trading, we now need to discuss the process of choosing a platform.

With hundreds of providers active in the space, knowing which demo account to open can be challenging. As such, be sure to make to consider the guidelines listed below.

Opt for a Broker That you Intend on Using

As we have noted throughout our guide, you will need to use an online broker if you wish to open a paper trading account. This is because you will be replicating real-world market conditions. For example, while the price of GBP/USD might be 1.2200 at broker A, it might be slightly higher at 1.2240 at broker B.

With that being said, you should only open a demo account with an online broker if you actually intend on using the platform when you get around to trading with real money. After all, there is no point spending weeks on-end testing a paper trading strategy out at a broker, to then switch brokers at a later date. If you do, you might notice that the broker operates in a completely different nature to that of your demo account.

Real-World Trading Conditions

Without a doubt, you must make sure that your chosen paper trading account provides real-world market conditions. If it doesn’t, then it defeats the overarching objective. Crucially, whether you are a newbie looking to learn how trading works or a seasoned investor hoping to test-drive a new auto robot – the key point is that you want to replicate actual market conditions.

Length of Trial

Some online brokers will place a limit on the amount of time that you can trade via a demo account. This is with the view of getting you to make the transition with a real money brokerage account. With that said, you will likely want at last 30 days to test out the platform, so be sure to assess how long the broker is willing to give you before the demo account is revoked.

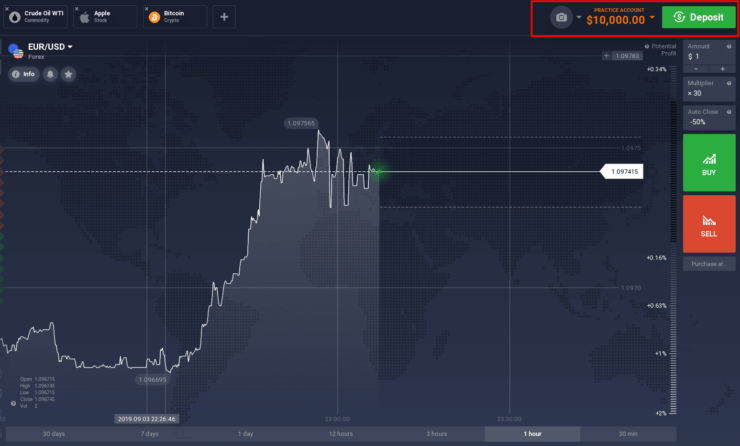

Demo Account Balance

You then need to assess what balance the paper trading account comes with. This will ensure that you are given sufficient ‘funds’ to test out your strategies. Some of the best paper trading account providers that we recommend on this page give you a starting balance of at least $50,000.

Chart Reading Tools

Once you’ve covered the fundamentals, you then need to explore what chart reading tools the paper trading facility comes with. Technical indicators like the RSI and MACD sit at the core of online trading, so it’s crucial that you are provided with the necessary tools to test-drive your strategies.

Payment Method

A select number of online brokers will ask you to attach a payment method – even if you only intend on using the demo account facility. Although the broker likely does this to provide people from opening up several accounts, we typically avoid platforms that ask you to attach a debit/credit card. After all, one of the main reasons to paper trade is to test out the broker before making a financial commitment!

How to Get Started With a Paper Trading Account

Looking to get started with a paper trading account today, but not too sure where to start? Below you will find a step-by-step guide that could get you a demo account platform in minutes!

Step 1: Choose an Online Broker

Your first port of call will be to find an online broker that offers a paper trading account facility. You then need to look at a range of other factors to determine whether or not the online broker is right for you. After all, you should only join a paper trading platform if you intend to use the broker at a later date.

Some of the things you should look out for are:

- What assets does the broker allow you to trade?

- How competitive is the broker when it comes to spreads, fees, and commissions?

- What payment methods does the broker support?

- What regulatory licenses does the broker hold?

- If you’re looking to engage in auto trade, does the broker support MT4/5?

- Does the broker offer top-notch customer support?

If you don’t have time to research an online broker yourself, then you will find out five top-rated paper trading providers listed towards the end of this page.

Step 2: Open a Demo Account

Once you have found a suitable online broker, you will then need to open an account. This will require you to enter some basic personal information so that the broker knows who you are. Don’t worry – you are under no obligation to deposit any funds – or even add a payment method for that matter. Instead, it’s just to prevent users from opening up multiple paper trading accounts.

As such, you’ll need to provide your:

- Full Name

- Home Address

- Date of Birth

- Nationality

- Contact Details

Step 3: Choose a Trading Platform

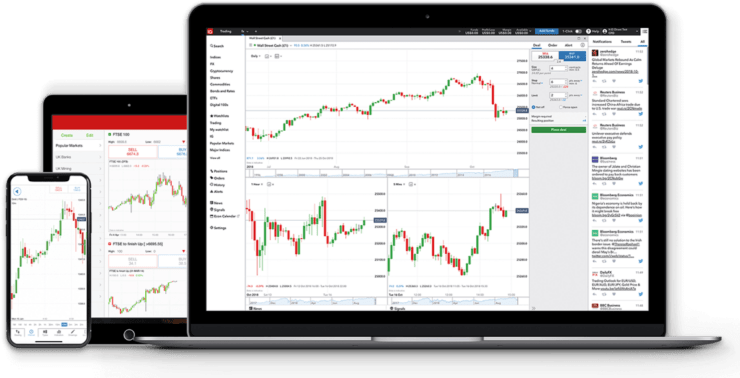

Once you have opened an account with your chosen broker, you will then need to decide what trading platform works best for you. In the vast majority of cases, you will get to choose from a web trading platform that allows you to access the demo facility via your browser, or you can download a platform like MT4/5. If opting for the latter, this will allow you to test out your EA strategies or an automated robot!

Step 4: Start Paper Trading

Once you load up your preferred trading platform, you should see a ‘dummy’ balance. You are now free to place buy and sell orders. As and when you do, the funds will be deducted from your paper trading balance. You should attempt to trade as if you are doing so with real-world money.

We would also suggest keeping tabs on your historical order statistics. This will outline what your gains and losses amount to, which is crucial to determine whether or not your trading strategies are working.

Step 5: Upgrade to a Real Brokerage Account

If, and only ‘if’ you find that your trading strategies are working, you might then consider upgrading to a fully-fledged brokerage account. The good news is that you have already provided your personal information, so all you need to do is upload some ID and a proof of address. This is a minimum requirement at regulated online brokers, as platforms need to ensure that they remain compliant with anti-money laundering laws.

After that, you simply need to deposit some funds with a debit/credit card, e-wallet, or bank account – and you’re good to go! With that said, if you find that your trading strategies aren’t as successful in a real-world environment, you might want to consider heading back to your paper trading account. This will allow you to assess what is going wrong without losing any more money.

Best Paper Trading Brokers of 2023

Don’t have time to find a top-notch paper trading account yourself? If so, below will you find our five recommended paper trading account providers of 2023.

Each provider is a regulated broker that offers heaps of asset classes – and all paper trading facilities mirror that of the real financial markets like-for-like.

1. AVATrade – 2 x $200 Forex Welcome Bonuses

The team at AVATrade are now offering a huge 20% forex bonus of up to $10,000. This means that you will need to deposit $50,000 to get the maximum bonus allocation. Take note, you'll need to deposit a minimum of $100 to get the bonus, and your account needs to be verified before the funds are credited. In terms of withdrawing the bonus out, you'll get $1 for every 0.1 lot that you trade.

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

2. VantageFX – Ultra-Low Spreads

VantageFX VFSC under Section 4 of the Financial Dealers Licensing Act that offers heaps of financial instruments. All in the form of CFDs - this covers shares, indices, and commodities.

Open and trade on a Vantage RAW ECN account to get some of the lowest spreads in the business. Trade on institutional-grade liquidity that is obtained directly from some of the top institutions in the world without any markup being added at our end. No longer the exclusive province of hedge funds, everyone now has access to this liquidity and tight spreads for as little as $0.

Some of the lowest spreads in the market may be found if you decide to open and trade on a Vantage RAW ECN account. Trade using institutional-grade liquidity that is sourced directly from some of the top institutions in the world with zero markup added. This level of liquidity and availability of thin spreads down to zero are no longer the exclusive purview of hedge funds.

- The Lowest Trading Costs

- Minimum deposit $50

- Leverage up to 500:1

Conclusion

In summary, paper trading accounts are ideal for investors of all shapes and sizes. If you’re just starting out in the world of online trading, a demo facility will allow you to learn the ropes before risking your own money. At the other end of the spectrum, paper trading platforms are great for testing out advanced trading strategies, as well as EAs and automated robots.

If you’re ready to get your paper trading journey started today, we would suggest considering our top-rate broker Crypto Rocket. The regulated platform offers demo accounts that mirror that of real-world market conditions – which is crucial. Best of all, there is no requirement to download any software – as everything can be accessed by the web-trader platform.

AvaTrade - Established Broker With Commission-Free Trades

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Awarded Best Global MT4 Forex Broker

- Pay 0% on all CFD instruments

- Thousands of CFD assets to trade

- Leverage facilities available

- Instantly deposit funds with a debit/credit card