Following a bullish performance on Saturday, Bitcoin (BTC) has dropped sharply below the $44k level. The recent BTC decline dragged the altcoin industry along, causing the entire cryptocurrency market valuation to fall by $120 in a few hours. However, Bitcoin has rebounded to the $45k level at press time.

That said, Bitcoin’s market valuation continues to slide, with the benchmark cryptocurrency losing more than $200 million over the past week.

Meanwhile, CryptoQuant, a cryptocurrency analytics firm, recently reported that the crash in Bitcoin price could be because of profit-taking by miners following the several-month-long bull run. The analytics company tracked significant outflows of funds from their wallets into exchanges just before the slump from $58,000 to $45,000 and from the recent $50,000 slump to $45,000.

In other news, the altcoin market recorded an even worse dip. Ethereum (ETH) fell by a whopping 10% and dropped below the $1,350 level. For better understanding, the price of Ethereum peaked at $2,050 just eight days ago.

Cardano (ADA), which has performed exceptionally well before now, fell by more than 12% to $1.2. Meanwhile, Polkadot (DOT), Ripple (XRP), Litecoin (LTC), and Bitcoin Cash (BCH) all posted significant declines as well at (-9%), (-6.5%), (-10%), and (-9%), respectively.

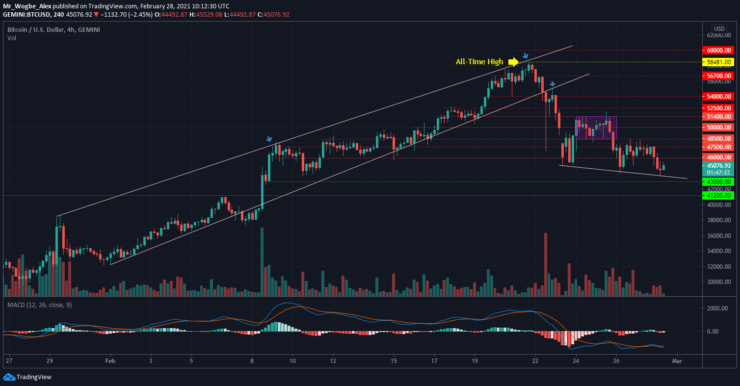

Key BTC Levels to Watch — February 28

Bitcoin is having a hard time regaining any bullish momentum, as bears appear to be in the driver’s seat of late. The cryptocurrency failed to capitalize on its goodish rebound from the $44k area yesterday and got promptly sent to below the $44k line earlier today.

That said, a bearish trendline has emerged and suggests that more declines could follow in the coming hours or days. Bitcoin has to regain stability above the $48,500 pivot zone to negate the current bearish bias.

Meanwhile, our key resistance levels are at $46,000, $47,500, and $48,500. While our key support levels are at $44,000, $43,000, and $42,000.

Total Market Capitalization: $1.35 trillion

Bitcoin Market Capitalization: $832 billion

Bitcoin Dominance: 61.6%

You can purchase crypto coins here: Buy Coins

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.