Goldman Sachs has announced that it will be offering its private wealth management clients exposure to Bitcoin (BTC), Bitcoin derivatives, other cryptocurrencies, and traditional investment vehicles. The bank noted that the new investment option would be available to its wealthy customers in the next three months.

Clients will get educated about blockchain technology and the crypto ecosystem by the newly appointed global head of digital assets for the bank’s private wealth management division, Mary Rich.

Rich explained that the move to offer Bitcoin and crypto-related investments was due to client demand and that the new investment option would be only accessible to clients with at least $25 million.

Rich added that:

“There’s a contingent of clients who are looking to this asset as a hedge against inflation, and the macro backdrop over the past year has certainly played into that.”

As governments and central banks continue to flood the economy with bailout packages, Bitcoin is rapidly becoming the most preferred hedge against inflation.

Meanwhile, Goldman Sachs’ announcement comes a few weeks after another behemoth financial institution, Morgan Stanley, reported that it could roll out Bitcoin funds in April.

Morgan Stanley indirectly gained exposure to the asset class when it increased its total stake in MicroStrategy to 10.9%.

Key BTC Levels to Watch — April 1

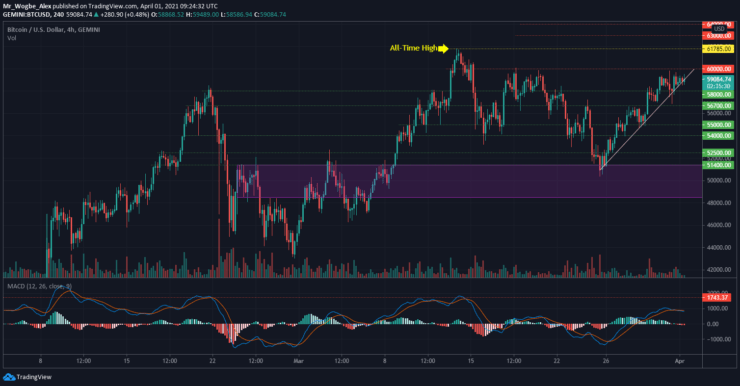

Following a goodish bullish recovery over the past few days, Bitcoin appears to be losing bullish momentum. Yesterday, the benchmark cryptocurrency failed to break the crucial $60k psychological resistance, which sent it to the $56,700 level.

That said, the primary cryptocurrency managed to rebound over the hours and is now in a rangebound momentum around the $59k resistance. Failure to facilitate a takedown of the $60k resistance in the coming hours or risk falling to the $56,700 support or below.

Meanwhile, our resistance levels are at $60,000, $61,000, and $61,785, and our key support levels are at $58,000, $56,700, and $55,000.

Total Market Capitalization: $1.89 trillion

Bitcoin Market Capitalization: $1.99 trillion

Bitcoin Dominance: 58%

You can purchase crypto coins here: Buy Coins

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.