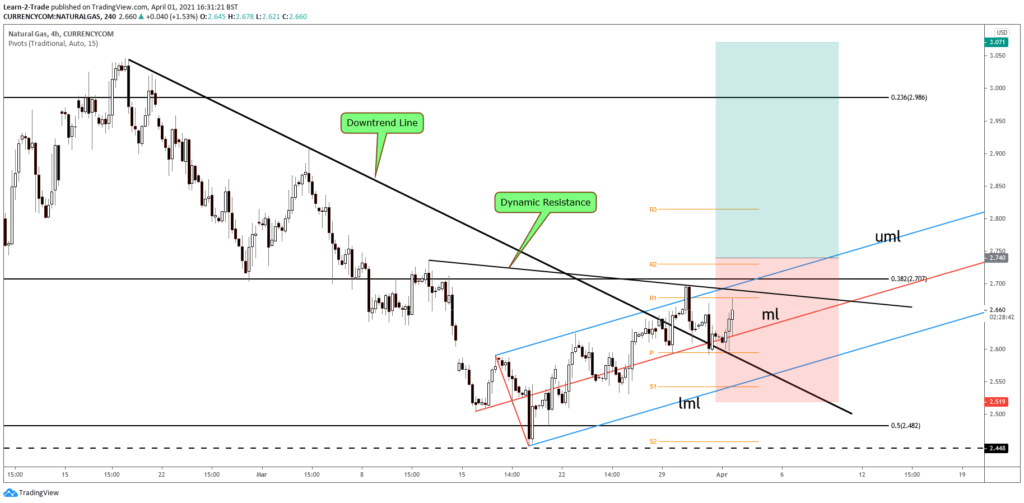

Natural gas is trading in the green at 2.660 trying to escape from a minor range. The price has broken above the downtrend line signaling that we may have a bullish reversal in the short term.

The price action has signaled a potential growth, but we still need strong confirmation before taking a long position. The volatility is high on this commodity after failing to reach the former higher high.

Natural Gas H4 Technical Analysis!

Technically, a potential new higher high, a valid breakout above the near-term resistance levels could signal a strong growth ahead. Natural Gas has retreated in the short term to test and retest the pivot point (2.595), the broken downtrend line, and the median line (ml) before jumping higher again.

A valid breakout above 2.696 former high, beyond the upper median line (uml), and through 38.2% could validate a further upwards movement on the H4 chart. The bullish scenario could be invalidated if the price drops below the lower median line (lml) and under the S1.

Conclusion!

The selling pressure is still high, that’s why we have to wait for the price to register a new higher high, to jump and stabilize above 38.2% (2.707) and beyond the upper median line (uml) before deciding to go long.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.