Bitcoin (BTC) traded in a constrained manner over the past weekend but has unexpectedly broken out of its range and is now headed for higher bullish targets. According to some analysts at CryptoQuant, there might be a few fundamental factors behind the recent rise.

One of the factors highlighted by the analysts was the recent decision by Visa, one of the world’s largest payment processors, to settle USDC transactions using Ethereum (ETH). While Ethereum is only the second-largest cryptocurrency, such positive news tends to have a ripple effect across the entire crypto market.

With that, Bitcoin took the initiative and ran with it and has driven the market higher with no sign of slowing down ahead.

CryptoQuant analysts also revealed that the total number of stablecoins on exchanges has hit an all-time high and could be a proponent behind the recent BTC rally.

The increase of stablecoins on exchanges is indicative that there is plenty of inactive capital on exchanges. Additionally, the analysts provided another metric, the stablecoin ratio, to back their claims. This ratio measures the number of Bitcoins against the number of stablecoins lying dormant on exchanges. This number is currently at its lowest level last November.

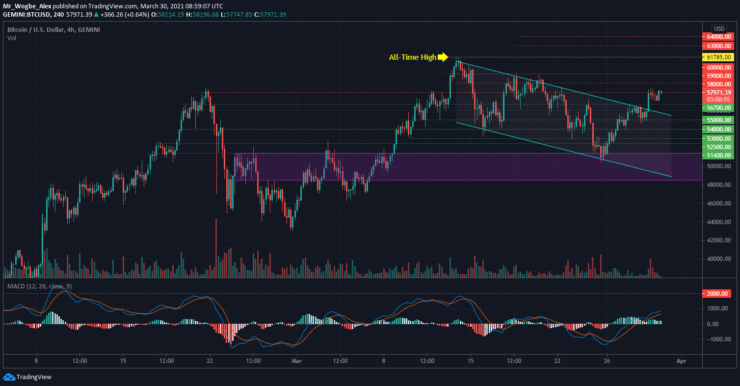

Key BTC Levels to Watch — March 30

Bitcoin has recently broken above the crucial $56,700 level in a decisive stroke. That said, the benchmark cryptocurrency is now faced with the $58k, where it has consolidated for the past 24 hours.

That said, a decisive break above the $58k psychological resistance could open the doors for Bitcoin to reach $60k and above in the coming days. However, failure to clear this level over the coming hours could trigger a correction to the $55k area, thereby sending the cryptocurrency below the crucial $56,700 price level.

Meanwhile, our resistance levels are at $58,000, $59,000, and $60,000, and our key support levels are at $56,700, $55,000, and $54,000.

Total Market Capitalization: $1.82 trillion

Bitcoin Market Capitalization: $1.07 trillion

Bitcoin Dominance: 59%

You can purchase crypto coins here: Buy Coins

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.