USDCHF Price Analysis – March 30

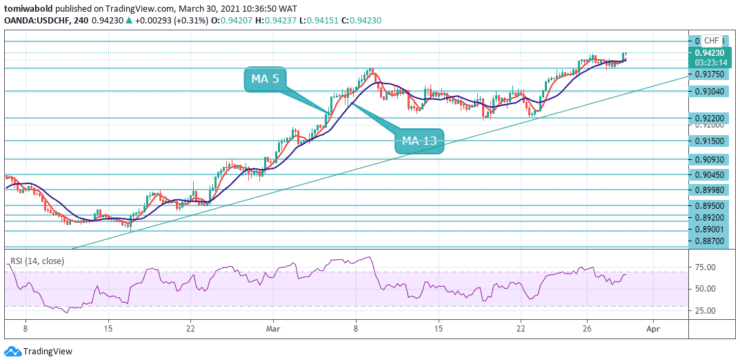

The USDCHF upside move regained traction after a brief pause around 0.9380 level during Tuesday European session. The pair’s buyers are building on fresh momentum beyond the mid 0.9400 marks. The US dollar pushes higher as the US Dollar Index (DXY) rallies to fresh highs in the area above the 93.00 hurdles.

Key Levels

Resistance Levels: 0.9608, 0.9547, 0.9457

Support Levels: 0.9375, 0.9220, 0.9150

As observed on the daily, USDCHF is trading bullish. The pair’s rallies are bought into as anticipated. Beyond the mid 0.9400 level, traders may see a continuation towards 0.9500 level and also beyond 0.9547 towards 0.9600 levels. As for the near future, the exchange rate is likely to continue to edge higher.

Bullish traders could target the resistance level at 0.9547 during the present trading session. While the momentum is steady, a likely retracement to the lift-off zone of 0.9400 may occur but in rather smaller rallies. The latest breakout of the level at 0.9400 is a confirmation that buyers have regained control and the price could be on its way to 0.9500 and beyond.

The intraday bias in USDCHF stays at the upside for further a rally past the 0.9375 support zone. The downside may be contained well above the 0.9220 support level to usher in a resumption of the upside rally. Considering the bullish moving average of 5, the latest run will eye the 0.9500 thresholds.

On the upside, the breach of 0.9457 level may increase the advance from 0.8870 to 61.8% retracement of 0.9901 to 0.8870 levels at 0.9457 level. A sustained breach there may approach the 0.9901 resistance level next. However, the quote’s further upside will be challenged by the local barriers at the upside before a meaningful advancement.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.