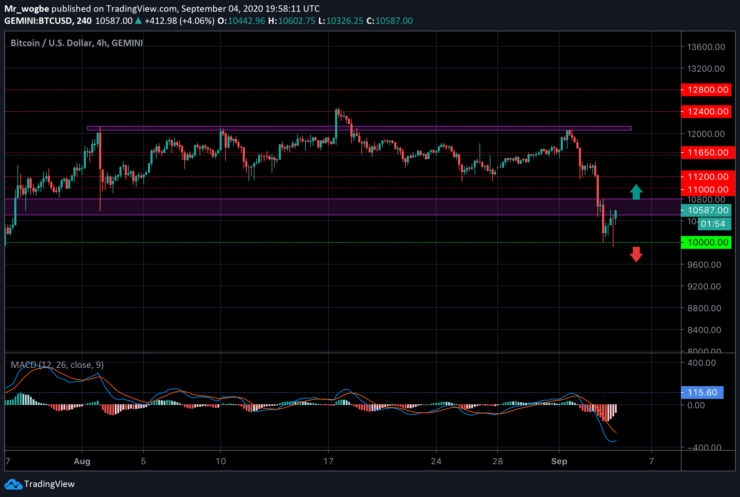

From a ‘big picture’ perspective, the benchmark cryptocurrency has been consolidating for months as bulls defended the $11,000 price point while bears prevented any major rally above $12,000.

It appears that the reversal that occurred on Tuesday from the $12,060 level was the catalyzing factor that sent the boulder rolling for Bitcoin.

The cryptocurrency fell as far as $9,990 before it could find any support from bulls, which eventually helped it rebound to the $10,700 level.

Ever since then, BTC has been in a sideways move between those levels and has failed to provide investors with any clear trend in the meantime.

However, speculators have suggested that the recent BTC collapse was sponsored by ‘weak-handed’ investors who panic-sold after the cryptocurrency fell from the upper-$12k level. A Bitcoin analytics platform, Whalemap, reported that most of the investors who bought Bitcoin around the mid-to-upper $11,000 level panic-sold into yesterday’s drop.

That said, it means that these investors have been flushed out and Bitcoin is set to get back on top.

Regardless, one analyst believes that the worst is not yet over for Bitcoin and a potential decline to the mid-$9,000 area cannot be dismissed.

Key BTC Levels to Watch

Bitcoin is trading on a very weak sentiment as bulls try to pull their act together. In a recent analysis, we explained that a move towards the $10,000 area could take BTC into oversold territories, which could prompt a sharp rise. Currently, after the recent $10k break, Bitcoin is now well within oversold conditions, indicating that our previous analysis could come to pass.

The major resistance to beat in the near-term is the $10,800 mark, which could usher-in the $11,000’s once again.

Total market capital: $342 billion

Bitcoin market capital: $194 billion

Bitcoin dominance: 56.7%

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.