Following the fresh attack on the crypto industry, Bitcoin (BTC) proponents have argued that this is “a blessing in disguise” for the benchmark cryptocurrency.

The recent Evergande real estate crisis triggered a selloff in the benchmark cryptocurrency last week. Shortly after, BTC received another blow from a reiteration of intolerance on the crypto industry by the PBoC.

Usually, when events like this occur, Bitcoin proponents react to the FUD with panic. However, it was different this time as the crypto community is increasingly coming to terms with the fact that the Bitcoin market can and will survive (and thrive) without the Chinese market.

Many prominent figures have asserted that the crackdown on crypto by the Chinese government is a healthy development for the industry in the long term. In 2009, China placed a ban on YouTube and Facebook and extended this ban to Google in 2010. In 2019, Wikipedia suffered the same fate. Interestingly, all of these organizations have thrived, excelled, and grown into multi-billion dollar entities despite the opposition from the Chinese government.

As such, Bitcoin proponents argue that China’s fear of the cryptocurrency industry is simply its natural reaction to new and emerging technology and that just like the other entities mentioned earlier, BTC would thrive and succeed.

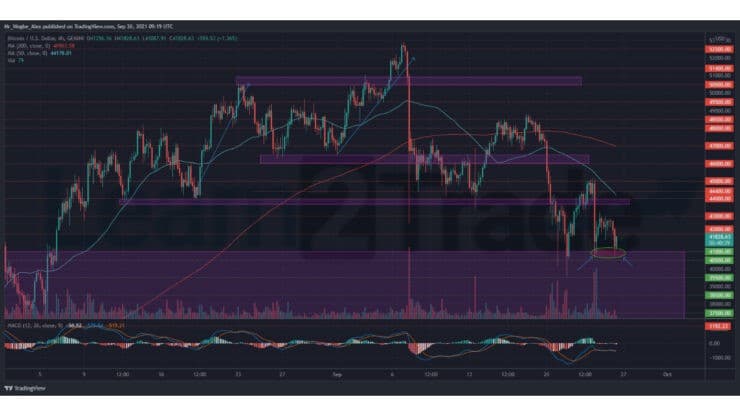

Key Bitcoin Levels to Watch — September 26

Following its sharp decline this morning, BTC has touched the $41,000 line again. The benchmark cryptocurrency has recorded a double-bottom pattern on our 4-hour chart, which typically alerts us of a looming bull rally. That said, we have our Bullish target on the $44,000 line (and possibly higher) for today amid the impending rebound.

However, the primary cryptocurrency has wandered too close to the critical $41,000 pivot area and needs to regain a footing above $43,000 soon to forestall any bearish aspirations.

Meanwhile, our resistance levels are at $43,000, $44,000, and $45,000, and our key support levels are at $41,000, $40,500, and $40,000.

Total Market Capitalization: $1.89 trillion

Bitcoin Market Capitalization: $795.3 billion

Bitcoin Dominance: 42.1%

Market Rank: #1

You can purchase crypto coins here: Buy Tokens

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.