The Bitcoin (BTC) Fear and Greed Index, a measure of the general outlook on BTC, had entered “extreme fear” conditions for the first time since late June. This deterioration in outlook follows the recent $8,500 crash to the $40,000s.

Many analysts have fingered the recent Evergrand debt crisis in China as the primary catalyst of the recent crash in the crypto market. As a result, Bitcoin fell to its lowest point since early August. Other developments also added the sentiment change in the digital asset market and the financial market at large.

The BTC Fear and Greed Index only confirmed the effect of these developments on the market. The last time this index fell to such low levels was in late July when BTC dropped below the $30,000 mark.

Other crypto assets suffered a similar fate as BTC, with Ethereum (the second-largest cryptocurrency) falling into “Fear” territory following its drop below $3,000.

While the phrase “extreme fear” might imply a negative asset outlook for some, the reality is quite the opposite. Many experts in the industry assert that this is the best time to buy BTC, as it is at a “discount.” Veteran investor Warren Buffett previously advised that investors should become greedy when the crowd is fearful and vice-versa.

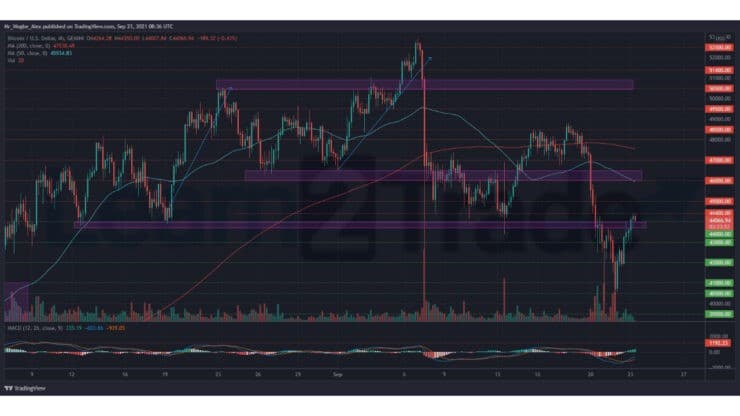

Key Bitcoin Levels to Watch — September 23

BTCUSD bulls appear to have snapped out of their trance as the price breaks regained some bullish traction around early Thursday. The primary cryptocurrency broke above the critical $43,600 – $44,000 pivot zone in the early Asian session today as $45,000 comes into view.

We expect a bullish continuation in the coming hours as our 4-hour MACD turns green again. That said, bulls could experience a slowdown at the $45,000 area, which could determine the near-term fate of the crypto. Nonetheless, the $44,000 pivot zone remains the crucial defense point for bulls today.

Meanwhile, our resistance levels are at $44,400, $45,000, and $46,000, and our key support levels are at $43,600, $43,000, and $42,000.

Total Market Capitalization: $1.98 trillion

Bitcoin Market Capitalization: $828.3 billion

Bitcoin Dominance: 41.7%

Market Rank: #1

You can purchase crypto coins here: Buy Tokens

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.