Bitcoin (BTC) recorded a surge after a streak of downward momentum courtesy of the US Fed interest rate decision announcement. The benchmark cryptocurrency tapped the $40,000 top for the first time since April 28.

As expected, the broader market reacted similarly to the news, as the total market cap added 5.7% to its value yesterday.

The US Federal Reserve raised its benchmark rate by 0.50%, its highest single increase since 2000, as it worked towards curbing worsening inflation. That said, the central bank noted that it could raise rates by another 0.50% in its next meeting, dashing hopes of a more aggressive outlook.

US Federal Reserve Chairman Jerome Powell noted at the FOMC meeting that he sees the surging inflation and the negative effect it had on the country. He asserted that his organization was well-equipped with the necessary tools to combat the lingering economic crisis. Excerpts from the minutes read:

“Inflation is much too high. We understand the hardship it is causing, and we are moving expeditiously to bring it back down. We have both the tools we need and the resolve that it will take to restore price stability on behalf of American families and businesses.”

Key Bitcoin Levels to Watch — May 5

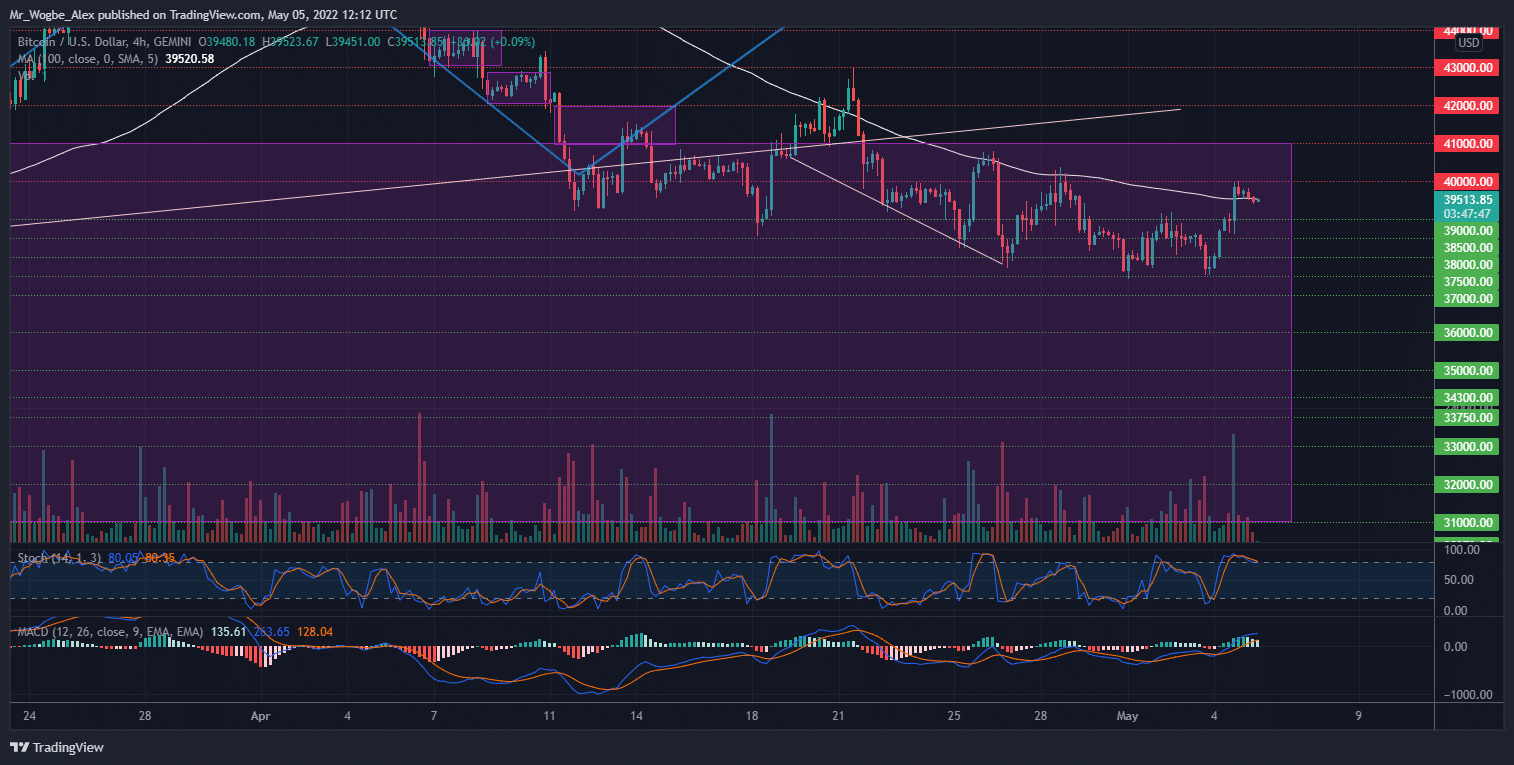

Just as projected in my last analysis, Bitcoin has responded favorably to the US Fed rate announcement, as the benchmark cryptocurrency bounced from the $37,700 area to the $40,000 top, a 5.8% jump. However, the cryptocurrency lacked the coordination to take the $40,000 barrier, prompting a correction to the mid-$39,000 area today.

That said, BTC holds its place around the 4-hour 100 EMA, which could prop it up for a push above the $40,000 ceiling in the coming days. Regardless, the primary cryptocurrency needs a comfortable close above the $41,000 pivot ceiling to put the still-present bearish bias to rest. Unless we record this move above the pivot area in the coming days, the window for a bearish continuation remains present.

Meanwhile, my resistance levels are at $40,000, $41,000, and $42,000, and my key support levels are at $39,000, $38,000, and $37,000.

Total Market Capitalization: $1.79 trillion

Bitcoin Market Capitalization: $752.1 billion

Bitcoin Dominance: 41.9%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.