Top executives in the cryptocurrency space have written to the US Environmental Protection Agency (EPA) to address falsities and preconceived notions surrounding Bitcoin (BTC) mining.

Not surprisingly, the letter was authored by MicroStrategy CEO Michael Saylor, along with Castle Island Ventures partner Nic Carter and Core Scientific co-founder Darin Feinstein.

This address comes after some members of the US Congress called on the EPA “to ensure cryptocurrency mining facilities are not violating foundational environmental statutes like the Clean Air Act and Clean Water Act.”

The letter, a lengthy 11-page document, was written to dismiss “misconceptions” about Bitcoin mining processes and highlight some of the defamatory statements politicians made on the matter.

The letter disputed claims that Bitcoin mining processes contributed significantly to greenhouse gas emissions, a claim the letter labeled “deeply misleading.” The letter explained that data centers used by BTC miners were similar to those used by tech companies like Google and Amazon. The document also highlighted that research from the Bitcoin Mining Council revealed that 58.4% of all energy used to mine Bitcoin comes from sustainable sources.

Dispelling the false claims that suggest that digital assets come with environmental risks and pollution, the letter detailed:

“There are no pollutants, including CO2, released by digital asset mining. Bitcoin miners have no emissions whatsoever…Digital asset miners simply buy electricity that is made available to them on the open market, just the same as any industrial buyer.”

Key Bitcoin Levels to Watch — May 3

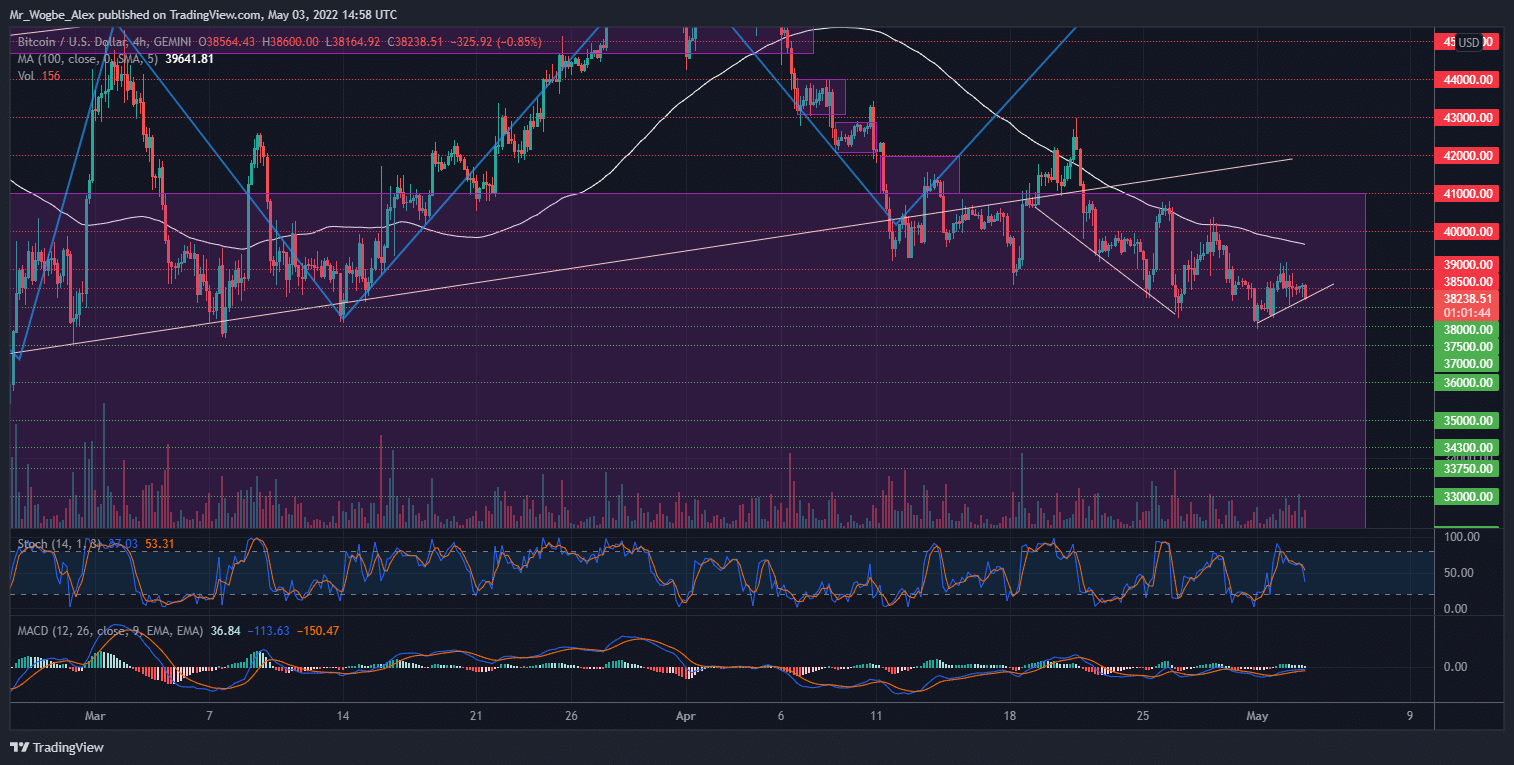

Bitcoin has fallen into a sideways pattern over the past few hours as traders retire to the sidelines ahead of the US Fed’s rate decision tomorrow.

Opinions are divided across the markets as some expect the bearish momentum to resume once the institution announces its decision. However, others argue that the potential downside has already been priced-in, meaning that a bullish reversal could be triggered by the decision announcement.

Some argue that a 270 basis points rate hike, spread across several months until early 2023, has already been priced-in.

That said, a breach of the $38,000 low should confirm a bearish continuation in the coming hours. However, a rebound above the 4-hour 100 EMA at $39,650 should kickstart a rebound back to $41,000 and above.

Meanwhile, my resistance levels are at $39,000, $40,000, and $41,000, and my key support levels are at $37,000, $36,000, and $35,000.

Total Market Capitalization: $1.73 trillion

Bitcoin Market Capitalization: $729.2 billion

Bitcoin Dominance: 42.1%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.