Following news that Fidelity Investment plans to create a Bitcoin (BTC) plan in its 401(k) retirement accounts, MicroStrategy CEO and vocal Bitcoin supporter Michael Saylor has commended the move, arguing that BTC is perfect for retirement and better than bonds.

Speaking to CNBC on April 26, the pro-Bitcoin CEO argued that BTC is significantly better as an investment choice than traditional assets like gold, stocks, and bonds. According to Saylor, the benchmark cryptocurrency “is less risky and much safer” than other traditional assets. He noted:

“Bitcoin’s digital property and that makes it the perfect asset for a retirement plan. It’s less risky than bonds and stocks and commercial real estate and gold.”

Saylor also noted that his company plans on working with Fidelity to provide MicroStrategy employees access to Bitcoin retirement 401(k) accounts. He noted that he was beyond excited to offer employees the chance to have BTC in their retirement plans, considering the potential of the asset.

The executive also described that Fidelity’s BTC move Will fill “an important vacuum” in the investment industry and bolster the legitimization of the crypto asset among mainstream users.

Fidelity Investments is the largest retirement planning company in the US and one of the latest financial services companies globally, with a jaw-dropping $2.7 trillion in assets under management (AUM).

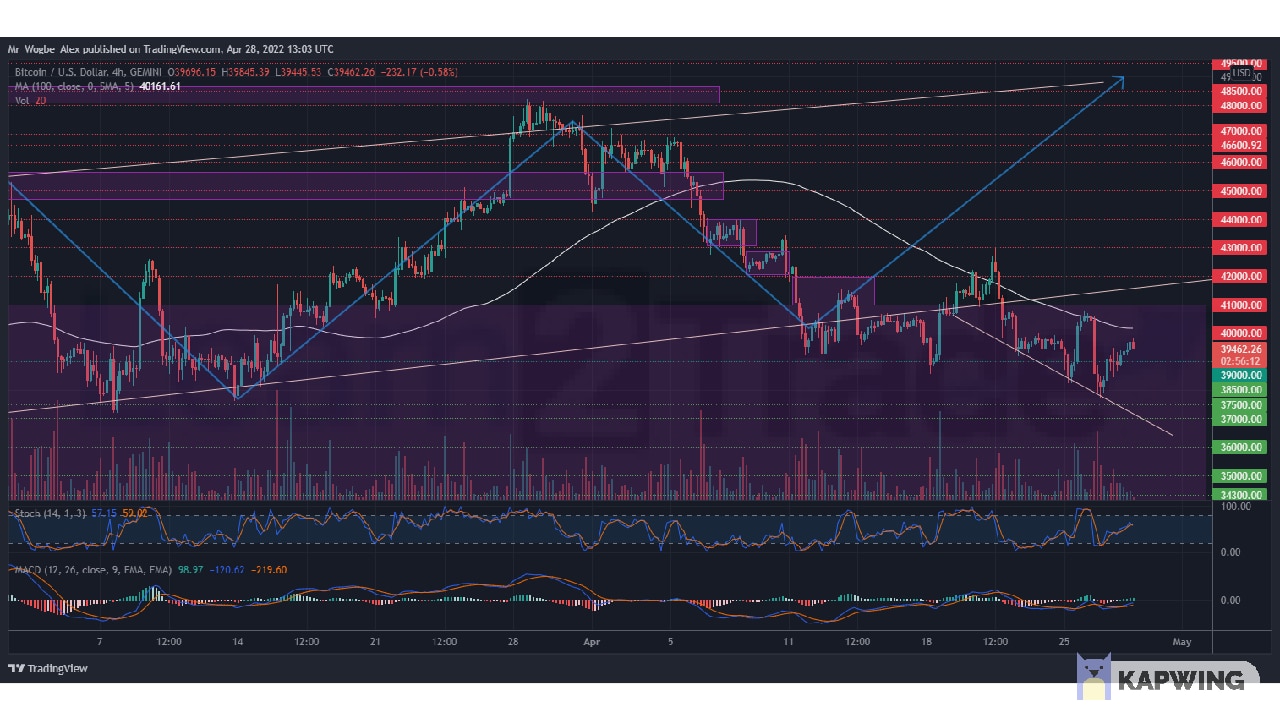

Key Bitcoin Levels to Watch — April 28

Bitcoin continues to struggle with momentum into the end of the week, as the benchmark cryptocurrency approached the $40,000 barrier on Thursday.

The prevailing weakness in the cryptocurrency market is worsened by the strengthening dollar, which continues to break ceilings. A few hours ago, the dollar index (DXY) broke the 103.82 top of 2017 to hit a new peak of 103.93 since December 2002.

The $40,000 line is crucial for the near-term price action for BTC. A break and close above this level should stall the prevailing bearish trend and help the benchmark cryptocurrency re-emerge atop the $43,000 ramp.

However, failure to take the $40,000 level in the coming hours could trigger a fresh leg-down to the $37,000 low.

Meanwhile, my resistance levels are at $40,000, $41,000, and $42,000, and my key support levels are at $38,500, $37,500, and $36,000.

Total Market Capitalization: $1.82 trillion

Bitcoin Market Capitalization: $755.5 billion

Bitcoin Dominance: 41.4%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.