Last week, Bitcoin (BTC) made a solid attempt at the $46,000 barriers but failed to make meaningful use of this bullish charge after the Federal Reserve announced its inflation number on Thursday and has fallen into a sideways momentum.

That said, the benchmark cryptocurrency currently trades down by 7% at $45,860 from its Thursday high, maintaining its market capitalization above the $800 billion mark.

Despite this mild bearish tone, Bitcoin’s supply on crypto exchanges has receded to three-year lows. A recent report by on-chain analytics platform Santiment showed:

“With another series of dramatic drops, #Bitcoin’s supply on exchanges is now down to just 10.87%, the lowest percentage seen since December 2018. Generally, this continued trend of coins moving off of exchanges limits the risk of major sell-offs.”

The Santiment report also revealed that the positive market sentiment led to a FOMO-kind outlook, which triggered a price correction in the primary cryptocurrency. The report added:

“Bitcoin’s crowd sentiment has remained positive this week, and this is likely contributing to the decline it & #altcoins have seen to end the week. We will be looking for a bit of crowd #FUD as a signal that bounces will happen heading into next week.”

Meanwhile, a Bloomberg report published on Friday revealed that BTC miners have amped up selling efforts recently. The report highlighted that the net BTC miners’ holdings entered negative territory since February 5, explaining:

“The turn in the metric, or the net change of miner balances over a trailing 30-day window, shows that miners have sold their coins in a possible sign a shakeout of less-efficient operators is coming.”

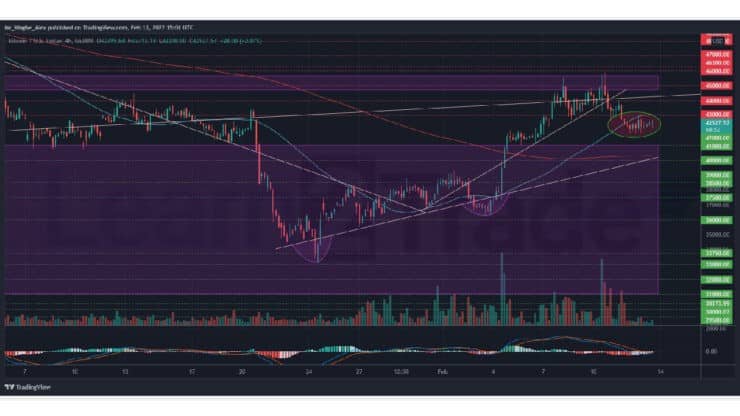

Key Bitcoin Levels to Watch — February 13

BTC has fallen into a sideways bias following another rejection from the $45,650 pivot top last Thursday. The benchmark cryptocurrency currently consolidates between $43,000 and $42,000 as we enter the new week.

That said, bulls need to sustain the $42,000 support base over the coming days to help the cryptocurrency resume its bullish trajectory towards $50,000. However, with the current supply of BTC on exchanges dropping to multi-year lows, a spike can be anticipated in the near term.

Meanwhile, my resistance levels are at $43,000, $44,000, and $45,000, and my key support levels are at $42,000, $41,000, and $40,000.

Total Market Capitalization: $1.91 trillion

Bitcoin Market Capitalization: $807.7 billion

Bitcoin Dominance: 42.2%

Market Rank: #1

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.