JPMorgan Chase & Co. strategists have made some price projections for Bitcoin (BTC), as they argue that Bitcoin’s “fair value” should be 12% lower than its actual value.

According to the team, led by Nikolaos Panigirtzoglou, the benchmark cryptocurrency is overpriced, and it should trade at $38,000. This projection is based on the assumption that BTC is about four times more volatile than gold, according to Bloomberg.

That said, should Bitcoin’s volatility drop to three times that of gold, the fair value would increase to about $50,000. The strategist’s report noted:

“The biggest challenge for Bitcoin going forward is its volatility and the boom and bust cycles that hinder further institutional adoption.”

Meanwhile, JPM’s weekly letter to investors also showed that the behemoth institution increased its long-term price prediction for BTC. About a year ago, the strategists noted that the long-term price for BTC was $146,000. However, the latest update shows that they have revised this projection to $150,000. That said, they failed, again, to provide a proper definition or time scale of “long term.”

Also, the strategists noted that the new price projection of $150,000 would put the total market value of BTC at the same level as that of all the gold held privately for investment purposes.

Key Bitcoin Levels to Watch — February 10

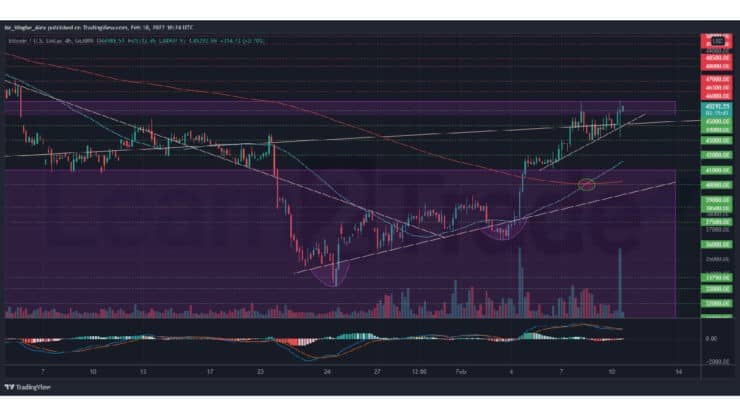

BTC has reentered the $45,650 – $44,650 pivot area as bulls remain unrelenting in their resolve to breach the $50,000 barrier and higher. This bullish continuation comes following the formation of a golden cross pattern, which I mentioned was a solid bullish indicator.

The benchmark cryptocurrency suffered a minor dip a few hours ago following positive US CPI data release but recorded an immediate rebound and printed a new monthly high in the process. I await a sustained breach of the $45,600 pivot top over the coming hours, followed by a mild consolidation and a bullish continuation, as bulls likely look to maximize the historical February bullishness in reclaiming the upper $50,000 zone.

Meanwhile, my resistance levels are at $46,000, $47,000, and $48,000, and my key support levels are at $45,000, $44,000, and $43,000.

Total Market Capitalization: $2.04 trillion

Bitcoin Market Capitalization: $858.5 billion

Bitcoin Dominance: 42%

Market Rank: #1

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.