The US Securities and Exchange Commission (SEC) has approved Valkyrie’s Bitcoin (BTC) Miners exchange-traded fund (ETF) to be listed and traded on the Nasdaq Stock Market with the ticker symbol “WGMI,” according to a filing published by the agency yesterday.

The approval comes only a few weeks after Valkyrie applied with the SEC to list the fund on the capital market. According to Valkyrie’s filing, the Bitcoin Miners ETF plans to invest at least 80% of its net assets in firms that “derive at least 50% of their revenue or profits from Bitcoin mining operations and/or from providing specialized chips, hardware, and software or other services to companies engaged in Bitcoin mining.”

The investment company also asserted that it plans to focus on only cryptocurrency mining firms that use green and renewable energy for their operations. That said, the WGMI is set for launch and trading on Nasdaq later today.

In other news, the SEC remains steadfast in its refusal to approve a spot Bitcoin ETF. Last month, the regulatory watchdog threw out a spot BTC ETF proposal from SkyBridge, citing that the company failed to meet the requirements.

Some other spot BTC ETFs that have failed to scale the SEC’s impossible requirements include Valkyrie and Kryptoin. Additionally, the agency turned down Grayscale’s application to make its Grayscale Bitcoin Trust (GBTC) a spot BTC ETF.

Key Bitcoin Levels to Watch — February 8

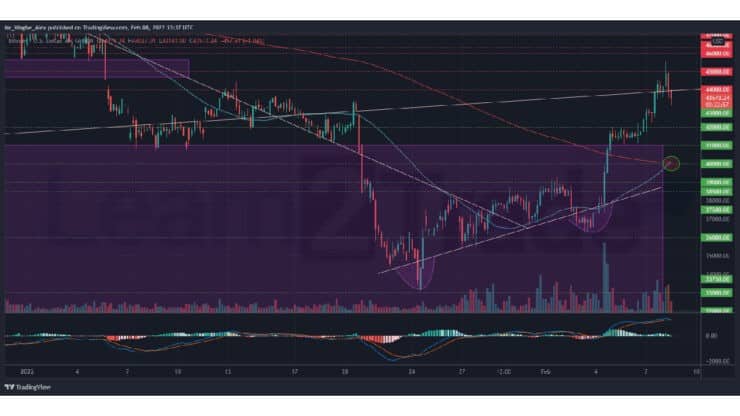

BTC has had a significantly bullish trading season over the past few days, as the benchmark cryptocurrency breached the $45,000 resistance. The cryptocurrency also scaled my long-prevailing trendline around the $45,000 axis yesterday, following its +6% surge.

Moving on, we can see the formation of a golden cross on my 4-hour chart, which typically indicates an imminent price surge for the underlying cryptocurrency. That said, BTC is currently on a retracement journey to $43,000, where I expect bears to run out of steam and more buyers to hop on, which should drive the price above the $46,000 pivot top in the coming days.

Meanwhile, my resistance levels are at $44,000, $45,000, and $46,000, and my key support levels are at $43,000, $42,000, and $41,000.

Total Market Capitalization: $1.98 trillion

Bitcoin Market Capitalization: $824.9 billion

Bitcoin Dominance: 41.7%

Market Rank: #1

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.