The last 48 hours have been an interesting one for Bitcoin (BTC) and the cryptocurrency market and have greatly favored bulls.

The benchmark cryptocurrency breached the $41,000 on Friday for the first time in two weeks pushing the broader market valuation up by over 10% in the last seven days. Interestingly, some factors played a critical role in the recent bullish resurgence.

One of these factors is the recently-developed correlation between Bitcoin and the traditional stock market. That said, recent favorable macroeconomic events have boosted the equities market, which also benefited BTC and the crypto market by extension.

Also, a recent CoinGlass revealed that the market recorded a massive $220 million short position liquidating between Friday and Saturday across top crypto exchanges, including Binance, OKEx, FTX, Bybit, Huobi, BitMEX, and many others.

That said, 80% of all liquidations in the last two days were short positions, which sparked a short squeeze.

Finally, the market recently welcomed better-than-expected NFPs data from the US labor department, which showed that the country added 467K jobs in January, despite the adverse effects of the Omicron variant. The US Labor Department’s Bureau of Labor Statistics revealed that the unemployment rate grew from 3.9% to 4% in a short period.

Key Bitcoin Levels to Watch — February 6

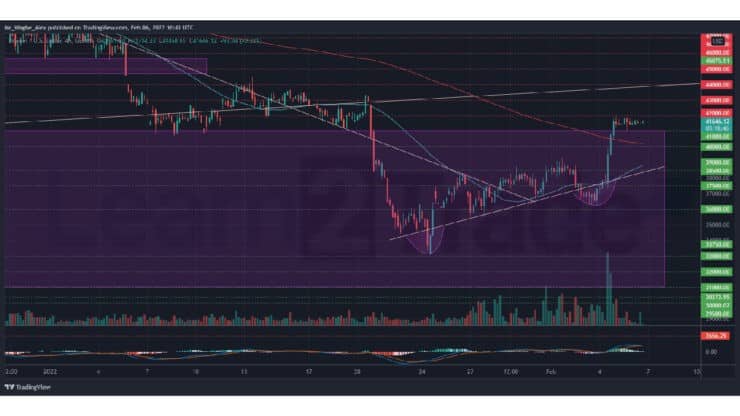

After recording a ‘cup’ pattern between Thursday and Friday, BTC finally received the push it needed to post a leg-up, the next phase of the ongoing mini bullish cycle. However, thanks to influx from other fundamental factors, the benchmark cryptocurrency recorded a sharp surge to the $42,000 top within 12 hours.

The flagship cryptocurrency has now recorded a momentum slowdown at the $42,000 top and has fallen into a short consolidation between $42,000 and $41,000. That said, we are likely to see a bullish continuation over the coming hours and days amid a goodish pickup in the global financial markets and the crypto space.

Meanwhile, my resistance levels are at $42,000, $43,000, and $44,000, and my key support levels are at $41,000, $40,000, and $39,000.

Total Market Capitalization: $1.90 trillion

Bitcoin Market Capitalization: $789.1 billion

Bitcoin Dominance: 41.5%

Market Rank: #1

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.