A recent Bloomberg report shows that some of the largest Bitcoin (BTC) mining companies traded on the US stock market have suffered a cumulative loss of $1 billion in the second quarter of 2022. The report noted that the firms incurred this massive loss due to the drop in crypto prices in the past few months.

Between April and June, Bitcoin shed almost 60% of its value, slumping from $45,000 to $20,000. BTC was not alone in the crash, with GPU-mineable Ethereum losing about 70% of its value within Q2 as well.

The report detailed that Core Scientific, Marathon Digital Holdings, and Riot Blockchain reported net losses of $862 million, $192 million, and $366 million, respectively, in Q2. Other large mining firms, such as Bitfarms and Greenidge Generation Holdings, took part in the downturn and reported notable impairments.

That said, miners are now selling their BTC faster than they produce. In June, Bitcoin miners recorded the highest asset dump this year, with top miners selling 14,600 BTC but minting only 3,900. Core Scientific reportedly sold 80% of its holdings to cover operational costs and finance its expansion, while Bitfarms offloaded nearly half of all its coins.

What’s worrisome is that the trend appears to remain the same in Q3, with July coming in as the second highest selling month with 6,200 BTC sold.

Key Bitcoin Levels to Watch — August 18

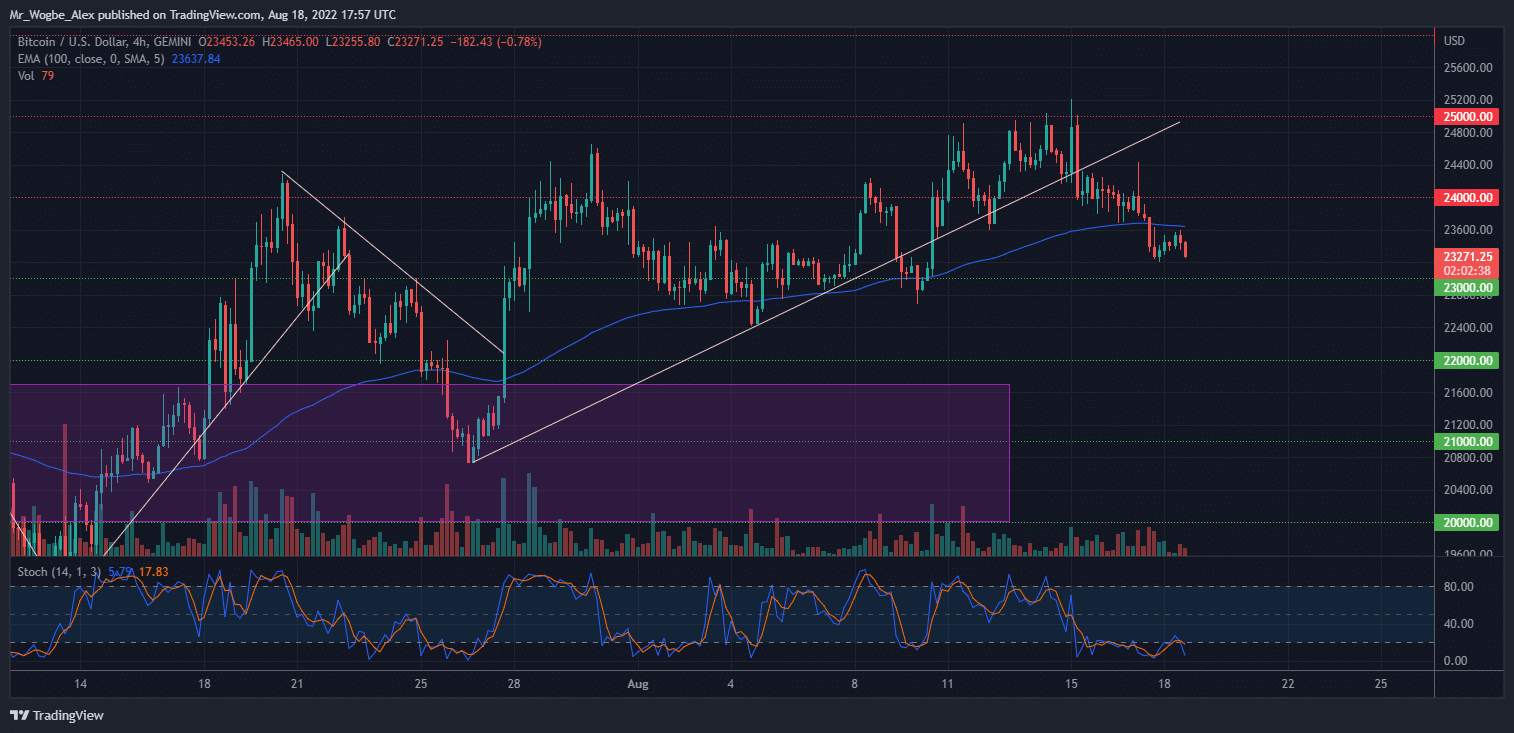

Bitcoin is on a bearish correction towards refreshing a seven-day low of $23,200 ok Thursday, as market sentiment seems to have taken a turn. This turn comes after the benchmark cryptocurrency breached the 4-hour 100 EMA yesterday.

The flagship cryptocurrency needs to return above the 100 EMA line in the near term to revive the bullish. With the dollar regaining a bullish front following the release of July’s meeting minutes, BTC might be in for a sustained bearish move into the weekend. Which would come first: $23,000 or $23,640 (100 EMA)?

Meanwhile, my resistance levels are at $24,000, $25,000, and $26,000, and my key support levels are at $23,000, $22,000, and $21,000.

Total Market Capitalization: $1.12 trillion

Bitcoin Market Capitalization: $446 billion

Bitcoin Dominance: 39.9%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.