Michael Saylor, the former CEO of MicroStrategy, has said Bitcoin (BTC) is on track to “demonetizing gold” in the long run.

The investor and entrepreneur made the comments in an interview with Kitco, where he also argued that gold is unlikely to be adopted as money in the 21st century, explaining that: “Gold was metallic money for the 19th century.” Instead, Saylor sees the benchmark cryptocurrency as becoming an institutional investment-grade asset that will receive unprecedented adoption by top investors, regulators, and legislators.

The business executive also predicted that a spot-based Bitcoin exchange-traded fund (ETF) was on the horizon and that we could see one become a reality in the US within the next year.

Furthermore, the MicroStrategy executive chairman argued that traditional economists do not understand BTC because of their inhibitions towards volatility. He noted: “The volatility is the price you pay for the performance. If you can’t stomach the heat, you can’t be in the kitchen… I would rather win in a volatile fashion than lose slowly.”

Commenting on the broader market, Saylor asserted in the Kitco interview that a “great deal of bad behavior” has been expunged from the market. Regardless, he believes that there are a lot of unregistered securities.

Michael Saylor unexpectedly stepped down as the CEO of MicroStrategy some days ago. The move came after the software company lost over $1 billion on its Bitcoin investment due to the recent crash in crypto prices.

Bitcoin topped the $25K top for the first time since June, following a solid bull run fueled by expectations of a US Fed monetary policy easing and the excitement ahead of the Ethereum ‘Merge’ upgrade.

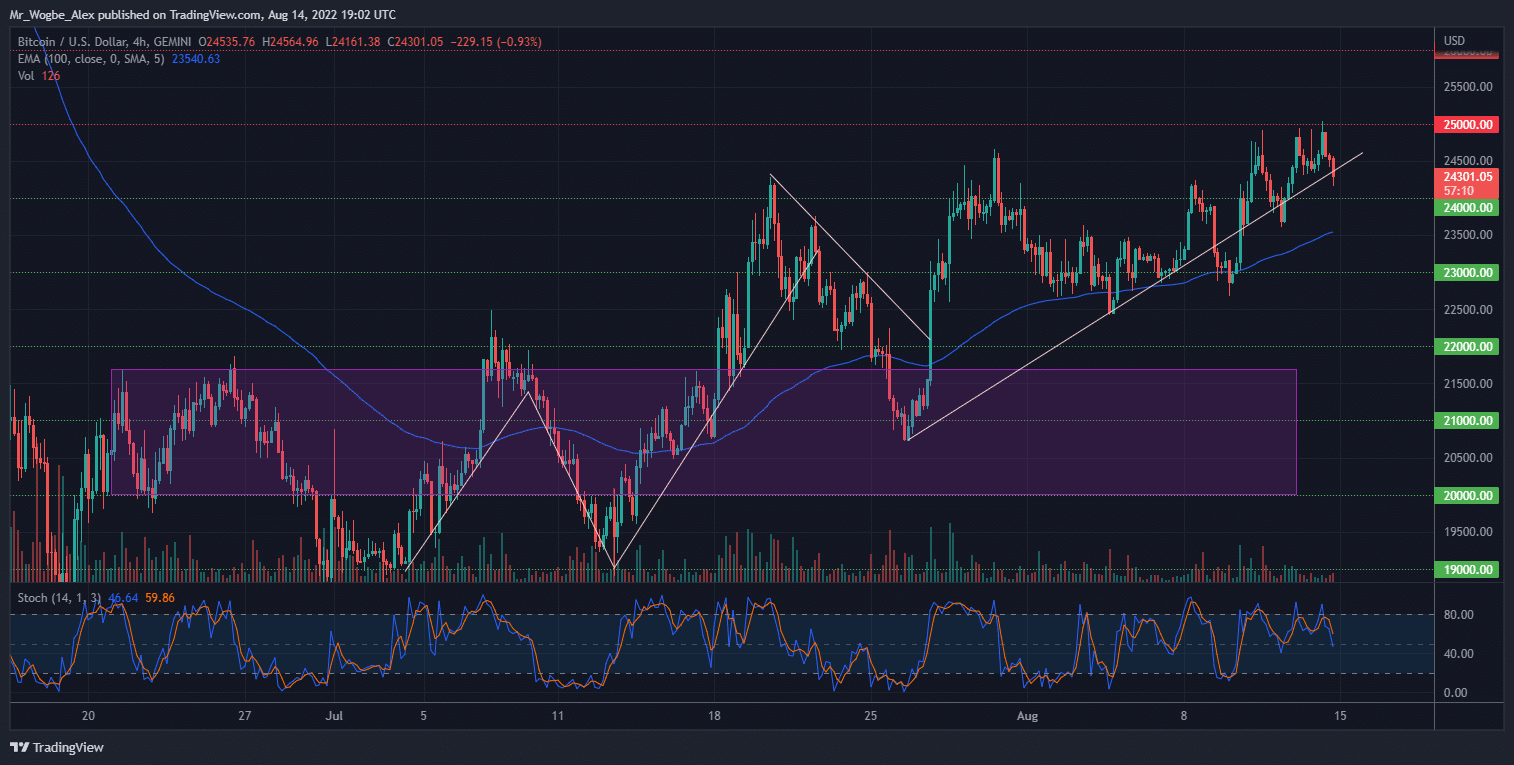

Key Bitcoin Levels to Watch — August 14

However, this long-awaited retest was short-lived, with BTC tumbling towards the $24,000 low. At press time, the benchmark cryptocurrency trades around $24,300 and is testing my August trendline.

A candle-close below this line would open the door to a complete correction to the $24,000 low and possibly the $23,500 level, where the 4-hour 100 EMA should cushion the fall. On the flip side, a sustained consolidation above the trendline should accelerate a retest and breach of the $25,000 top.

As mentioned earlier, Bitcoin briefly tapped the $25K top before retreating near the $24K low.

Meanwhile, my resistance levels are at $25,000, $26,000, and $27,000, and my key support levels are at $24,000, $23,000, and $22,000.

Total Market Capitalization: $1.16 trillion

Bitcoin Market Capitalization: $464.9billion

Bitcoin Dominance: 40%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.