As Bitcoin (BTC) continues to struggle, the number of Google searches for the benchmark cryptocurrency has plummeted to its lowest level since late 2020.

Meanwhile, the Bitcoin Fear and Greed Index has settled in “fear” territory, despite Bitcoin’s commendable performance over the past few days.

While whale accounts continue to transact heavily with BTC, the latest report from Google Trends shows the retail demand for the cryptocurrency has slumped to multi-month lows.

Typically, the number of searches on the behemoth search engine directly correlates with the behavior of smaller investors, who tend to flood the market during substantial bull runs. This was the case when BTC spiked to $20,000 in 2017 and the late 2020 rally above $20,000.

However, the number of searches receded in the year-long bear market after 2017’s bull run. A similar trend occurred in 2021 when the benchmark cryptocurrency went on a tear in April and later in November when it tapped the $69,000 all-time high.

However, BTC began one of its worst bear rallies ever since, which led to a 50% decline to $33,000 in January within six months. Not surprisingly, Google Trends data shows that the “Bitcoin” queries have slumped to pre-December 2020 levels.

Key Bitcoin Levels to Watch — April 21

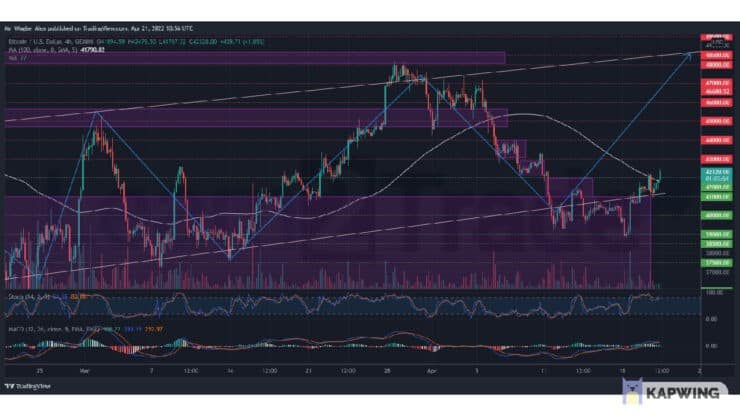

Bitcoin resumed its bullish momentum on Thursday, as the benchmark cryptocurrency painted a new multi-week high at $42,400. This rally comes shortly after a retrace to the $41,000 support from the $42,000 psychological point yesterday, which BTC lacked the conviction to break.

Today, however, the benchmark cryptocurrency is set to close a 4-hour candle above this mark, which should foster a push to the critical $43,000 resistance over the coming hours.

As mentioned previously, a break above the $43,000 level should lock in a bullish market bias and catapult BTC to the $48,000 top. In the meantime, any bearish attempt will get rejected by the shorter ascending trendline at the $41,000 region.

Meanwhile, my resistance levels are at $43,000, $44,000, and $45,000, and my key support levels are at $41,000, $40,000, and $39,000.

Total Market Capitalization: $1.94 trillion

Bitcoin Market Capitalization: $803.5 billion

Bitcoin Dominance: 41.3%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.