After dropping to the $38,560 low yesterday, following a prolonged consolidation around the $40,000 mark, Bitcoin (BTC) began to acquire a growing bearish sentiment over its near-term price action. However, many saw this dip as a good chance to stack up on BTC for less, and this strategy appears to have paid off over the last few hours as the benchmark cryptocurrency taps the $41,700 top.

Technical analyst at CryptoQuant Minkyu Woo revealed that during the recent sell-off, a significant volume of BTC seeped out of centralized crypto exchanges. Woo explained that whales are responsible for this BTC move as they likely purchased a large sum of coins.

The analyst further explained that he sees the $37,000 – $40,000 price range as a critical accumulation zone and that this range has served as such since March, urging investors to hold or buy the dips into this range if they could.

Every time BTC recorded an outflow volume increase in the past, it usually led to a significant upward swing and a change in short-term bearish sentiment.

Additionally, Woo explained that as long as Bitcoin trades beneath the 200 MA support line, which it has done since Q4 of 2020, a notable amount of “smart money” would begin stacking up on the benchmark cryptocurrency. Describing his chart, the analyst explained that BTC dipped into the “bottom zone,” and buying interest has increased accordingly.

Key Bitcoin Levels to Watch — April 19

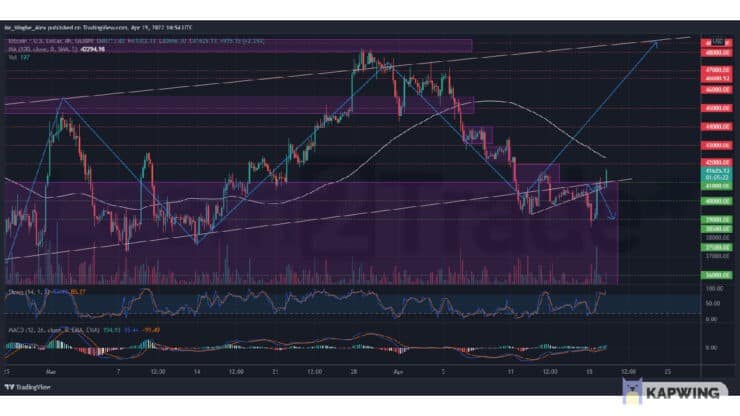

After taking the plunge to the $39,000 low as predicted in my previous analysis, Bitcoin has pulled a stunt on bears on Tuesday after retaking the critical $41,000 level. The benchmark cryptocurrency now sits comfortably above the $41,000 pivot top and my medium-term ascending trendline.

That said, bulls need to sustain their newly-found market control and push to the $43,000 mark over the coming hours and days to secure a bullish sentiment in the market. Failure to do so in the near term could force prices below the $40,000 psychological support again.

Meanwhile, my resistance levels are at $42,000, $43,000, and $44,000, and my key support levels are at $41,000, $40,000, and $39,000.

Total Market Capitalization: $1.92 trillion

Bitcoin Market Capitalization: $789.4billion

Bitcoin Dominance: 41%

Market Rank: #1

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.