The Japan 225 market has edged higher on the week. However, as soon as price action crossed a technical resistance, the chatter surrounding the GDP revision spooked investors into taking caution ahead of the data release. Let’s dive into the signals indicated by technical indicators below.

Key Levels

Resistance: 43,000, 45,000, 47,000

Support: 42,000, 40,000, 38,000

NIKKEI Keeps Its Base Above Key Levels

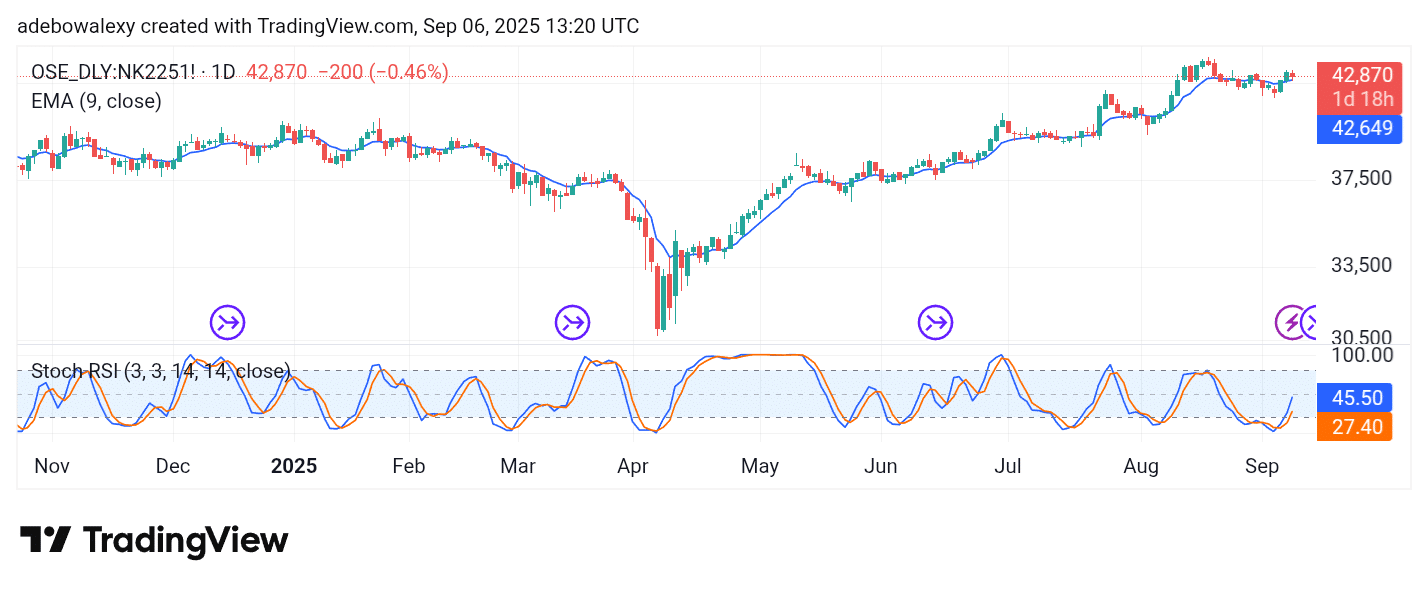

The Japan 225 market keeps hitting barriers from one point to another. The market had rebounded off support during the week. And after the market rose past the 9-day Exponential Moving Average (EMA) line, it hit another hard crust.

Albeit, one good thing is that price action has kept itself above the 9-day EMA curve at 42,649. Meanwhile, the Stochastic Relative Strength Index (SRSI) indicator lines are rising strongly upward from the oversold region. This aligns with the opinion that the downward rejection may just be noise, and the market may shake it off.

Japan 225 Keeps a General Bullish Stand

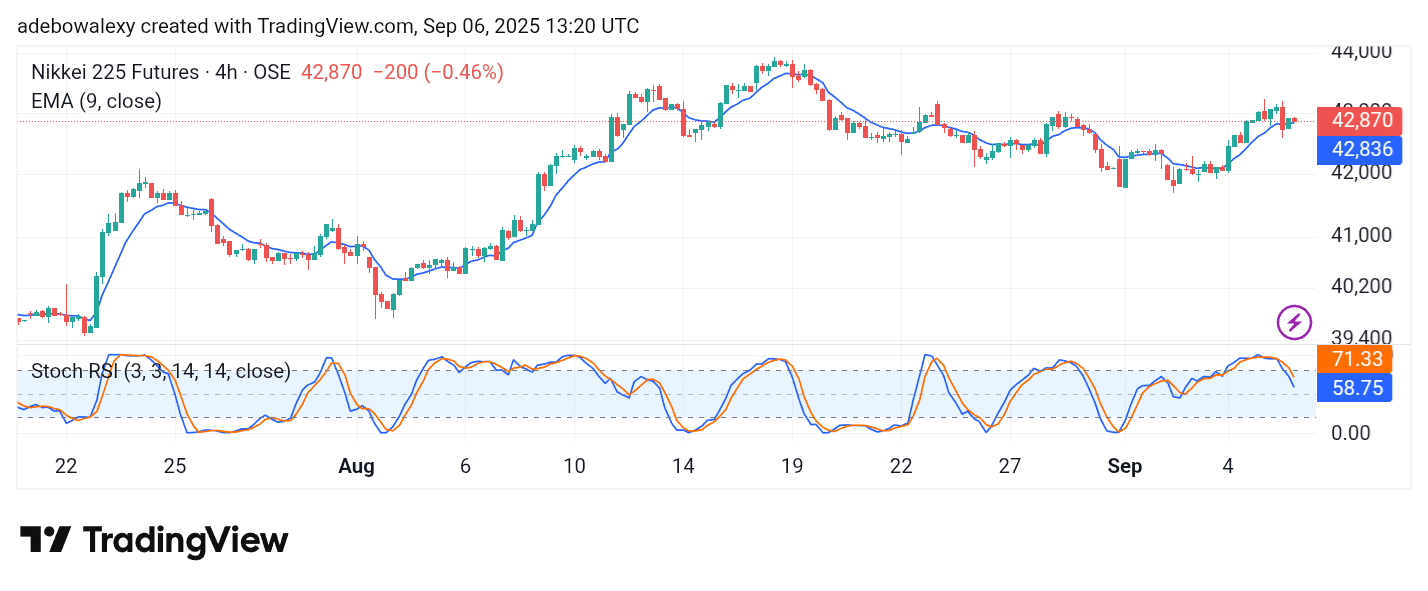

The NIKKEI 225 market maintains a striking stance. The last price candle on the 4-hour chart stays red. However, the mentioned price candle stays above the 9-day EMA curve as well. This shows a consistency that calls for careful consideration among bullish traders.

Interestingly, the SRSI lines seem to be moving too quickly as they fall sharply below the 80 mark at such a minimal price decline. In fact, price action stands above the 9-day EMA curve. Consequently, it appears price action may push its way through toward 45,000, as downward forces seem too weak at this point.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.